Expectations are rising for entering a semiconductor supercycle (boom). Globally, the growth of 5th generation (5G) mobile communications, artificial intelligence (AI), and autonomous vehicles is expected to increase demand for semiconductors such as memory and non-memory (system semiconductors). The Ministry of Trade, Industry and Energy forecasted that semiconductor exports this year will reach $111 billion, a 10.2% increase compared to last year. Additionally, the global semiconductor market size is expected to grow by 8.7% to $477.5 billion. Semiconductor companies worldwide are investing or preparing investments to meet the rising demand. As a result, companies supplying equipment for semiconductor processes are also expected to benefit. Asia Economy aims to gauge the current status and future growth potential of semiconductor equipment companies Wonik IPS and DB Hitek.

[Asia Economy Reporter Park So-yeon] Last year, as non-face-to-face activities increased due to COVID-19, demand for semiconductors needed for IT and electronic products surged. Semiconductor companies worldwide increased production mainly for products used in IT and electronic devices, but as vaccines began to be supplied, a shortage of automotive semiconductors has emerged. Experts predict that the semiconductor shortage will continue for some time. This is because as IT products become more advanced, the number of semiconductors per product has rapidly increased. There is also analysis that a future autonomous vehicle will require 2,000 semiconductors per unit. Not only leading semiconductor companies such as Samsung Electronics and SK Hynix but also small and medium-sized semiconductor-related companies have entered the semiconductor 'super boom' cycle. Domestic foundry specialist DB Hitek is also experiencing a sharp increase in performance due to the flood of orders.

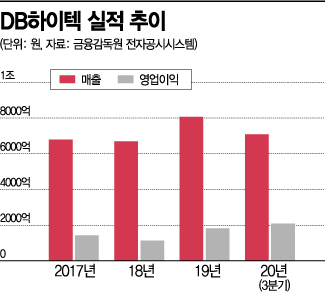

According to the Financial Supervisory Service's electronic disclosure system on the 1st, DB Hitek recorded cumulative sales of 708.1 billion KRW and operating profit of 208.9 billion KRW in the third quarter of last year. Sales increased by 18.9% and operating profit by 56.6% compared to the same period last year. Although the fourth-quarter results have not been announced, securities firms' consensus estimates annual sales of 930 billion KRW and operating profit of 270 billion KRW. This represents increases of 16.2% and 47.82%, respectively, compared to the previous year. There are also forecasts that this year sales will surpass 1 trillion KRW and operating profit 300 billion KRW.

Expectations to Surpass 1 Trillion KRW in Sales This Year

Possibility of Price Increases and Factory Expansion

Considering Maximizing Profit to Meet Demand

◆Full Operation Even in Off-Season Due to Semiconductor Shortage=DB Hitek, ranked 10th globally in foundry, mainly produces 200mm (8-inch) wafers, one step below the 12-inch wafers produced by Taiwan's TSMC and Samsung Electronics. It specializes in analog semiconductors that convert analog signals such as light, sound, and temperature into digital signals usable in PCs and smartphones. It actively targets power management ICs (PMIC), display driver ICs (DDI), and image sensors rather than mobile semiconductors requiring ultra-fine processes.

PMICs are semiconductors that convert, process, and control power to improve energy efficiency and are essential in electronic devices that require charging. As IT devices become more advanced, the number of PMICs needed increases. Demand for image sensors has also steadily expanded as the number of cameras installed in smartphones has increased. While previously there were only one or two cameras, recently even mid-to-low-end phones come equipped with two to three cameras as standard. Additionally, image sensors are considered the eyes of autonomous vehicles, and demand is expected to surge in the future.

With the spread of COVID-19 increasing demand for smartphones, TVs, and other products, DB Hitek's production plants have become busier. Due to semiconductor supply shortages, DB Hitek is maintaining 100% operation even during the traditionally off-season winter period. Kim Kyung-min, an analyst at Hana Financial Investment, said, "Orders continue to flood in," and "This situation is expected to persist throughout this year."

As orders pour in, there are ongoing talks in the industry that DB Hitek will expand its factories. Especially, Taiwan's TSMC, the number one foundry company, is known to be investing 30 trillion KRW in facilities this year, raising expectations for expansions by domestic companies. Price increases are also continuing in the foundry industry. Accordingly, DB Hitek is expected to raise contract prices for TV display driver ICs by 10-20%. According to foreign media reports, major foundry companies such as Taiwan's UMC raised 8-inch wafer prices by 10-15% in the fourth quarter of last year and have announced plans for an additional increase of over 20% this year. It is expected that additional price hikes will begin in earnest from the first quarter when new IT and electronic products are launched.

◆Maximizing Profit Timing... Is There Capacity for Aggressive Investment? DB Hitek's order volume increased about 7% annually, with 1,142,074 units in 2017, 1,226,315 units in 2018, and 1,321,251 units in 2019. Its production capacity also grew from less than 100,000 units in 2015 to 117,000 units in 2018, 122,000 units in 2019, and 130,000 units in 2020.

Although DB Hitek increased production capacity and maximized utilization rates, it is insufficient to handle the overflowing demand. To actively respond to the rapidly growing semiconductor market demand and maximize profits, additional expansion requiring trillion-KRW-level investments is necessary. However, unlike Samsung Electronics or SK Hynix, DB Hitek finds it difficult to make aggressive investments worth trillions of KRW. It has increased production capacity through annual facility investments of about 100 billion KRW and productivity improvements in bottleneck processes but lacks the capacity for large-scale external borrowing.

DB Hitek has production facilities only in Korea. It does not have manufacturing plants in the United States or China but operates production plants in Bucheon-si, Gyeonggi-do, and Eumseong-gun, Chungbuk. DB Hitek has grown through semiconductor business acquisitions and has no experience with large-scale expansions. Even if it proceeds with actual fundraising for expansion, issuing corporate bonds will not be easy. It is expected to rely on facility loans provided by institutions such as the Korea Development Bank.

As of the third quarter, DB Hitek's cash equivalents amounted to about 50 billion KRW. Its debt ratio was 118% in 2017, 91% in 2018, and 68.91% in 2019. As of the third quarter of 2020, it was 48%. A DB Hitek official said, "Unlike TSMC, which focuses on mass production of a few products, we manufacture a wide variety of analog semiconductors in small quantities, so large-scale investments do not necessarily directly translate into increased sales and profitability," adding, "Expansion will be approached cautiously after comprehensively reviewing customers and market conditions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)