$1.9 Trillion Stimulus Impact Spurs Inflation Concerns

US Treasury Yield Surges to 1.3%

Yellen and Powell Confident in Inflation Control

Yellen Shows Willingness to Boost Economy with Overheating

Concerns Over Early Tapering if Inflation Rises

Bank of Korea Alert to Future Shocks

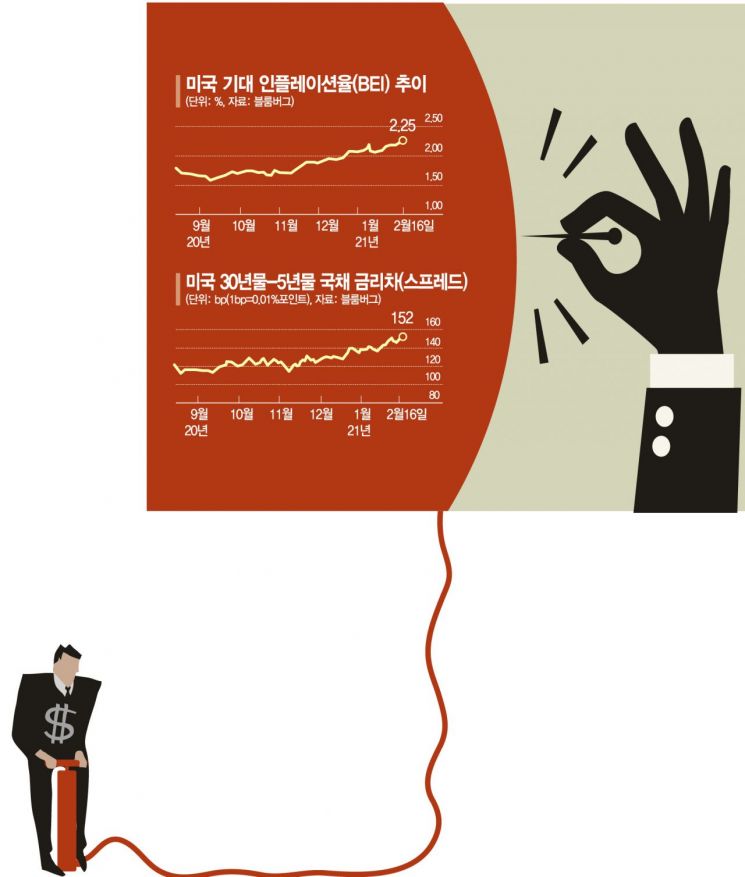

[Asia Economy New York=Correspondent Baek Jong-min, Reporter Kim Eun-byeol] As concerns over U.S. inflation grow and government bond yields surge, attention is focused on the U.S. government and the Federal Reserve's (Fed) responses to economic stimulus and price control. Treasury Secretary Janet Yellen and Fed Chair Jerome Powell have expressed their intention to tolerate rising prices while pushing for large-scale fund disbursement to accelerate economic recovery, but market worries that inflation expansion could hasten exit strategies have not disappeared.

On the 16th (local time), after the President's Day holiday ended and the New York financial market opened, the yield on the 10-year U.S. Treasury bond soared to 1.3%. This was a sharp rise of 0.1 percentage points compared to the previous week. The 10-year U.S. Treasury yield exceeding 1.3% is the first time since February last year. As inflation concerns were simultaneously reflected and bond yields surged, the New York stock market showed mixed trends that day, and gold prices plunged by 1.3%.

◇ Biden experimenting with a ‘High Pressure Economy’ = The Biden administration is scheduled to disburse $1.9 trillion in economic stimulus funds, and the Fed has stated it will align monetary policy to support full employment recovery. President Joe Biden and Secretary Yellen have been emphasizing the need to "act big" daily to restore the U.S. economy, making large-scale fiscal spending a foregone conclusion.

Some view the Biden administration as undertaking a large-scale fiscal experiment unseen since World War II, attempting to completely overturn the government policy direction of the past 40 years focused on combating inflation. Secretary Yellen, who proposed the ‘High Pressure Economy’ during her tenure as Fed Chair in 2016, aims to lead post-crisis economic recovery through this approach.

The High Pressure Economy refers to a situation where demand exceeds supply, causing prices to rise. It means temporarily tolerating employment and inflation exceeding target levels to expand demand amid a trend of declining potential growth rates.

U.S. investment bank Morgan Stanley forecasts that if a High Pressure Economy is attempted amid the faster-than-expected economic recovery, the U.S. gross domestic product (GDP) could increase by more than 3% compared to pre-COVID-19 levels by 2021.

The key to the success of the High Pressure Economy lies in keeping inflation within a controllable range. Since the oil shocks of the 1970s, inflation has been a source of fear for governments worldwide, but now the U.S. government and Fed believe it is a challenge that can be overcome.

The High Pressure Economy is also a subject of debate within the U.S. academic economic community. Paul Krugman, a professor at the City University of New York, supports the Biden administration’s stance, saying the concept that low unemployment drives up prices was only relevant in the 1970s. On the other hand, Larry Summers, a Harvard professor and former Treasury Secretary under the Bill Clinton administration, expresses daily concerns about inflationary pressures and actively opposes additional stimulus.

◇ U.S. says "Inflation is controllable," but shock concerns remain = The Fed is actively denying concerns about inflation and the possibility of early tapering (reduction of asset purchases). Fed Chair Powell emphasized on the 10th, "Do not expect rapid or long-term inflation," and reiterated the denial of early tapering by stating, "In the past, when unemployment fell, we responded with rate hikes, but now we cannot do that."

Mary Daly, President of the San Francisco Fed, said in a lecture that she is not worried about inflation and asserted, "Even if prices rise above 2%, the Fed has sufficient ability to manage it."

Interest rate increases reflecting inflation can negatively affect economic recovery. Especially amid the COVID-19 crisis, where government and household debt burdens have surged, rising interest rates lead to increased interest expenses. Rising rates also burden the stock market. Art Hogan, Chief Market Strategist at National Securities, evaluated, "When rates rise for the right reasons, the market can absorb it, but not when they rise in a straight line."

The Bank of Korea is also on high alert for potential inflation shocks. A senior official at the Bank of Korea stated, "Ten years ago, the financial system was fragile, making it difficult to generate liquidity through loans and bond issuance, but recently, except for face-to-face service industries, the financial system is robust, increasing liquidity and possibly leading to inflation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)