Pay Attention to US Interest Rate Trends... Buy Semiconductor and Chemical Cyclical Stocks on Dips

Focus on Chairman Powell's Semiannual Congressional Testimony... Advises Caution Over Bargain Hunting

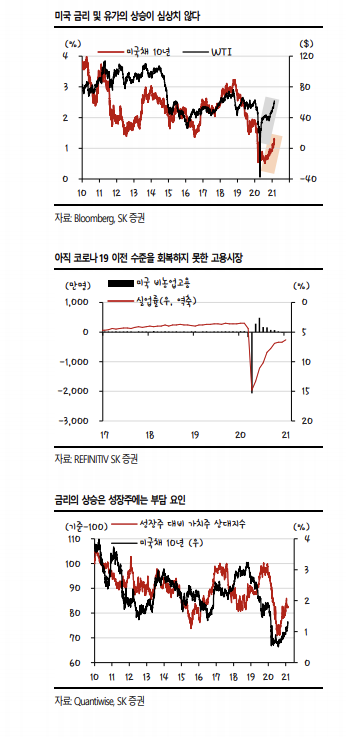

[Asia Economy Reporter Lee Seon-ae] The securities industry unanimously described the stock market outlook for this week (22nd-26th) as 'sideways movement within a range.' This is due to widespread concerns over rising interest rates. The index is expected to be influenced by accommodative monetary policies, discussions on additional stimulus measures, and nominal interest rate increases.

According to the securities industry on the 21st, NH Investment & Securities projected the KOSPI weekly expected band at 2970?3130. The factors supporting an increase include the reaffirmation of the accommodative monetary policy direction by the U.S. central bank, the Federal Reserve (Fed), improvements in U.S.-centered economic indicators, and discussions on additional stimulus measures by the U.S. administration. The downside risk is attributed to the burden on stock market discount rates due to rising nominal interest rates.

Labor Gil, a researcher at NH Investment & Securities, explained, "The Fed reaffirmed the necessity of the current accommodative monetary policy in the January FOMC (Federal Open Market Committee) minutes, and the members continue to express their intention to effectively support economic recovery through maintaining the current low policy rates and asset purchase programs." He added, "They agreed on the passage of a $900 billion stimulus package and the possibility of economic recovery due to vaccine supply."

He continued, "Chairman Jerome Powell maintains a dovish stance, focusing on the need for economic recovery, and the committee members are more concerned about a slowdown in the labor market recovery than inflation," adding, "Concerns about Fed monetary policy tightening are expected to remain subdued until the next March FOMC meeting."

Despite the global stock market's upward trend, the domestic stock market's rise is slowing down. Continued program selling mainly by institutional investors and simultaneous profit-taking by foreigners in both spot and futures markets are factors slowing the index's rise.

Researcher Noh said, "Although the domestic stock market's rise is slowing, considering the strong belief in global economic recovery and corporate earnings growth, the upward trend is expected to continue." He emphasized, "When foreigners switch to net buying, their purchases are likely to concentrate on the semiconductor sector, so maintaining weight in this area is necessary." He pointed out semiconductor and chemical sectors as cyclical stocks of interest and advised buying during corrections. Particularly from a supply-demand perspective, considering that KOSPI small and mid-cap stocks may escape the influence of program selling linked to index products, he mentioned the need to maintain a favorable view on cyclical stocks and pay attention to KOSPI small and mid-cap stocks.

SK Securities advised that the direction of interest rates is most important alongside Chairman Powell's semiannual congressional testimony. Han Dae-hoon, a researcher at SK Securities, said, "Chairman Powell's speech is scheduled, and the market's attention is inevitably focused on it," adding, "Since the Fed has stated it will continue accommodative monetary policy, the dominant view is that Chairman Powell will try to soothe the market." He continued, "Despite the short-term surge in interest rates and oil prices, individual investors' net buying continues, and there are no signs yet of liquidity outflows due to rising interest rates," and predicted, "In the short term, cyclical stocks are expected to strengthen due to rising interest rates." However, he emphasized caution regarding the outlook that cyclical stocks will become the leading stocks.

On the other hand, there is a view that rising interest rates could be a significant turning point in the current stock market trend. The macro team at KTB Securities said, "We must keep open the possibility that the U.S. 10-year Treasury yield could rise to 1.5% in the first quarter," and analyzed, "If it reaches this level, it is essential to respond by observing rather than buying at low prices." In particular, the macro team viewed, "If the U.S. 10-year Treasury yield approaches 2%, it will be a significant turning point in the price fluctuations of growth stocks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.