80% of Delisted Foreign Companies Are Chinese... Cold Water Poured by Yi Hang Freezes Investor Sentiment

Chinese Stock Market Expected to Show Positive Trend on Anticipation of Stimulus Policies Announced at March Two Sessions

Top 10 overseas stocks held by Korean investors as of the 18th. Captured from Korea Securities Depository Save.

Top 10 overseas stocks held by Korean investors as of the 18th. Captured from Korea Securities Depository Save.

[Asia Economy Reporter Lee Seon-ae] EHang, a leading Chinese drone company listed on the New York Stock Exchange, has been engulfed in allegations of revenue and technology manipulation, deepening the concerns of Korean investors who invested in the company. Online investment communities are flooded with posts such as "I will never touch Chinese stocks again" and "I shouldn't have invested in Chinese stocks," but experts have diagnosed that, rather, with the Chinese Lunar New Year holiday now over, the Chinese stock market is expected to show an upward trend due to policy expectations and seasonal factors, making investment still valid.

According to the Korea Securities Depository on the 19th, among the top 20 overseas stocks held by Korean investors as of the previous day, there is only one Chinese company (Hengrui Medicine). Even when expanding the category to the top 50, there are only four Chinese companies (China International Travel Service, Guizhou Moutai, BYD, etc.). This shows that Korean investors do not prefer Chinese companies as overseas investment destinations.

EHang further dampened investment sentiment. Founded in Guangzhou, China in 2014, EHang attracted global attention by unveiling an autonomous drone taxi at CES, the world's largest consumer electronics show, in 2016. In 2019, it became the first Chinese drone company to be listed on the NASDAQ, raising $40 million (approximately 44.232 billion KRW). At the beginning of this year, the stock price was only $21, but as EHang's Urban Air Mobility (UAM) technology gained attention, the price skyrocketed sixfold to the $124 range within about 40 days, earning the nickname "Tesla of the sky." Korean investors also showed interest in EHang, triggering an investment rush. However, on the 16th, global investment research firm Wolfpack Research published a 33-page report titled "EHang: The Stock That Was Doomed to Crash," causing the stock price to fall 62.7% and close at $46.3. On that day, EHang ranked among the top 10 overseas stocks held by Korean investors, with a holding amount of $55.034 million. Simple calculations estimate losses of about 600 billion KRW.

Previously, Luckin Coffee, famous as the "Chinese Starbucks," was delisted from NASDAQ in June of the same year after short-selling investment firm Muddy Waters' allegations of accounting fraud were confirmed in January last year, instilling fear of investing in Chinese companies.

In the Korean market, about 80% of foreign companies that have been delisted are Chinese companies. According to data submitted by Hong Sung-guk, a member of the Democratic Party of Korea, from the Korea Exchange in October last year, the exchange listed a total of 39 foreign companies since 2007, including 9 on KOSPI and 30 on KOSDAQ. However, nearly 40%, or 14 companies (5 on KOSPI, 9 on KOSDAQ), were delisted. Among the delisted companies, over 80%, or 12 companies, were Chinese firms. Most of the issues were related to accounting fraud.

Accordingly, there is a growing voice advising more meticulous scrutiny. Hwang Se-woon, a research fellow at the Korea Capital Market Institute, advised, "In a liquidity-driven market, stock prices of companies with unclear substance can surge rapidly, so even companies called innovative should be carefully examined for technology and growth potential to separate the wheat from the chaff."

However, despite these fears, investment advice has emerged that the current timing to buy Chinese stocks is valid. This is based on the judgment that after the Chinese Lunar New Year holiday (February 11?17), liquidity supply will be flexibly managed through monetary easing policies, maintaining a tighter stance compared to the global environment, and that attention will focus on Chinese government policies and corporate earnings thereafter. Accordingly, sectors related to domestic consumption and new infrastructure are expected to maintain high policy expectations and continue a strong earnings trend.

Hong Rok-gi, a researcher at Kiwoom Securities, said, "After the Lunar New Year, the Chinese stock market tends to rise seasonally, and the robust economic recovery trend compared to the global market will continue." He added, "Especially during this Lunar New Year, signs of domestic normalization have been detected, with estimated box office sales in China during the holiday reaching 8 billion yuan (a 32.4% growth)." Kang Hyo-joo, a researcher at KB Securities, also forecasted, "Although short-term stock market volatility may occur due to changes in monetary policy, the Chinese stock market is not expected to shift into a downward trend. Positive momentum is expected to continue after the Lunar New Year due to expectations of stimulus policies to be announced at the March Two Sessions."

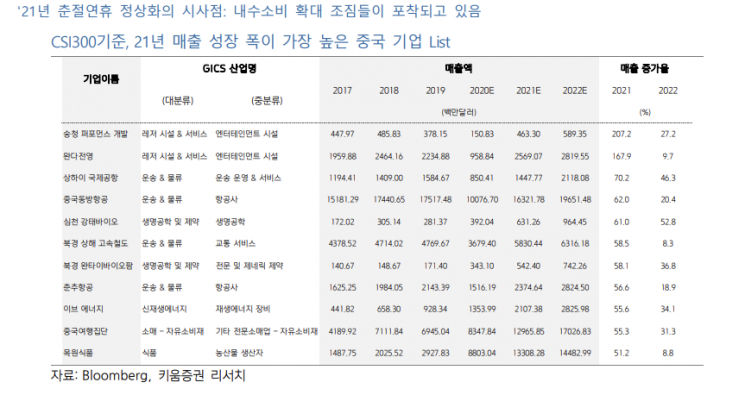

Kiwoom Securities identified the Chinese companies with the highest sales growth this year based on the CSI300 index as Songcheng Performance Development, Wanda Film Holding, Shanghai International Airport, China Eastern Airlines, Shenzhen Kangtai Biological, Beijing-Shanghai High-Speed Railway, Beijing Wantai Biological Pharmacy, Spring Airlines, Eve Energy, China Tourism Group, and Mowon Food. All these companies are expected to have sales growth rates exceeding 50% this year. Notably, Songcheng Performance Development and Wanda Film Holding are expected to exceed 100%, with 207.2% and 167.9%, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.