0.04%P Increase Compared to Previous Month... Due to Rising Credit Loan Interest Rates

Household Debt Negative Factors at Play... High Possibility of Market Interest Rate Increase

[Asia Economy Reporter Kwangho Lee] As the interest rate gap between bank deposits and loans widens, consumers are facing increasing interest burdens. This is expected to act as a negative factor for household debt, which is estimated to have exceeded 1,700 trillion won last year.

The loan-deposit interest rate spread is the difference between the overall loan interest rate (corporate loans + household loans) and the deposit interest rate.

According to the Bank of Korea on the 2nd, the loan-deposit interest rate spread in December last year was 1.84%, up 0.04 percentage points from the previous month (1.81%). It also rose 0.06 percentage points compared to October (1.78%).

This is because at the end of last year, banks raised credit loan interest rates sharply by reducing preferential interest rates as a means to tighten credit loans.

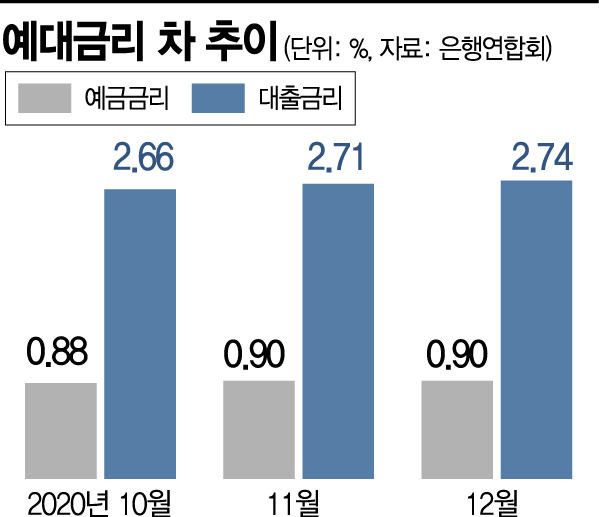

Loan interest rates have been rising: 2.66% in October, 2.71% in November, and 2.74% in December last year. Meanwhile, deposit interest rates remained flat at 0.88% in October, 0.90% in November, and 0.90% in December.

In fact, according to the Bankers Association’s loan product interest rate comparison, among 14 deposit products sold by the five major banks?KB Kookmin, Shinhan, Woori, Hana, and NH Nonghyup?none had a basic interest rate exceeding 1% per annum. The average interest rate for general credit loans at the five major banks ranged from 2.69% to 3.02%.

For example, if a depositor places 50 million won?the deposit insurance limit?in the 'Shinhan S Dream Fixed Deposit' with a basic interest rate (simple interest) of 0.6%, they would receive 400,000 won in interest over one year. However, a borrower with a credit rating of 5 to 6 taking out a loan of the same amount with equal principal and interest repayments over one year would have to pay about 1.64 million won in interest alone. This means that the interest burden on those who borrow to the maximum (Yeongkkeul) or invest with debt (Debt Investment) has increased significantly.

Concerned about this, Lee Nak-yeon, leader of the Democratic Party, pointed out at a financial industry video conference at the end of last year, "If the average deposit interest rate is 1% per annum and the credit loan interest rate is 3.1%, the loan-deposit margin becomes 2.1%. Considering that household debt reached a record high of 1,682 trillion won as of the third quarter last year, banks are sitting on an astronomical 35 trillion won annually." He urged, "I hope efforts will be made to ease the loan-deposit interest rate spread."

A bank official said, "Raising deposit interest rates makes it easier to attract customers but reduces profitability," adding, "Due to prolonged low interest rates and a surge in credit loans, deposit interest rates are expected to remain at similar levels for the time being."

A financial sector official forecasted, "Market interest rates are likely to continue rising. Since about 70% of bank household loans apply variable interest rates, these households may face increased interest burdens due to rising rates."

As of December last year, the proportion of variable interest rate household loans at banks was 68.1%, slightly down from 69.2% the previous month but increased compared to 51.6% a year earlier.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.