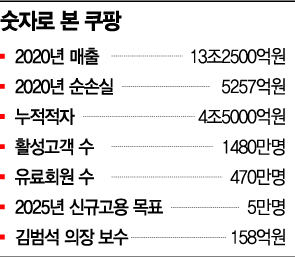

[Asia Economy Reporter Hwang Junho] On the 16th, the KOSPI continued its upward trend as Naver's stock price surpassed 400,000 KRW per share following Coupang's listing on the US Nasdaq, and the previous day's semiconductor stock rally carried over. Meanwhile, the KOSDAQ turned downward due to weakness in bio-pharmaceutical stocks.

KOSPI's Upward Momentum Continues

On the 15th, the KOSPI opened at 3,108.70, up 8.12 points (0.26%) from the previous trading day, as employees were working in the dealing room of Hana Bank in Jung-gu, Seoul. The KOSDAQ opened at 965.83, up 1.52 points (0.16%) from the previous trading day. The won-dollar exchange rate started at 1,105.0 won, down 2.0 won from the previous trading day. Photo by Kim Hyun-min kimhyun81@

On the 15th, the KOSPI opened at 3,108.70, up 8.12 points (0.26%) from the previous trading day, as employees were working in the dealing room of Hana Bank in Jung-gu, Seoul. The KOSDAQ opened at 965.83, up 1.52 points (0.16%) from the previous trading day. The won-dollar exchange rate started at 1,105.0 won, down 2.0 won from the previous trading day. Photo by Kim Hyun-min kimhyun81@

As of 10:58 AM, the KOSPI is up 13.40 points (0.43%) at 3,160.40. The market is characterized by notable net buying from individuals (110.4 billion KRW) and foreigners (86.6 billion KRW).

Foreign investors are holding Samsung Electronics, IHQ, Daehan Electric Wire, Pan Ocean, BNK Financial Group, Poongsan, among others, and are currently net buying KT, Pan Ocean, Dongbang, Samsung C&T, Hana Financial Group, and Sunjin.

By sector, paper and wood products are up over 2%, while service, food and beverage, and telecommunications sectors are rising by over 1%. Among the top market capitalization stocks, Naver (NAVER) continues its rise of over 3%, with Samsung Electronics, Hyundai Motor, and Kakao maintaining upward momentum.

Shinhan Financial Investment Research Center analyzed that the KOSPI's rise is driven by visible vaccine effects and growing expectations for Europe's economic recovery, with foreigners net buying in the electrical and electronics sector. Particularly, Naver's notable rise is seen as a revaluation of online distribution platforms and parcel logistics-related stocks ahead of Coupang's US Nasdaq listing.

KOSDAQ, Bio Sector Weakness

On the 15th, the KOSPI opened at 3,108.70, up 8.12 points (0.26%) from the previous trading day, as employees were working in the dealing room of Hana Bank in Jung-gu, Seoul. The KOSDAQ opened at 965.83, up 1.52 points (0.16%) from the previous trading day. The won-dollar exchange rate started at 1,105.0 won, down 2.0 won from the previous trading day. Photo by Kim Hyun-min kimhyun81@

On the 15th, the KOSPI opened at 3,108.70, up 8.12 points (0.26%) from the previous trading day, as employees were working in the dealing room of Hana Bank in Jung-gu, Seoul. The KOSDAQ opened at 965.83, up 1.52 points (0.16%) from the previous trading day. The won-dollar exchange rate started at 1,105.0 won, down 2.0 won from the previous trading day. Photo by Kim Hyun-min kimhyun81@

On the other hand, the KOSDAQ is down 7.14 points (0.73%) at 974.83. Individuals are net buying 187.2 billion KRW, while foreigners and institutions are showing net selling intentions of 116.4 billion KRW and 57.4 billion KRW respectively. By sector, telecommunications services are up over 3%, and telecommunications broadcasting is rising over 1%. Among the top market cap stocks, Pearl Abyss is up over 2%, while Celltrion Healthcare, Celltrion Pharm, and Seegene are down over 2%.

Shinhan Financial Investment analyzed that although the KOSDAQ started higher due to strong semiconductor stock prices, it turned downward due to weakness in bio stocks.

Meanwhile, the USD/KRW exchange rate is trading at 1,098.21, down from the 1,100 level for the first time in a month, driven by growing economic recovery expectations amid global vaccine rollout. Among major Asian stock markets, Japan rose 1.16%, Hong Kong 1.52%, while China and Taiwan markets were closed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.