[Asia Economy Reporter Hwang Junho] In the bond market, it is expected that the base interest rate will likely remain unchanged at the Monetary Policy Committee meeting held on the 25th. On the other hand, bond yields and inflation are forecasted to rise depending on the economic recovery outlook.

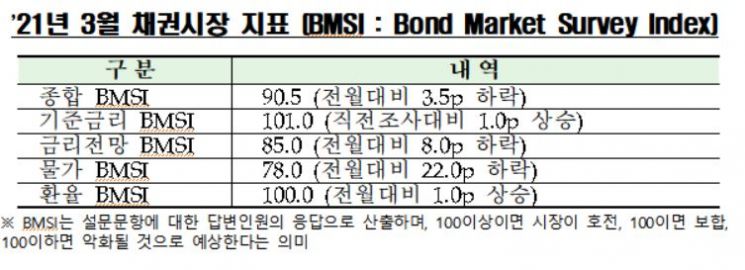

The Korea Financial Investment Association announced the Bond Market Sentiment Index (BMSI) for March this year on the 23rd. The association conducts monthly surveys targeting those involved in bond holding and management.

Forecast for South Korea's Base Interest Rate to Remain Unchanged

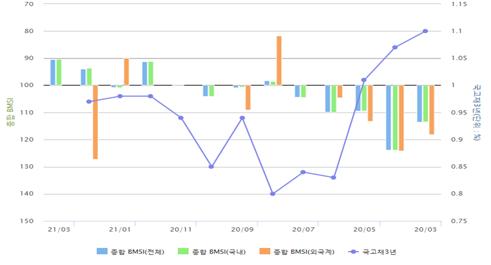

First, the comprehensive BMSI was 90.5 (previous month 94.0), down from the previous month. This slight deterioration in market sentiment is due to expectations of global economic recovery driven by expansionary economic policies and COVID-19 vaccinations. The BMSI is calculated based on the responses of survey participants to the questionnaire. A value above 100 indicates market improvement, 100 indicates stability, and below 100 indicates expected deterioration.

The Monetary Policy Committee, which determines the level of the base interest rate, viewed a high probability of keeping the rate unchanged. Although long-term government bond yields have shown a gradual upward trend due to increased government bond issuance and economic recovery expectations, uncertainties in the real economy remain large due to slowing consumption and employment. The base interest rate BMSI was 101.0, similar to the previous survey (previous 100.0), and 99.0% of respondents (previous 100.0%) expected the rate to remain unchanged.

Market Interest Rate Expected to Weaken

The sentiment in the bond market related to market interest rates deteriorated to 85.0 (previous month 93.0) compared to last month. It is expected that interest rates will rise within a limited range due to expectations of increased economic growth rates in major countries driven by the recovery of global economic activities. 23.0% of respondents (previous 18.0%) anticipated interest rate increases, which is 5.0 percentage points higher than last month, while 8.0% (previous 11.0%) expected interest rate decreases.

The inflation BMSI also declined to 78.0 (previous month 100.0), indicating worsened bond market sentiment related to inflation compared to the previous month. The number of respondents predicting inflation increases in March rose due to producer price increases and recent rises in oil prices and import prices. The exchange rate BMSI was 100.0 (previous month 99.0), showing stable bond market sentiment regarding exchange rates compared to the previous month. 62.0% of respondents (previous 69.0%) answered that the exchange rate would remain stable.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.