Expert: "Reporting transaction information to KFTC without customer consent... The Amendment to the Electronic Financial Transactions Act is a Big Brother Law"

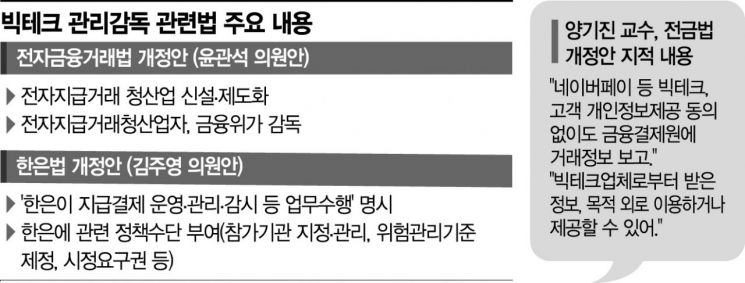

Rep. Kim Jooyoung: "Payment and settlement operations are under BOK authority" Proposed Amendment to the Bank of Korea Act

[Asia Economy Reporter Kim Eunbyeol] The Bank of Korea and the Financial Services Commission, which clashed over the authority to manage and supervise payment settlements of big tech companies such as Naver and KakaoPay, are showing signs of another confrontation regarding the provision of big tech customer transaction information to the Korea Financial Telecommunications and Clearings Institute (KFTC). The academic community has raised concerns about the Electronic Financial Transactions Act (EFTA) amendment, which allows customer personal information to be provided to the KFTC without consent. It appears that the conflict between the Bank of Korea and the Financial Services Commission has entered round two.

"The EFTA Amendment is a Big Brother Law... Information Must Be Provided Without Customer Consent"

Yang Gijin, a professor at Jeonbuk National University Law School, stated in his presentation at the ‘2021 Joint Economics Conference Financial Informatics Seminar’ on the 4th that "If the EFTA amendment passes, personal information related to electronic payment transactions could be concentrated without restrictions from related laws." The amendment mandates that all transaction information of big tech companies be provided to the KFTC and exempts the application of the three major personal information protection laws, which could pose problems.

The part he criticized is related to the newly established electronic payment transaction clearing obligation (Article 36-9) in the amendment. This provision obligates electronic financial operators (big tech companies) to provide electronic payment transaction information to the clearing institution (KFTC) while exempting the application of major personal information protection laws.

The exempted legal provisions include ▲ Article 4 of the Act on Real Name Financial Transactions and Confidentiality (Guarantee of Financial Transaction Confidentiality) ▲ Articles 32 (Consent for Provision and Use of Personal Credit Information) and 33 (Restrictions on Use of Personal Credit Information) of the Credit Information Use and Protection Act ▲ Article 18 of the Personal Information Protection Act (Restrictions on Use and Provision of Personal Information Beyond Purpose), among others. Additionally, related provisions of laws prescribed by presidential decree are also exempted.

Simply put, when purchasing goods or services using Naver Pay points, Naver must compulsorily report all transaction information to the KFTC without the customer's consent for providing or using personal information. He also expressed concern that the transaction information collected by the KFTC could be provided to external companies for commercial purposes. He said, "Excessive personal information will be concentrated in the clearing institution, and depending on who and how this database is used, there is a significant risk of information abuse," adding, "There is a strong possibility of a Big Brother controversy."

The Financial Services Commission drew a line on the controversy, saying it was "a criticism made without properly understanding the operational method."

Lee Hyungju, head of the Financial Innovation Planning Division at the Financial Services Commission, rebutted, saying, "There are always exceptions to confidentiality and the Act on Real Name Financial Transactions," and "Currently, related laws are also excepted in transaction details exchanged between financial institutions." Regarding criticism that no other country except China operates this way, Lee said, "China is the country where electronic payment transactions are most active worldwide, so it separately established a big tech payment clearing institution," emphasizing, "It is not right to criticize China's case, which the Bank for International Settlements (BIS) also cites as a best practice, based on prejudice."

"Payment Settlement Operation Authority Belongs to the Bank of Korea" - Representative Kim Jooyoung Proposes Amendment to Bank of Korea Act

There is also a move to counter the EFTA amendment by revising the Bank of Korea Act. Kim Jooyoung, a member of the National Assembly’s Planning and Finance Committee from the Democratic Party of Korea, officially proposed a partial amendment to the Bank of Korea Act on the same day. The amendment proposed by Representative Kim stipulates that "The Bank of Korea shall perform tasks such as operation, management, supervision, domestic and international cooperation, and promotion of development to ensure the safety and efficiency of the payment settlement system," thereby codifying that payment settlement tasks are the Bank of Korea’s exclusive authority.

The amendment also establishes a legal basis for the Bank of Korea to designate and manage private fund settlement system operators and participating institutions such as the KFTC. Along with this, it grants the Bank of Korea policy tools such as the authority to establish risk management standards, inspection, and correction requests. To prevent changes in the payment settlement environment from becoming risk factors for the entire payment settlement system, the Bank of Korea is also given policy tools such as on-site investigation rights and sanction request rights.

The current Bank of Korea Act allows institutions other than the Bank of Korea to request data or improvements to operating standards for the payment settlement system. However, Kim argues that due to the recent complexity of payment settlement structures caused by the convergence of IT and finance, the Bank of Korea’s responsibilities and authority should be strengthened to prevent system risks in emergencies. For example, in the UK, a fintech company was expelled from the large-value payment system due to poor financial soundness. Kim explained that the Bank of Korea is the only institution that can monitor the entire payment settlement system in real time, respond quickly, and act as the lender of last resort by injecting funds in emergencies, thus preventing the spread of system risks. Ultimately, the issue, which seemed to have been settled in the February National Assembly session, appears to be escalating.

The Bank of Korea also welcomed Representative Kim’s amendment proposal. A senior Bank of Korea official said, "The stable operation and continuous development of the payment settlement system is an essential duty of the central bank," adding, "It is neither principled nor globally precedent-setting for the operation of the payment settlement system to be controlled by financial supervisory authorities." Furthermore, the official emphasized, "Considering that digital payment methods are expanding and fintech and big tech growth have increased payment convenience but also the possibility of payment system instability, amending the Bank of Korea Act is an urgent matter that can no longer be postponed," and "We hope that substantive discussions will be held promptly at the Planning and Finance Committee level, and the Bank of Korea will actively participate in discussions if requested by the National Assembly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)