Amendment of Follow-up Enforcement Rules for the 2020 Revised Tax Law

[Sejong=Asia Economy Reporter Son Sun-hee] From April, securities transaction tax exemptions will be excluded for stocks with a market capitalization of 1 trillion won or more or those with active trading.

The Ministry of Economy and Finance announced on the afternoon of the 9th its plan to promote the "2020 Revised Tax Law Follow-up Enforcement Rules Amendment" containing this content. The enforcement rules to be amended include 18 laws such as the Framework Act on National Taxes, Income Tax Act, Corporate Tax Act, Inheritance and Gift Tax Act, and Comprehensive Real Estate Tax Act. These enforcement rules are expected to be promulgated and enforced in mid-March after legislative notice, inter-ministerial consultation, and review by the Ministry of Government Legislation.

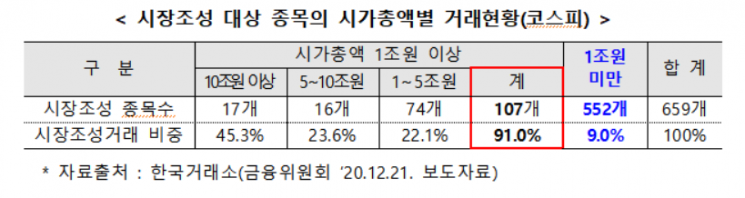

Previously, 22 securities companies designated as "market makers" have been exempted from securities transaction tax on stocks they transfer since 2016. However, contrary to the original intention to activate trading in the KOSDAQ market and startup and venture companies with insufficient liquidity, trading volume concentrated on blue-chip stocks, leading to repeated criticisms that the basis for tax exemption was insufficient.

Accordingly, the Ministry of Economy and Finance decided to exclude securities transaction tax exemptions for stocks with a "market capitalization of 1 trillion won or more" or those ranked in the top 50% by turnover rate in each KOSPI and KOSDAQ market. The turnover rate is calculated by dividing the daily trading volume by the total number of shares of a specific stock, which simply indicates "how active the trading is." The intention is to tax stocks that are already actively traded and have no liquidity concerns.

In addition, for derivatives, stocks with a futures or options market trading value ratio of 5% or more or an annual trading value of 300 trillion won for futures and 9 trillion won for options will also be excluded from the transaction tax exemption. This will apply to transfers made after April 1.

The Ministry of Economy and Finance also decided to adjust the interest rate applied when calculating national tax and customs refund premiums or deemed rental income on real estate lease deposits in line with market interest rate trends. Previously, the interest rate was adjusted annually considering the average interest rate of time deposits (1.8% last year), but it has been decided to reflect recent market interest rate trends, lowering the interest rate to 1.2%. The refund premium will apply from the period after the enforcement date of the rules, and the deemed rental income on real estate will apply from the taxable year starting after January 1.

Furthermore, the integrated investment tax credit applied to new growth technology commercialization facilities will be expanded to 158 facilities in 10 fields by adding related facilities such as system semiconductors, carbon dioxide reduction, and solar cells.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.