Long-awaited 'Fuel Cost Linkage System' Introduced, but Electricity Rates Fail to Keep Up with KEPCO's Purchase Price Increase

[Sejong=Asia Economy Reporter Kwon Haeyoung] As the pace of international oil price increases has been faster than expected, there are concerns that the profits of Korea Electric Power Corporation (KEPCO), a public enterprise, could worsen again. While the electricity market price that power generation companies pay rises with the strong oil prices, it is difficult to pass these costs on to consumers. The government introduced a fuel cost linkage system in the electricity tariff structure this year, but with the rapid rise in oil prices, it is struggling to come up with countermeasures.

On the 18th (local time), international oil prices surpassed $60 per barrel. West Texas Intermediate (WTI) recorded $60.52, and Brent crude briefly rose to $65.52 during the session, reaching the highest level in over a year.

The recent rise in oil prices has been faster than expected. The Ministry of Trade, Industry and Energy projected that oil prices would remain in the $40 range this year when it introduced the fuel cost linkage system for electricity tariffs in December last year. In a press release, the ministry cited institutional forecasts expecting oil prices to be around $44.8 per barrel in the first half and $48 per barrel in the second half of the year. However, as major oil-producing countries effectively implemented production cuts, oil prices surpassed $60 per barrel early this year.

The sharp rise in oil prices has increased the impact on electricity tariffs. The fuel cost linkage system benefits both electricity suppliers and consumers when oil prices are low. However, when prices are strong, it acts as a factor pressuring tariff increases. Producing electricity requires fuels such as coal, liquefied natural gas (LNG), and oil, and the cost of electricity production varies depending on fuel price fluctuations. To reduce the gap between electricity production and sales prices, the government and KEPCO decided to reflect the fuel cost linkage portion in electricity tariff calculations on a quarterly basis starting this year. If the average fuel cost over the previous three months (actual fuel cost) is higher than the average fuel cost over the previous year (standard fuel cost), electricity tariffs increase by the difference.

The rise in oil prices leads to concerns for KEPCO. Despite the long-awaited introduction of the fuel cost linkage system, the rapid surge in oil prices is expected to cause difficulties. The electricity market price (SMP), which is the wholesale price KEPCO pays to power producers, is expected to rise rapidly in the second half of the year as the effect of oil price increases is fully reflected. However, KEPCO cannot raise the retail price it charges consumers by more than 3 won per kilowatt-hour (kWh) compared to the previous quarter. When the government restructured the electricity tariff system last December, it imposed such limits and established a dual safety mechanism allowing the government to withhold tariff adjustments if necessary. Currently, KEPCO’s retail electricity price is about 120 won per kWh.

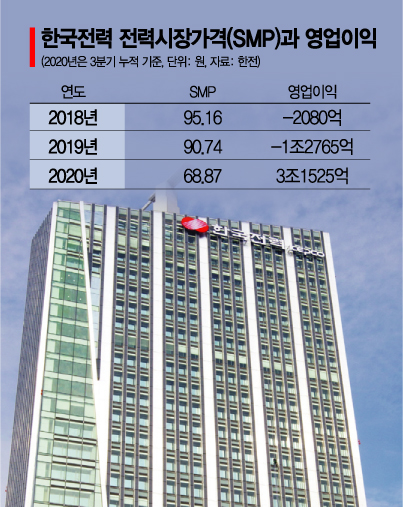

Oil prices have had a significant impact on KEPCO’s operating profit. According to KEPCO’s recently released electricity statistics bulletin, the SMP dropped sharply from 90.74 won per kWh in 2019 to 68.87 won in 2020. During the same period, WTI oil prices fell from $60?70 per barrel to $10?40 per barrel. KEPCO’s operating profit also turned from a 1.3 trillion won loss in 2019 to a cumulative 3.2 trillion won profit by the third quarter of 2020. Considering oil price forecasts, KEPCO expected to endure through this year, but the timing of performance deterioration has come sooner than anticipated.

The Ministry of Trade, Industry and Energy is also closely monitoring the recent oil price situation.

An official from the ministry said, "There are various factors affecting electricity tariff calculations besides oil prices, such as LNG prices and exchange rates. Recently, there is about a five-month lag before oil prices are reflected in LNG prices, and the exchange rate is declining, so the possibility of electricity tariff increases in the immediate term is low. We need to observe oil price trends until next month when the second quarter electricity tariffs are calculated." While the immediate possibility is low, the ministry is considering consumer protection measures such as exercising the right to withhold tariff adjustments if necessary.

Nam-il Kim, Senior Research Fellow at the Korea Energy Economics Institute, said, "The introduction of the fuel cost linkage system is positive in that it lifted retail market regulations that were previously tied to the wholesale market," adding, "In the mid to long term, it is necessary to expand the scope of electricity tariff increases due to rising raw material costs beyond the current level."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.