National Tax Service Investigates 61 Individuals Suspected of Unfair Tax Evasion

Average Asset Value of Young and Rich Tax Evaders: 18.6 Billion KRW

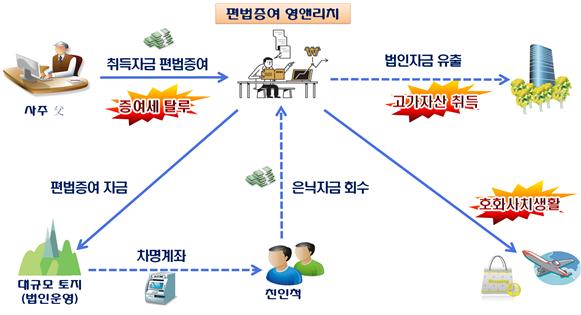

Using Tax Evasion to Buy Buildings and Memberships, Taking Overseas Trips Dozens of Times... Purchasing Supercars Under Corporate Names

[Sejong = Asia Economy Reporter Kim Hyunjung] Mr. A, in his 20s, acquired 100,000 pyeong of land and purchased two small buildings worth over 5 billion KRW in Gangnam, Seoul, through tens of billions of KRW in illicit gifts from his father without clear sources of income. Over the past five years, he has led a luxurious lifestyle including more than 30 overseas trips and purchasing luxury goods.

Mr. B, in his 30s, received stock worth approximately 7 billion KRW from his parents and operated a corporation. As sales increased, he established a shell company to embezzle tens of billions of KRW under the pretext of advertising expenses. Using these funds, he acquired and resides in an ultra-high-priced house in Seoul worth over 7 billion KRW, purchased commercial buildings worth 8 billion KRW, and multiple golf club memberships. He continued a lavish lifestyle by buying luxury goods with corporate expenses and using hotels, golf courses, and two supercars valued at around 900 million KRW.

The National Tax Service is targeting tax evasion suspicions among the young wealthy class, so-called 'Young and Rich,' who increase their assets through illicit gifts from parents or income concealment. It also announced a crackdown on illegal lenders exploiting the COVID-19 situation and medical device and health food companies.

On the 17th, the National Tax Service announced it had launched tax investigations into a total of 61 individuals suspected of unfair tax evasion who increased their assets irregularly during the COVID-19 crisis and antisocial tax evaders exploiting the crisis.

The investigation targets include ▲ Young and Rich who increased assets through illicit gifts from parents or family owners without income sources ▲ tax evaders who acquired high-value assets with hidden income and live luxuriously ▲ illegal lenders charging exorbitant interest rates to self-employed and small business owners ▲ medical device and health food companies profiting by commercializing COVID-19 anxiety ▲ and pseudo-investment advisory firms charging high information usage fees with high returns.

Using NTIS data, FIU information, and data collected from related agencies, the National Tax Service confirmed that the average asset value of 16 Young and Rich family owners is 18.6 billion KRW. The average asset values of the investigation targets are 4.2 billion KRW for residences, 13.7 billion KRW for small buildings, and 1.4 billion KRW for memberships.

Cases of earning high income through illegal lending exploiting the national disaster of COVID-19 or profiting by exaggerating the efficacy of medical devices were also included in the tax investigation targets.

Previous investigations revealed that lending company C lent funds at interest rates exceeding the legal maximum to companies struggling financially due to low credit and difficulty obtaining bank loans, deliberately omitting income by dispersing principal and interest into nominee accounts. There are also medical device companies that made excessive profits by exaggerating the effects of medical devices, leaked corporate funds as rebates to large hospitals, and reduced reported income.

The National Tax Service stated, "For malicious tax evaders exploiting the national crisis, the entire related companies and family owners have been designated as related parties," adding, "If during the investigation, intentional tax evasion such as using nominee accounts or double bookkeeping is confirmed, strict measures including prosecution under the Tax Crime Punishment Act will be taken."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)