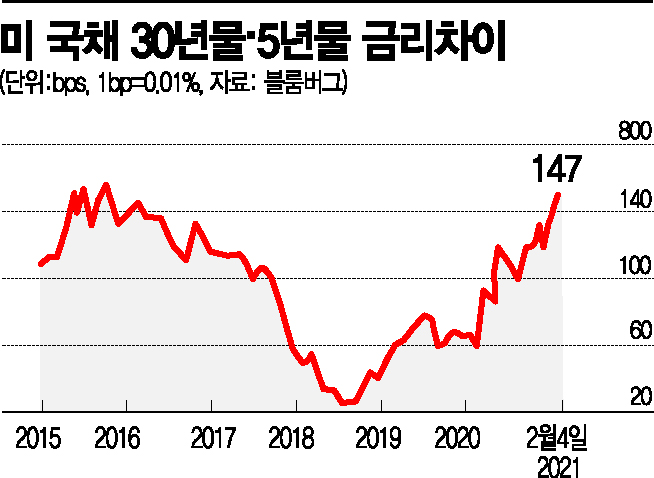

Difference Between 30-Year and 5-Year Bonds: 1.47%P

[Asia Economy Reporter Byunghee Park] The spread between long- and short-term U.S. Treasury yields widened significantly amid expectations for a large-scale economic stimulus package from the Joe Biden administration. Analysts say the bond market is reflecting optimism about a sharp rebound in the U.S. economy.

According to major foreign media on the 4th (local time), the yield spread between the 30-year and 5-year U.S. Treasury bonds reached 1.47 percentage points, marking the highest level since October 2015. Typically, an expanding long-short yield spread is interpreted as a signal reflecting expectations of economic expansion. When optimism about economic improvement grows, demand for safe-haven assets like bonds declines. At this time, bond yields, especially on long-term bonds, rise, widening the yield spread.

On that day, a large volume of 30-year Treasury bonds was sold in the U.S. bond market. The 30-year Treasury yield rose for six consecutive trading days. Starting the year at 1.65%, the 30-year Treasury yield climbed to 1.93% on that day. During the same period, the 10-year Treasury yield also increased from 0.92% to 1.14%. The yield spread between the 10-year and 2-year U.S. Treasuries also widened to the largest gap since 2017.

Market participants explained that the Biden administration's large-scale stimulus package and global economic recovery due to vaccine distribution are reducing the popularity of bonds.

Leslie Falconio, Senior Bond Investment Strategist at UBS Global Wealth Management, said, "Expectations for inflation are rising," adding, "The market anticipates that a large-scale stimulus package will be implemented." The 10-year break-even inflation rate, calculated using the 10-year U.S. Treasury yield, rose from 2.01% at the beginning of the year to 2.18%, marking the highest level since 2018.

On the 1st, President Biden met with Republican senators at the White House to explain the details of his proposed $1.9 trillion stimulus plan. Although Republicans argue for scaling down the package due to fiscal concerns, President Biden is expected to push forward with the large-scale stimulus. The Democrats plan to invoke the 'budget reconciliation' process, which allows approval of tax and spending-related bills with a simple majority, to pass Biden's stimulus plan.

The popularity of other safe-haven assets is also waning. Gold futures prices on the New York Mercantile Exchange fell below $1,800 per ounce. On that day, April delivery gold futures closed at $1,791.20 per ounce, down $43.90 (2.4%) from the previous day, marking the lowest level since November last year.

Expectations for U.S. economic recovery are also confirmed by the strengthening of the dollar. The dollar index, which measures the relative value of the dollar against six major currencies including the euro and pound, rose to 91.5, reaching a two-month high.

Tom Porcelli, Chief Economist at RBC Capital Markets, said, "Economic activity is picking up, and if additional stimulus is added, already improving economic indicators will get even better," adding, "Even without additional stimulus, the U.S. economy is expected to grow at least 5% this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)