Bank of Korea Producer Price Index for January 2021 Up 0.9% MoM

Rising for Three Consecutive Months... Export, Import, and Consumer Prices Also Increase Simultaneously

Currently Supply Shortage-Driven Inflation

Demand Surge During COVID-19 Recovery May Lead to Inflation

[Asia Economy Reporter Kim Eunbyeol] International oil prices have surged sharply, compounded by cold waves and avian influenza (AI), causing steep increases in prices of agricultural, forestry, and fishery products as well as petroleum products. Due to ongoing supply shortages, prices may continue to rise for the time being, and there are concerns that if demand surges during the COVID-19 recovery period, it could lead to inflation.

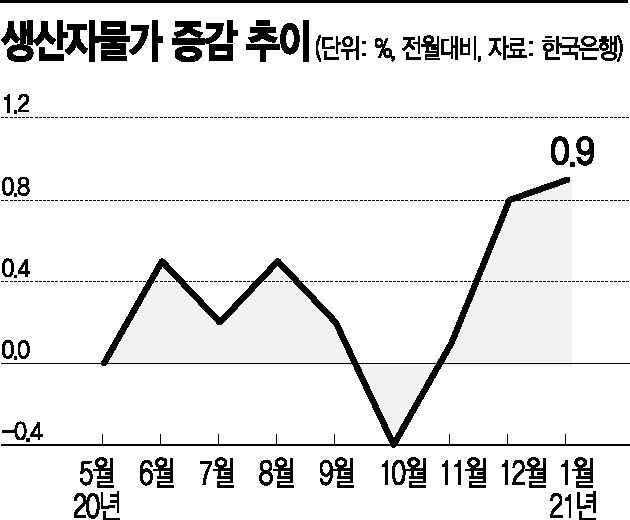

According to the Bank of Korea on the 19th, the Producer Price Index (PPI) last month was 104.88 (2015=100), up 0.9% from the previous month. This is the largest increase in four years since January 2017 (1.5%). The PPI fell in October last year after five months but rebounded by 0.1% in November and then rose for three consecutive months. Compared to January 2020, it is 0.8% higher, marking the second consecutive month of year-on-year increase.

The PPI measures price changes of goods and services supplied by domestic producers to the domestic market. Since it leads the Consumer Price Index (CPI) by about a month, the CPI for February is also expected to continue its upward trend.

Kim Younghwan, head of the Price Statistics Team at the Bank of Korea’s Economic Statistics Bureau, said, "Since the producer price has risen for three consecutive months compared to the previous month and for two consecutive months year-on-year, it can be seen that prices are trending upward. Inflationary pressures from oil prices, agricultural products, and raw materials continue, so the upward trend is expected to persist in February."

With producer prices rising, the three major price indices (consumer, import, and producer prices) all increased for two consecutive months in January. This is the first time in about two years since April-May 2019 that all three indices have risen for two consecutive months.

Sharp Rise in Perceived Prices in Daily Life... Three Major Price Indices Show 'Triple Increase' for Two Consecutive Months

Looking at the January PPI, which rose at the largest rate in four years, it is notable that prices of items felt in everyday life surged sharply. Oil and raw material prices continue to rise sharply, which is expected to affect consumer prices as well.

According to the Bank of Korea’s report on the month-on-month changes in the PPI by item on the 19th, prices of agricultural, forestry, and fishery products jumped 7.9%, the largest increase in two years and five months since August 2018 (8.0%). Livestock products rose 11.8%, and agricultural products increased 7.8%. Detailed items with high increases included green onions (53%), pumpkins (63.7%), chicken (42.8%), eggs (34%), onions (29.5%), croaker fish (33.6%), and rockfish (47.8%). Prices of manufactured goods also rose 1.0%. The rise in coal and petroleum products was clear, with diesel up 9.7%, naphtha 14%, and gasoline 7.5%. Last month, the international oil price based on Dubai crude was $54.82 per barrel, up 10% from the previous month ($49.84).

Other price indices also rose simultaneously. The import price index last month was 100.74 (2015=100), up 2.8% from the previous month, marking a two-month streak of over 2% increases. Import prices are a factor that raises consumer prices. Generally, prices of petrochemical products and agricultural and fishery products are reflected relatively quickly. Therefore, the consumer price index, which rose 0.8% month-on-month last month, is also likely to continue rising in February.

Concerns Over Inflation if Demand Surges During COVID-19 Recovery... Government Says "Will Not Lower Guard on Price Stability"

A moderate rebound in prices can be interpreted as a sign of economic recovery, which is positive. However, experts caution that the recent price rebound is due more to supply shortages than demand recovery. Due to the severe cold wave and heavy snow that hit the U.S. mainland, oil and refining facilities were shut down, and supply shortages of grains and agricultural products were major factors driving price increases. The key issue is how much demand will surge when the effects of COVID-19 vaccines take hold and whether supply can keep up with demand. Kim Jeongsik, emeritus professor of economics at Yonsei University, explained, "When COVID-19 stabilizes, the pent-up demand inflation and the liquidity that was restrained will act together, potentially causing prices to surge sharply."

The government also expressed concerns about inflation and announced plans to monitor prices by sector. Kim Yongbeom, First Vice Minister of the Ministry of Economy and Finance, chaired the "6th Innovation Growth Strategy Review Meeting, Policy Review Meeting, Korean New Deal Review Meeting, and 3rd Price-Related Vice Ministers Meeting" at the Government Seoul Office on the same day and stated that measures will be prepared for items showing upward trends such as grains and crude oil. Vice Minister Kim emphasized, "Concerns remain about potential risks to financial stability, such as the gap between real economy and asset price movements, and debates over abundant liquidity have even raised inflation concerns. We will not lower our guard."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.