Analysis of Seoul Citizens' Consumption and Seoul-Based Store Sales Using Credit Card Big Data

Online Consumption Increases Amid Contactless Trend... "Not a Substitute for Offline Consumption but a New Channel"

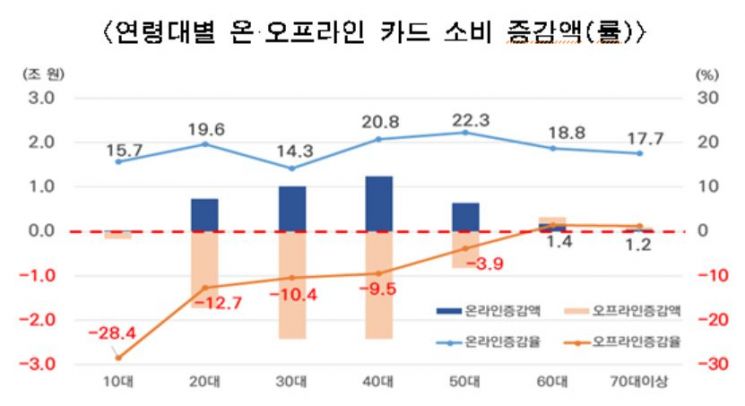

Online Consumption Grows Most Among 50s... 60s and 70s Also Join

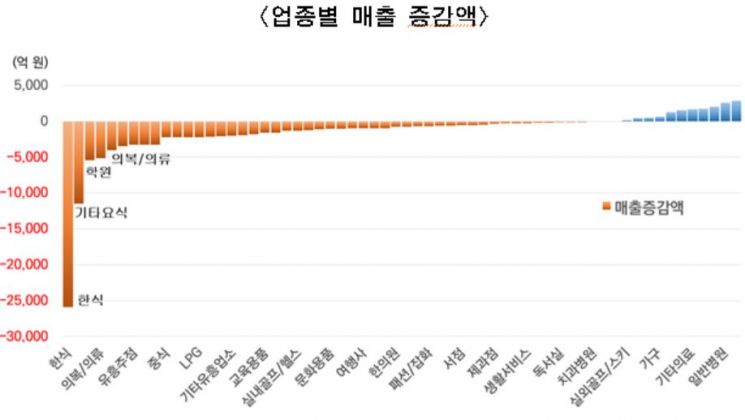

Offline Store Sales Decrease by 9 Trillion Won

Due to the prolonged COVID-19 pandemic, difficulties for small business owners and self-employed individuals are increasing. On the 1st, the rest area in the Euljiro underground shopping mall in Seoul was closed. Photo by Mun Ho-nam munonam@

Due to the prolonged COVID-19 pandemic, difficulties for small business owners and self-employed individuals are increasing. On the 1st, the rest area in the Euljiro underground shopping mall in Seoul was closed. Photo by Mun Ho-nam munonam@

[Asia Economy Reporter Lim Cheol-young] Since the spread of COVID-19, as non-face-to-face interactions became normalized, the online and offline consumption patterns of Seoul citizens last year diverged sharply. Online consumption among people in their 50s surged by more than 20% compared to before COVID-19, and even those aged 70 and above joined the online consumption trend, sustaining a noticeable strength in online spending.

On the other hand, offline store sales decreased by 9 trillion KRW compared to the previous year despite various government stimulus measures such as disaster relief payments. The Korean food industry and other dining sectors were hit hard, and academies and clothing industries also suffered. With ongoing concerns about COVID-19 resurgence due to sporadic cluster infections, it appears that policy support from the central government and local governments for small business owners will need to continue this year as well.

According to a survey conducted by the Seoul Metropolitan Government on the 22nd based on Shinhan Card users' spending, online consumption through online transactions, payment agencies, and home shopping increased by 18.4% (3.9 trillion KRW) last year, while offline consumption decreased by 7.5% (7.4 trillion KRW). This trend began to appear after the first wave of COVID-19 in March and became more pronounced over time.

In March, online sales increased by 1.8% year-on-year, while offline sales dropped by 24.8%. The increase in online sales expanded to the 9% range in April and May and continued to rise steadily, exceeding 20% significantly from August onward. The Seoul Metropolitan Government analyzed, "Since March, when consumption activities were greatly reduced due to COVID-19, offline consumption decreased while online consumption continuously increased," adding, "Regardless of changes in offline consumption, online consumption has steadily grown, becoming a new consumption channel."

By age group, offline consumption decreased the most by over 2 trillion KRW among people in their 30s and 40s, but online consumption increased by more than 1 trillion KRW, leading online spending. In particular, online consumption among those in their 50s recorded the largest increase at 22.3% year-on-year, and even among the elderly aged 70 and above, who previously had a smaller share of online consumption compared to those in their 20s to 40s, online consumption increased by more than 17%.

However, despite the noticeable increase in online consumption, the total card spending of Seoul citizens last year was recorded at 116 trillion KRW, a 2.9% decrease from the previous year. Card spending decreased by 2 trillion KRW in March during the first wave of COVID-19, followed by decreases of 860 billion KRW in April and 960 billion KRW in December.

The industry with the largest decrease in card spending was the Korean food industry, which dropped by 1.6 trillion KRW (16.5%), followed by airlines, other retail, other dining, and gas stations. This is interpreted as a reduction in consumption related to dining out and travel and transportation industries due to reduced outdoor activities. In particular, three travel-related sectors?travel agencies, airlines, and duty-free shops?showed year-on-year decreases of 83.7%, 73.4%, and 69.7%, respectively, as overseas travel became difficult.

This was also confirmed through Seoul's store sales figures. Last year, Seoul's store sales amounted to 91 trillion KRW, down 9 trillion KRW from the previous year. Although sales temporarily increased following the emergency disaster relief payments distributed from late May to early June last year, it was insufficient to reverse the trend. This analysis is based on the sales of 62 industries located in Seoul, estimated from Shinhan Card merchant sales data.

By industry, sales in the Korean food sector decreased by 2.59 trillion KRW (18.2%). Other dining, academies, and clothing industries also saw significant sales declines. In terms of sales decline rate, duty-free shops experienced the largest drop with an 82.4% decrease, and sales in travel agencies, comprehensive leisure facilities, entertainment pubs, and other entertainment establishments plummeted by more than 50%. By administrative district, sales decreased by more than 300 billion KRW in three districts: Yeoksam 1-dong, Seogyo-dong, and Sinchon-dong. Sales also dropped by more than 200 billion KRW in Myeong-dong, Samseong 1-dong, Jongno 1, 2, 3, 4-ga-dong, Jamsil 3-dong, and Sogong-dong, indicating significant sales declines in commercial business areas.

Lee Won-mok, Director of Smart City Policy at the Seoul Metropolitan Government, explained, "The three waves of the pandemic coincided with periods of increased sales throughout the year, worsening the perceived economic conditions for small business owners," adding, "Data analysis shows that the extent of damage varies by region and industry, and online transactions are becoming a new consumption channel. Therefore, city policies need to be formulated more precisely based on data to prepare for the post-COVID era."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.