Budongsan114, Apartment Price Trends in the Seoul Metropolitan Area for the First Week of February

[Asia Economy Reporter Kim Hyemin] Seoul apartment prices increased their rate of rise despite a shortage of listings. Outlying areas such as Nodogang (Nowon, Dobong, Gangbuk) led the price increases, and the Gangnam area also saw continued price rises amid expectations of eased regulations on redevelopment projects. The impact of the '2·4 Supply Plan' on the apartment market is expected to be detected in 1 to 2 weeks.

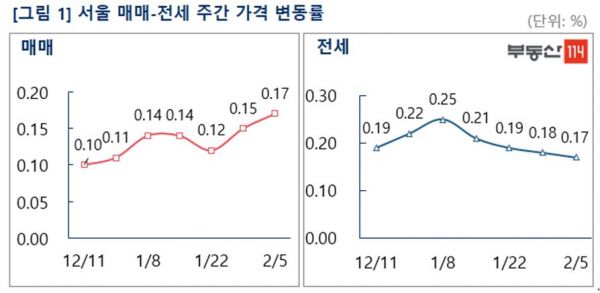

According to Real Estate 114 on the 5th, Seoul apartment sale prices in the first week of February rose 0.17% compared to the previous week, an increase in the rate of rise from last week. General apartments rose 0.15% compared to the previous week, and redevelopment apartments increased by 0.25% in price.

Apartment sale prices in Seoul rose across all 25 autonomous districts, with outer areas such as Guro continuing to lead the upward trend. The Gangnam area, including Gangdong and Songpa, also maintained the upward trend this week due to expectations related to the supply plan that includes easing redevelopment regulations. The increases were as follows: ▲Gangdong (0.38%) ▲Nowon (0.32%) ▲Guro (0.28%) ▲Dobong (0.28%) ▲Gangbuk (0.27%) ▲Dongdaemun (0.27%) ▲Songpa (0.19%) ▲Yongsan (0.19%) ▲Gwangjin (0.18%) ▲Geumcheon (0.18%).

Apartment sale prices in new towns rose 0.14% compared to the previous week. Ilsan led the upward trend with a 0.28% increase compared to the previous week. Following were ▲Pyeongchon (0.22%) ▲Bundang (0.19%) ▲Dongtan (0.16%) ▲Sanbon (0.12%) ▲Jungdong (0.12%). Real Estate 114 stated, "Ilsan continues to benefit from the GTX (Great Train Express) transportation advantage."

In Gyeonggi and Incheon, prices rose in the order of Uiwang (0.35%), Yongin (0.29%), Yangju (0.26%), and Suwon (0.25%).

The jeonse (long-term lease) market saw a decrease in demand due to the winter off-season, but the upward trend continued due to a shortage of listings. Seoul rose 0.17% compared to the previous week, while Gyeonggi, Incheon, and new towns rose 0.15% and 0.06%, respectively. In Seoul, Nowon (0.3%) had the highest increase; in new towns, Ilsan (0.15%) was highest; and in Gyeonggi and Incheon, Incheon (0.25%) had the highest rise.

It is analyzed that the impact of the supply plan announced on the 4th on housing prices will become clearer after the Lunar New Year holiday. Senior Specialist Lim Byungcheol said, "This plan is expected to somewhat calm the overheated housing buying sentiment," adding, "Since it signals large-scale supply mainly in central areas like Seoul, it may reduce supply-demand instability to some extent."

However, Specialist Lim added, "This plan is based on voluntary participation by the private sector, so the key is how quickly actual supply can be brought to the market," and "Considering that it takes time until actual supply, there may be limits to curbing the immediate rise in housing prices and the rapid increase in jeonse prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.