Institutional Adoption Acts as a Positive Catalyst... Records First Ever Breakthrough of $50,000

Asset Exchange Surpasses 5 Million Cumulative Subscribers... Sevenfold Increase in 5 Years

Investment Fever in Virtual Assets Among 2030 Generation

Investment Shifts to High-Risk, High-Return Cryptocurrencies, Stock Market, Real Estate Due to Record Low Interest Rates

Concerns Raised Amid High Volatility

[Asia Economy Reporters Song Hwajeong and Gong Byungseon] As money moves accelerate toward risky assets, the enthusiasm for Bitcoin investment is growing increasingly intense. With institutional adoption following one after another, Bitcoin surged past $50,000 for the first time ever, drawing investors' attention to Bitcoin.

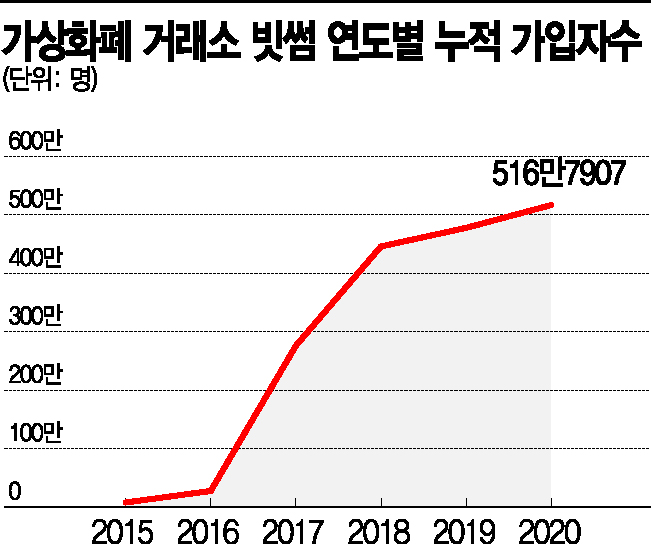

According to the cryptocurrency exchange Bithumb on the 17th, the cumulative number of registered users exceeded 5 million as of last year. This is about a sevenfold increase compared to 75,278 users in July 2015 over five years. The number of users surged to 1,700,860 in 2018 due to the cryptocurrency craze at the end of 2017 and early 2018, but as the investment enthusiasm cooled down afterward, the increase slowed to 318,003 in 2019 and then rose again to 391,004 last year. With Bitcoin surging again at the beginning of this year, investment enthusiasm is heating up, and a rapid increase in registrations similar to 2018 is expected.

Especially, the 20s and 30s generations, who are actively investing in high-risk assets such as cryptocurrencies, are showing clearer investment movements toward cryptocurrencies. According to Bithumb, the proportion of users in their 20s expanded from 29.4% in 2019 to 32.9% at the beginning of this year. Those in their 30s increased from 24.3% in 2019 to 29.1% this year. A Bithumb official said, "New registrants are mostly in their 20s, but the cumulative number of users is highest in their 30s," adding, "The 20s and 30s generations overall account for the largest share."

Dreaming of Early Retirement with Bitcoin

Lee Jihyun (27, pseudonym), who dreams of becoming part of the FIRE (Financial Independence Retire Early) movement by building economic power through financial technology and retiring early, jumped into cryptocurrency investment after hearing from acquaintances who earned billions in profits through virtual currencies. Lee started raising funds to purchase real estate to secure her retirement but, lacking a proper way to accumulate a large sum, decided to invest in cryptocurrencies that could yield high returns. She said, "I plan to retire early and spend my retirement through rental income from real estate. I don't fully understand how Bitcoin creates value or what blockchain technology is, but I'm just waiting for the price to go up further."

Office worker Seo Jeongin (35, pseudonym) also recently started investing in Bitcoin. Seo, who owns Tesla stocks, decided to invest in Bitcoin after hearing news that Tesla had invested in Bitcoin. Seo explained, "I invested because I had high expectations for Tesla and earned high returns. After seeing the cryptocurrency bubble burst and prices plummet in the past, I thought cryptocurrencies were highly volatile and risky investments, but my perspective changed after learning that Tesla invested."

Money Moves to Bitcoin Amid Price Surge

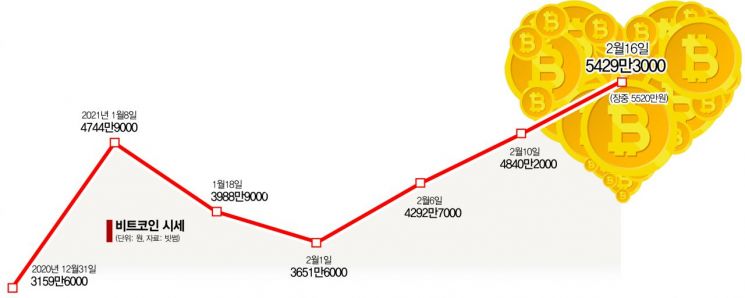

The growing interest of investors in cryptocurrencies is ultimately due to Bitcoin's rapid price increase. On the 16th (local time), Bitcoin surpassed $50,000 for the first time in history. At 7:32 a.m. in New York, Bitcoin was priced at $50,515. Bitcoin rose 170% in the fourth quarter of last year and has increased more than 70% since the beginning of this year. Leading companies such as Tesla and Mastercard recently purchased or announced plans to adopt Bitcoin, fueling the upward trend. Tesla CEO Elon Musk purchased $1.5 billion worth of Bitcoin, and Mastercard also decided to include cryptocurrencies partially in its payment system. Bitcoin recently hit 55 million KRW on domestic exchanges.

Along with this, the recently accelerating 'money move' has also become a factor driving funds into Bitcoin. Due to historically low interest rates, funds are flowing out of banks and moving toward the stock and real estate markets at an increasing pace. Money moves toward risky assets are also channeling funds into high-risk, high-return investment assets like Bitcoin.

However, concerns are also being raised amid this investment frenzy. Many investors suffered huge losses after the cryptocurrency bubble burst following massive investments in the past. Especially, since cryptocurrencies are highly volatile assets, a cautious approach is necessary. Hwang Sewoon, a research fellow at the Korea Capital Market Institute, said, "Bitcoin is still an asset with high volatility in its value. Although it has risen a lot now, it could also crash. Until now, Bitcoin has operated in a vacuum, but it needs to be nurtured under institutional frameworks by assigning product characteristics and legal status."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)