January, Twice the Average Receipt Amount

Launch of Secondary Financial Sector Loan Linkage Service

January Customer Growth Rate Doubles the Average

[Asia Economy Reporter Sung Kiho] Internet-only bank K-Bank saw its deposit balance increase by 750 billion KRW in January alone. Analysts attribute this to the highest-ever increase in users, driven by higher interest rates than commercial banks and the spotlight on Bitcoin. Additionally, K-Bank is expanding its scope by launching a linked loan service that introduces secondary financial institution loan products to customers who find it difficult to obtain loans from the bank.

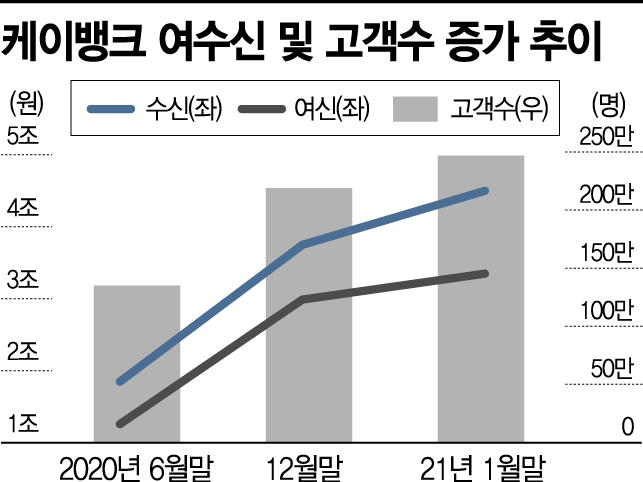

According to the financial sector on the 6th, as of the end of January, K-Bank's deposit and loan balances stood at 4.5 trillion KRW and 3.35 trillion KRW, respectively. Compared to the end of June last year, before K-Bank resumed capital increase and loan operations, when the balances were 1.85 trillion KRW and 1.26 trillion KRW respectively, these figures have nearly tripled. The number of customers also grew from 1.35 million to 2.47 million during the same period.

January's performance was particularly remarkable. At the end of December last year, K-Bank's deposit and savings balance was 3.75 trillion KRW, which increased by 750 billion KRW in January alone. Loans also increased by 360 billion KRW during this period. New customers reached 280,000. Considering that from July to December last year, the average monthly net increase in deposits and loans was 316.7 billion KRW and 288.3 billion KRW respectively, and new customers averaged 140,000 per month, this represents more than double the growth.

The market views K-Bank's partnership with Upbit in June last year to open the 'KRW deposit service' as a decisive factor. To open a real-name account for trading on Upbit, customers must go through K-Bank, and the Bitcoin craze in January naturally led to an increase in users and deposits.

Upbit's trading volume was 151,000 transactions in January last year but surged to 502,000 transactions in January this year. Notably, on the 2nd, the 24-hour trading volume reached 5.4244 billion USD, equivalent to about 6.02 trillion KRW traded in a single day.

Higher Interest Rates Than Commercial Banks... Aggressive Loan Strategy

Higher interest rates than commercial banks also had an impact. K-Bank's one-year fixed deposit interest rate is up to 1.3% per annum, and the one-year installment savings interest rate is up to 1.8% per annum. The 'Plus Box,' a 'parking account' (demand deposit account) where idle funds can be stored, offers up to 0.7% per annum interest even for just one day on deposits up to 100 million KRW. Considering that major commercial banks' one-year fixed deposit rates generally range in the mid-to-high 0% range, K-Bank guarantees up to 1 percentage point higher rates.

A K-Bank representative explained, "K-Bank's deposit, parking account, and savings interest rates are all competitive compared to commercial banks," adding, "Customer inflow has also significantly increased through partnerships with various content providers such as Upbit."

K-Bank has also taken an aggressive approach to its loan strategy. Starting immediately, it launched a linked loan service that introduces secondary financial institution loan products. Currently, five financial companies offer loan products through this linked loan service: Shinhan Savings Bank, DGB Capital, Eugene Savings Bank, JT Chin-Ae Savings Bank, and Hana Capital, with plans to expand further. Customers who receive loans from partner companies through K-Bank are exempt from early repayment fees regardless of loan period or execution amount.

Exclusive benefits are also provided for customers who receive partner company loans through K-Bank. To facilitate smooth loan repayment, early repayment fees are fully waived regardless of loan period or execution amount. Customers can also receive interest rate benefits of up to 1% depending on their credit score.

Furthermore, K-Bank continuously monitors the loan execution stage of partner company loans to ensure that loans are not processed in a manner unfavorable to customers compared to the initially presented loan screening results. Starting with the launch of the linked loan service, K-Bank plans to significantly strengthen products and services for middle to low credit customers this year. It plans to launch small overdraft accounts and Saetdol loans in the first half of the year, and mid-interest rate loan products using its own credit evaluation model in the second half.

A K-Bank representative said, "This service was introduced to reduce the financial exploration costs for middle credit customers who find it difficult to use banking services and to provide more diverse options," adding, "We will gradually expand benefits for middle to low credit customers starting this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.