Financial Services Commission "Closely Reflect Meeting Contents in Policy Development Process Related to Digital Finance Innovation"

[Asia Economy Reporter Park Sun-mi] The Financial Services Commission (FSC) announced on the 28th that it held an in-depth discussion at the Financial Development Council's Industry and Innovation Subcommittee meeting to accelerate this year's fintech promotion, activate non-face-to-face financial services, and build financial infrastructure to support digital innovation.

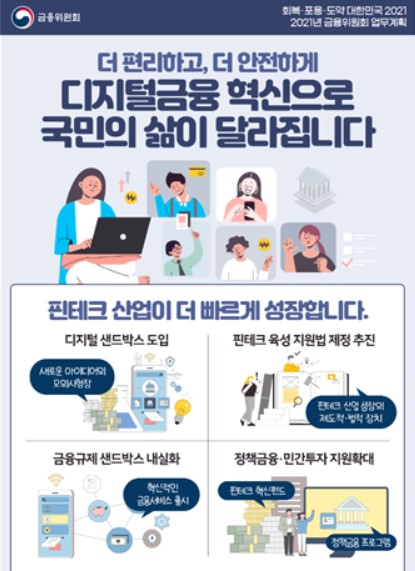

The FSC's major digital innovation tasks for this year’s work plan are summarized into three key areas: accelerating the promotion of the fintech industry, activating non-face-to-face financial services, and building financial infrastructure to support digital innovation. Specifically, these include ▲introduction of a digital sandbox ▲establishment of a systematic support system for each stage of fintech growth ▲strengthening the capabilities of fintech support organizations ▲activation of platform finance ▲establishment of convenient and secure non-face-to-face authentication and identity verification systems ▲providing a business environment suitable for the non-face-to-face era ▲advancement of open banking ▲building a system for effective management of personal information ▲advancement of financial sector data infrastructure ▲expansion of artificial intelligence (AI) service infrastructure in the financial sector.

At the meeting on the 26th, members of the Financial Development Council's Industry and Innovation Subcommittee engaged in in-depth discussions on digital financial innovation tasks, expressing agreement with the FSC’s policy direction related to digital innovation and actively offering policy suggestions to consider during the implementation process.

First, regarding the activation of platform finance, advice was given that it is necessary to balance the utilization of the platform’s innovation capabilities with market order aspects. In response, the FSC acknowledged the discussions on the need for activation and regulation of platform finance and stated that it is striving to find a balanced solution. It also added that ensuring diverse participants can join the market is important.

The members also mentioned that AI-related regulations should focus on field-centered codes of conduct and that recovery procedures should be considered in case of problems. The FSC expressed deep agreement with the importance of field-centered codes of conduct regarding AI and stated that it plans to seek advice during the research service process.

The meeting also pointed out that network separation regulations should be flexibly improved to promote digital innovation while carefully ensuring that financial security is not weakened.

The FSC plans to carefully consider both financial innovation and security aspects regarding the relaxation of network separation regulations. Opinions were also raised that, amid the rapid changes in various digital financial innovation systems, active use of disclosures and reports is necessary for smooth establishment and enforcement of systems. The FSC said, "Disclosures and reports are useful tools for both policy and supervisory authorities and consumers," adding, "In particular, we plan to improve consent forms for information provision from a behavioral science perspective to help financial users manage their personal information."

Furthermore, the FSC strongly agrees with the suggestion that, given the rapid technological advancements in the IT sector, it is necessary to actively utilize public discussions involving the government and private sectors to establish effective policies. From this year, the digital sandbox operation process will actively seek joint solutions between the government and private sectors.

An FSC official said, "The issues raised at this meeting will be closely reflected in the future policy-making process related to digital financial innovation," and added, "The Financial Development Council’s Industry and Innovation Subcommittee meetings will continue to be held to actively serve as a platform for effective policy suggestions and communication."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)