[Asia Economy Reporter Su-yeon Woo] As global giant IT companies recorded unprecedented earnings in the fourth quarter of last year, expectations for a rebound in demand for server DRAM have strengthened. Signs of a semiconductor 'super cycle' led by rising server DRAM prices have been detected, raising hopes for improved performance of domestic semiconductor companies such as Samsung Electronics and SK Hynix.

On the 15th, DRAMeXchange forecasted that the annual price of server DRAM this year will rise by about 35-40% compared to the previous year. Since the end of last year, the inventory levels of server DRAM at major IT companies such as Google, Amazon, Microsoft, and Facebook have decreased, prompting them to start restocking again.

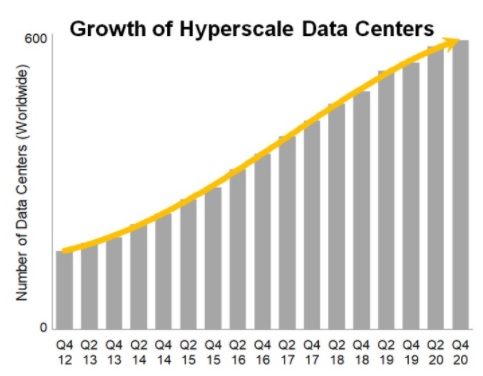

According to Synergy Research Group, global IT companies' data center investments in the third quarter of last year reached $37 billion, setting a record for the highest quarterly amount ever. The top three cloud companies?Google, Amazon, and Microsoft?had postponed investments in the first half of last year due to increased uncertainty from COVID-19 but confirmed untact demand and aggressively increased data center investments from the third quarter onward. These big three companies account for more than half of the global cloud market.

Data center investments by cloud service providers directly translate into increased demand for server DRAM. This is because core semiconductor components such as central processing units (CPUs) and server DRAM are essential for cloud businesses that rent servers to themselves or others. Such demand increases are reflected in server DRAM prices with a time lag depending on companies' inventory levels. In fact, the fixed price of server DRAM (DDR4 32GB) turned upward to $115 in January this year after seven months of decline.

Domestic semiconductor companies also have a positive outlook for the server DRAM market this year. Samsung Electronics expects a recovery in the memory semiconductor sector in the first half of this year due to increased demand for mobile and server applications, while SK Hynix anticipates DRAM demand growth in the high teens to 20% range this year, citing expanded investments in new data centers by global companies as the reason.

Moreover, with big tech companies achieving record-breaking sales in the fourth quarter of last year, expectations have risen that data center investments will continue this year. Microsoft's Intelligent Cloud division posted $14.6 billion in revenue in the fourth quarter, a 23% increase year-on-year, with cloud computing service Azure's revenue surging 50%, marking an all-time high.

Amazon Web Services (AWS), responsible for Amazon's cloud computing business, also achieved a record quarterly revenue of $12.7 billion in the fourth quarter. AWS plans to expand additional data center infrastructure in key locations such as India, Australia, and Switzerland by 2022.

Google, which has seen a surge in usage of major content services like YouTube due to COVID-19, has also settled into its cloud business trajectory. Google's revenue in the fourth quarter reached $56.9 billion, the highest quarterly performance, with cloud business revenue increasing approximately 46% year-on-year to $3.8 billion.

Geun-chang Noh, a researcher at Hyundai Motor Securities, said, "Google has been expanding server orders since January due to service disruptions in YouTube and other services. Given that cloud revenues of companies like Google and Alibaba, which delayed data center investments due to COVID-19 last year, have recently increased, we can expect investment expansion this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman Who Jumps Holding a Stolen Dior Bag... The Mind-Shaking, Bizarre Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)