[Asia Economy Reporter Park Jihwan] The Financial Services Commission and the Financial Supervisory Service announced on the 17th that they will distribute a virtual asset service provider registration manual about a month ahead of the enforcement of the amendment to the Act on Reporting and Using Specified Financial Transaction Information (hereinafter referred to as the Specified Financial Transaction Information Act, or Specified Act). The manual contains detailed procedures related to the registration of service providers.

Previously, the Specified Act was amended in March last year and is scheduled to be enforced on the 25th of next month. The amendment mainly imposes registration obligations on virtual asset service providers, along with obligations to prevent money laundering and terrorist financing activities. It also includes requirements that financial institutions must comply with when conducting financial transactions with virtual asset service providers.

According to the amendment, virtual asset service providers subject to the Specified Act must meet the requirements and submit a registration form and supporting documents to the Financial Intelligence Unit (FIU) upon enforcement of the law. Those required to register as virtual asset service providers include existing providers who conducted virtual asset business before the law’s enforcement and newly established providers. Existing providers must complete registration between the 25th of next month, which is within six months of the law’s enforcement, and September 24th.

If a provider fails to obtain Information Security Management System (ISMS) certification or if the corporation’s representative or executive receives a sentence of a fine or higher related to crimes specified by law, the registration may not be accepted. Exchanges and others must also obtain deposit and withdrawal accounts that require real-name verification.

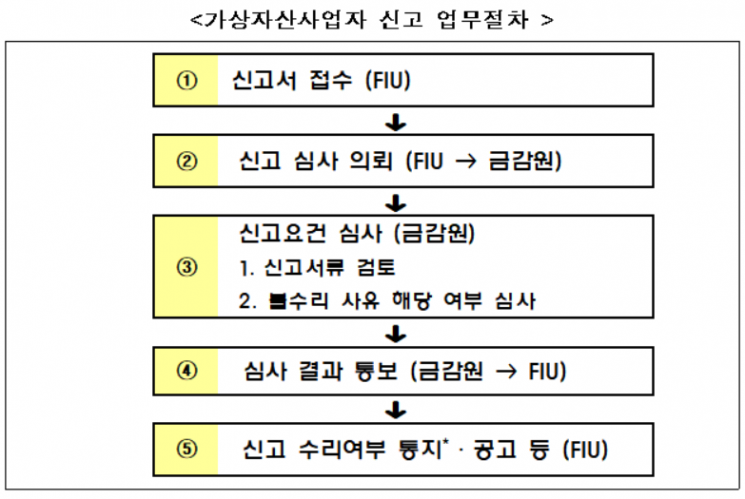

Looking at the specific registration procedures, virtual asset service providers must prepare the mandatory items on the registration form and supporting documents and submit them to the FIU. After receiving the registration form, the FIU requests a review from the Financial Supervisory Service. The Financial Supervisory Service then prepares an opinion on the registration documents and contents of the virtual asset service provider and notifies the FIU.

Finally, the FIU will notify the registering service provider of the acceptance or rejection of the registration. The FIU plans to notify the acceptance status within three months after receiving the registration.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.