Major System Faces Limits in Encouraging Individual Short Selling Participation 'Stock Lending Termination Movement Spreads'

Loan Transaction Contract Confirmation System 'Foreign Short Selling Forces Excluded from Resumption Due to Certification Differences'

Hantuyeon "Short Selling Should Resume Only After Establishing a System to 100% Control Illegal Short Selling"

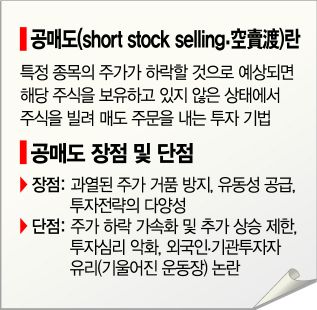

[Asia Economy Reporter Lee Seon-ae] With short selling resuming on May 3 only for the constituent stocks of KOSPI 200 and KOSDAQ 150, it is virtually equivalent to a full-scale allowance, and individual investors' investment sentiment is expected to weaken. Although individual investors are voicing strong demands that short selling should only resume after a system capable of 100% controlling illegal naked short selling is established, the improvement measures by financial authorities and related agencies remain 'half-hearted,' making it highly likely that the side effects of resuming short selling will persist.

Partial Resumption of Short Selling is Virtually Full-Scale Allowance

According to the financial investment industry on the 11th, the general view in the industry is that resuming short selling only for the constituent stocks of KOSPI 200 and KOSDAQ 150 is virtually no different from a full-scale allowance. The basis is that the KOSPI 200 and KOSDAQ 150, which are the targets for resuming short selling, hold a significant proportion of the market. Kang Dae-seok, a researcher at Eugene Investment & Securities, explained, "(As of the 5th) the KOSPI 200 accounts for 92% of the KOSPI market capitalization, and the KOSDAQ 150 accounts for 48% of the KOSDAQ market capitalization. In particular, the loan balance proportion of KOSPI 200 is 94% of the total loan balance, and for KOSDAQ 150, it reaches 77%."

The loan balance refers to the quantity of stocks borrowed by investors but not yet returned, and generally, an increase in loan balance indicates a high potential for short selling. Researcher Kang said, "Looking at the loan balance proportions of major KOSPI and KOSDAQ indices, the partial resumption of short selling inevitably results in an outcome similar to a full lifting of the short selling ban," adding, "Since this is disadvantageous to individual investors, it could act as a factor that dampens investment sentiment."

Limitations in Activating Individual Participation in the Lending System

The financial authorities and related agencies have introduced support measures to activate individual investors' participation in short selling and to alleviate distrust, but various loopholes have emerged, causing discomfort among individual investors.

The Financial Services Commission is promoting the establishment of a lending system to activate individual short selling participation. Currently, six securities firms participate in lending; this will be expanded to all 28 firms that provide margin loans, and a centralized system will be built to increase lending volume. The plan is to expand lending volume to about 1.4 trillion KRW and additionally secure 2 to 3 trillion KRW by borrowing stocks held by securities firms and insurance companies.

The problem is that the lending market is based on individual consent, and the consent rate was only 30% as of last year. The market size also shows a huge gap: as of 2019, the loan balance was 67 trillion KRW, whereas lending was only 23 billion KRW, a difference of over 2,900 times. The view is strong that it is nonsensical to expect the lending system itself to lead to the activation of individual short selling participation. Moreover, on the bulletin board of the Korea Stock Investors Association (HanTuYeon), an online community with about 40,000 members, posts encouraging participation along with instructions on how to cancel stock lending continue to appear, sparking a movement to cancel stock lending. An individual investor from HanTuYeon pointed out, "If individual stock lending cancellations continue to increase, the lending system will not function properly," adding, "It is difficult to induce individual participation with this support measure alone."

Foreigners Excluded from Loan Transaction Contract Confirmation System

The Loan Transaction Contract Confirmation System by the Korea Securities Depository (KSD), designed to block illegal naked short selling, is also criticized as being hollow. The system digitalizes the loan transaction contract process, which was previously handled manually between participants, by recording and storing it through the KSD system. Its purpose is to enhance transparency and alleviate distrust by storing loan transaction information, including the contract confirmation date and time. The problem is that while domestic investors will adopt the system from March 8, foreign investors will adopt it later this year due to different authentication methods. An individual investor from HanTuYeon criticized, "Foreigners, who are the illegal short selling forces, are excluded while short selling resumes, so it is questionable what effect the loan transaction contract confirmation system can have."

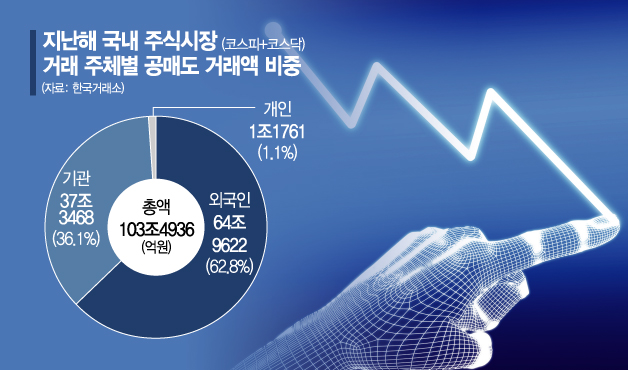

Currently, most short selling transactions are concentrated among foreign institutions. According to the Korea Financial Investment Association, in January this year alone, foreign investors' short selling accounted for 331.83 million shares, representing 60.26% of the total short selling volume (550.67 million shares). Furthermore, among 32 sanction cases detected for illegal short selling from 2017 to September 2020, 31 cases (96.8%) involved foreign financial firms and pension funds. HanTuYeon insists, "Short selling should only resume after a system capable of 100% controlling illegal short selling is established."

The Hana Financial Management Research Institute pointed out that improvements to the current short selling system are essential. Despite regulations against naked short selling?selling stocks without borrowing them?and violations of the 'uptick rule,' which restricts selling bids to be above the last transaction price, poor management has led to continued damage cases, indicating the need for institutional and strong supplementary measures to eradicate illegal activities.

The Korea Stock Investment Association (KOSIA), a private investors' group, operated a bus displaying phrases such as "Abolish Short Selling" and "Dissolve the Financial Services Commission" on the afternoon of the 1st in front of the Government Seoul Office in Gwanghwamun to protest against short selling.

The Korea Stock Investment Association (KOSIA), a private investors' group, operated a bus displaying phrases such as "Abolish Short Selling" and "Dissolve the Financial Services Commission" on the afternoon of the 1st in front of the Government Seoul Office in Gwanghwamun to protest against short selling. [Image source=Yonhap News]

Clear Impact on KOSDAQ, Caution Advised for Bio Sector

The impact of resuming short selling is expected to be more pronounced in KOSDAQ than in KOSPI. The reasons include some hedge demand due to individual stock futures, patterns of loan balances before and after the short selling ban, and precedents from the 2008 and 2011 short selling bans.

Researcher Kang said, "There are 124 individual stock futures listed on KOSPI and 22 on KOSDAQ. After the short selling ban, it is highly likely that some hedge demand was absorbed through individual stock futures on KOSPI (12 of which are in KOSPI 200)," adding, "Since March 16 last year, when short selling was banned, the loan balance in KOSDAQ has decreased sharply compared to KOSPI. Assuming a return to previous patterns after short selling resumes, short selling transactions are expected to increase relatively more in the KOSDAQ market."

In Korea, short selling was banned for eight months in 2009 and for three months in 2011. In both cases, the increase in loan balances was more pronounced in KOSDAQ than in KOSPI, and in KOSPI, foreign investors' net buying increased sharply in a short period.

Especially in the KOSDAQ bio sector, stock prices rose as the loan balance proportion decreased after the short selling ban, so it is highly likely that the gains will be given back upon resumption. Kim Min-gyu, a researcher at KB Securities, said, "The health management sector, which had a high loan balance proportion, showed an increase in loan balance and stock price after the short selling ban. If short selling intensifies again with the resumption, returns could be poor."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.