[Asia Economy Reporter Oh Hyung-gil] Among subscribers who renew their indemnity medical insurance every 3 to 5 years, some are expected to see their premiums increase by nearly 50% upon renewal.

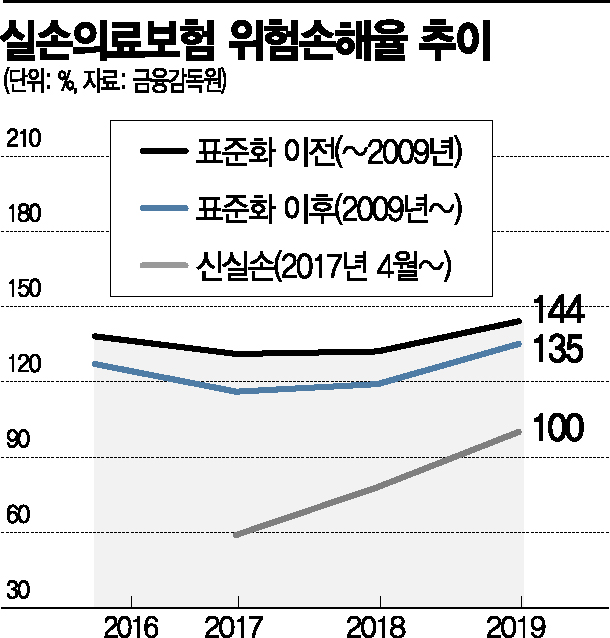

According to the insurance industry on the 23rd, standardized indemnity insurance premiums rose by 9% and 8% in 2022 and 2019 respectively, while they were frozen in 2018. In 2017, there was a wide variation among companies, with some increasing premiums by more than 20%.

Assuming insurance companies raised premiums by 10% four times over five years, the cumulative increase would be 46%. Additionally, applying differentiated increase rates by gender and age group means that older men tend to face relatively higher premium hikes.

Subscribers approaching renewal of the '1st generation' old indemnity insurance sold until September 2009 may face even steeper increases.

According to the insurance industry, old indemnity insurance premiums were raised by 10% in 2017 and 2019 except for 2018, and last year they increased by an average of 9.9%. This year, an increase rate of 15?19% is expected to be applied. The cumulative increase over five years corresponds to 53?58%. Subscribers with a 3-year renewal cycle face relatively smaller increases than those with a 5-year cycle, but increases of several tens of percent are still a concern.

With such significant premium hikes, the insurance industry anticipates that the burden of premium renewal this year may prompt old indemnity insurance subscribers to switch to new indemnity insurance or the '4th generation' indemnity insurance, which will be launched in July.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.