[Asia Economy Reporter Park Jihwan] The Financial Supervisory Service (FSS) will focus on inspecting the adequacy of disclosures related to the external audit system and internal accounting management in last year's business reports, about a month before the submission deadline for business reports of listed companies.

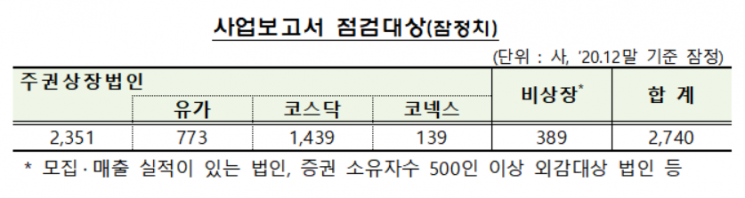

On the 21st, the FSS announced this content in the '2020 Business Report Key Inspection Items Preliminary Notice.' The total number of companies subject to business report submission, including listed companies with December fiscal year-end, is 2,740.

First, the FSS will concentrate on checking compliance with the preparation standards of corporate disclosure forms among financial matters. They plan to review the format of summary financial information, whether reasons for restating financial statements and the impact on financial statements are disclosed when restatements occur, and the disclosure status of inventories and allowance for doubtful accounts.

The adequacy of disclosures related to the external audit system is also a target for inspection. To enhance accounting reliability, the FSS will identify the status of external audits and internal accounting operations and check whether key audit matters are disclosed. Specifically, they will inspect whether disclosures related to the operation status of the external audit system, such as audit opinions and audit hours, are properly recorded.

Additionally, from the 2020 fiscal year, the scope of external audit application for internal accounting management systems has expanded to listed companies with assets exceeding 500 billion KRW. Therefore, the submission of not only the internal accounting management system operation and review report but also the audit report will be checked. The FSS will also inspect disclosures related to the strengthening of the linkage between internal control and external audit, such as whether discussions between internal audit organizations and external auditors are disclosed.

Among non-financial matters, the FSS will focus on inspecting items related to dividends, the use of direct financing funds, and sanction status. Furthermore, due to the amendment of the Enforcement Decree of the Commercial Act, listed companies must notify shareholders of the business report as an attachment to the notice of the general shareholders' meeting at least one week before the regular general meeting. Accordingly, the FSS plans to check compliance with the recently revised disclosure forms regarding articles of incorporation and dividend matters, as well as the status of candidates for appointment and dismissal of registered executives. They will also focus on whether special listing companies' disclosures and pharmaceutical and bio companies have faithfully reflected exemplary disclosure cases.

The FSS plans to individually notify companies and auditors of any insufficient entries found during the business report inspection by May and guide them to voluntarily correct the issues. For companies that repeatedly make poor disclosures of the same content or falsely disclose or omit important matters, the FSS will consider not only issuing warnings but also the possibility of sanctions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.