Strengthening Management Disclosure, Implementing Adjustments to Leverage Limits for Non-Card Companies, and More

[Asia Economy Reporter Park Sun-mi] Financial authorities have decided to implement measures to strengthen liquidity management for specialized credit finance companies (hereinafter referred to as credit finance companies), including ▲establishing model guidelines for liquidity risk management ▲enhancing management disclosures ▲adjusting leverage limits for non-card companies.

According to the Financial Services Commission and the Financial Supervisory Service on the 21st, the liquidity risk management model guidelines for credit finance companies will be introduced as model guidelines by the Credit Finance Association and will be implemented starting from April. The guidelines apply to credit finance companies that issue corporate bonds and those with assets exceeding 100 billion KRW, totaling 56 companies. The model guidelines include liquidity management systems specifying the roles of the board of directors and management, liquidity risk management indicators, and the recognition, measurement, and management of liquidity risk.

Until now, in other financial sectors such as banks, financial companies have independently established and operated management standards to measure liquidity risk. However, in the credit finance sector, there has been no comprehensive management standard to recognize, measure, and manage liquidity risk.

Management disclosures related to liquidity risk for credit finance companies will also be strengthened. The scope of disclosures will be expanded to a level similar to that of the banking sector, including qualitative indicators. Credit finance companies have only disclosed quantitative indicators such as funding status and asset-liability maturity structures, leading to criticism that their disclosures on liquidity status were insufficient compared to other sectors.

Liquidity monitoring indicators will be expanded and reorganized. Currently, the management evaluation of liquidity uses three quantitative and four qualitative indicators, but during last year's liquidity crisis, it was found that the existing liquidity evaluation indicators did not adequately reflect reality. Accordingly, after analyzing the COVID-19 case, the ineffective quantitative indicator 'ratio of operational tangible assets' will be removed, and highly significant indicators such as 'immediately available liquidity ratio' and 'short-term funding ratio' will be newly introduced. Additionally, qualitative evaluation items will be supplemented to appropriately assess the ability to respond to liquidity crises.

Leverage limits for non-card credit finance companies will be gradually reduced. From 2022 to 2024, the limit will be set at 9 times, and from 2025 onward, 8 times. However, if dividends exceeding 30% of net income for the previous fiscal year are paid, the limit will be reduced by one time. Regulatory changes are expected to be announced in February. Leverage limit regulations (10 times for non-card companies) have been in place to prevent excessive expansion of credit finance companies, but following the liquidity crisis experienced by non-card companies in March last year, concerns were raised that their leverage limits were higher than those of card companies.

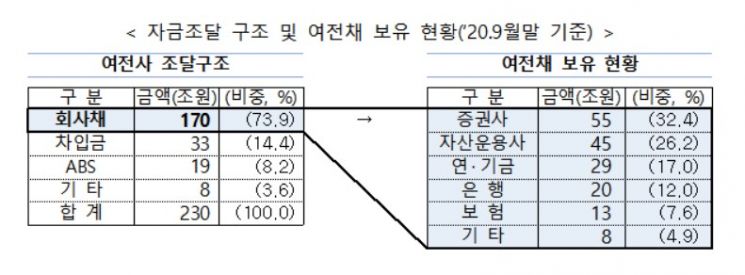

Credit finance companies are financial firms such as capital companies that engage only in credit business without deposit-taking functions. Since they lack deposit-taking functions, they raise funds through external borrowings, corporate bonds, and ABS issuance, with a particularly high proportion of corporate bond (credit finance bonds) issuance. This structure poses a risk that if a credit finance company becomes insolvent, the insolvency could spread and expand to financial companies holding credit finance bonds.

A Financial Services Commission official explained the background for implementing the liquidity management strengthening measures, stating, "Especially when unpredictable economic shocks like COVID-19 occur, there have been ongoing concerns that credit finance companies could act as transmission channels for financial system risks. If liquidity problems arise in credit finance companies, funding supply to medium- and low-credit borrowers may decrease, leading to contraction in private consumption and corporate facility investment, which could adversely affect the real economy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.