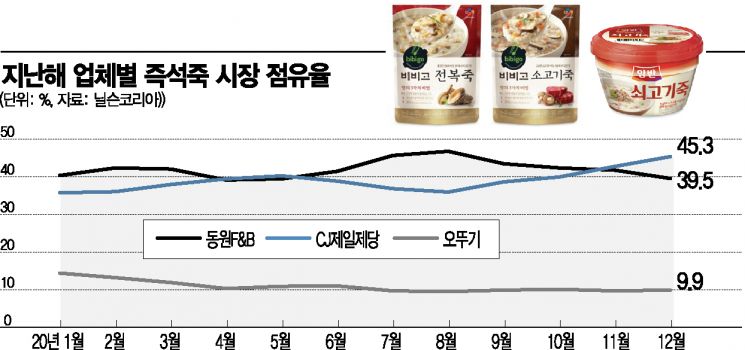

Last Year Market Share Gap 2.8P

Bibigo Juk Ranked 1st in November and December

Overwhelming 60%+ Share in Pouch Market

[Asia Economy Reporter Lim Hye-seon] CJ CheilJedang, the "rising prestigious brand," is shaking the long-standing dominance of Dongwon F&B, the "old-timer" that has led the instant porridge market for 30 years. The market share gap has narrowed to 2.8 percentage points (p), making a reversal likely soon.

CJ CheilJedang Bibigo Porridge's Rapid Rise

According to Nielsen Korea on the 15th, CJ CheilJedang's Bibigo Porridge ranked first in the instant porridge market share in November and December last year, recording 42.7% and 45.3%, respectively. Dongwon F&B's Yangban Porridge fell to second place with 41.7% and 39.5%. Ottogi's market share remained in the 9% range, holding third place. Earlier, in April and May last year, Bibigo Porridge's market share also surpassed Yangban Porridge with 39.4% and 40.2%, respectively.

By product category, CJ CheilJedang dominated the pouch market in November and December. Dongwon F&B recorded 28.9% and 29.6%, while CJ CheilJedang achieved 60.7% and 60.2%. Conversely, in the container market, Dongwon F&B led with 53.9% and 54.0%, while CJ CheilJedang recorded 25.7% and 25.5%.

From 4.3% Three Years Ago to 41.9% Last Year

Before CJ CheilJedang’s pouch porridge Bibigo Porridge was introduced, Dongwon F&B’s Yangban Porridge dominated the domestic instant porridge market. However, CJ CheilJedang changed the market landscape, which had been centered on container porridge, by leveraging pouch porridge and establishing a two-strong system. In 2018, CJ CheilJedang’s Bibigo Porridge had a negligible market share of 4.3%, but it jumped to 34.6% within a year. Yangban Porridge, which had been leading with 60.2% in 2018, dropped to 43.4% in 2019.

Last year, Yangban Porridge barely maintained first place, but the gap with Bibigo Porridge narrowed. Dongwon Porridge (41.9%) and Bibigo Porridge (39.1%) recorded a 2.8 percentage point difference. Over two years since its launch, Bibigo Porridge’s cumulative sales exceeded 150 billion KRW, and cumulative sales volume surpassed 60 million units. CJ CheilJedang aggressively invested to successfully enter the instant porridge market. They formed the ‘Bibigo Porridge R&D Team,’ composed of experts in ambient ready-to-eat rice processing. The R&D team focused on rice, broth, and raw materials. Through raw material preprocessing, sterilization, and broth technology, they enhanced the original taste and texture of the ingredients. Dongwon F&B is also releasing various products to fend off the chase. They launched pouch porridge in 2019 and strengthened their premium lineup (Yangban Sura).

Instant Porridge Market Reaches 150 Billion KRW Scale

The emergence of pouch porridge has also expanded the instant porridge market size. Having maintained a single-leader system for over 30 years, the porridge market had stagnated at around 70 to 80 billion KRW. Thanks to the popularity of pouch porridge, the market size surged to 135.7 billion KRW in 2019 and 146.5 billion KRW last year. The food industry expects the instant porridge market to continue growing. Previously, container porridge was mainly consumed as a simple meal replacement at convenience stores, but now pouch porridge is purchased at supermarkets and heated at home, becoming a part of everyday meals. As more people enjoy instant porridge for breakfast substitutes, dieting, hangover relief, and snacks, sales channels are shifting from convenience stores to discount stores.

A food industry official explained, "Due to the impact of COVID-19, the preference for home-cooked meals over dining out is increasing this year as well, benefiting the instant porridge market. We are focusing on improving quality to match that of professional porridge served in restaurants."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)