Savings Banks Face Over 20 Financial Supervisory Service Sanctions Annually Since 2018

23 Sanctions and 609 Million Won in Fines Last Year

"Calls for Strengthening Voluntary Internal Control Functions"

As financial authorities impose strong sanctions such as business suspension on ES Savings Bank (formerly Live Savings Bank), issues related to operational and managerial irregularities in the savings bank industry are once again coming to light. Although the industry was reorganized following major regulatory tightening after the 2011 savings bank crisis, practices such as so-called 'split loans' still persist, and financial authorities continue to impose sanctions accordingly.

Savings Banks Face 23 Sanctions and Fines Totaling 609 Million KRW

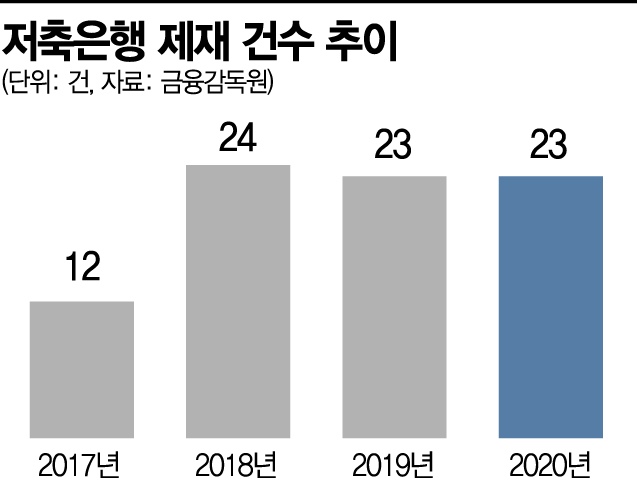

According to financial authorities on the 28th, a total of 21 savings banks received 23 sanctions last year. There were 8 reprimands and warning reprimands issued to institutions, and 24 disciplinary actions including warnings and cautionary warnings (including duplicates) against executives. After the number of sanctions doubled from 12 in 2017 to 24 within a year, legal violations have been occurring at a rate of 23 to 24 cases annually.

Fines (including penalties and administrative fines) amounted to 609 million KRW, with administrative fines at 380 million KRW and penalties at 229 million KRW. Although this is a significant decrease compared to the previous year’s 8.3246 billion KRW imposed due to illegal credit extensions by major shareholders and exceeding loan limits, it is still considered a high level given that fines had not exceeded 200 million KRW since 2017.

There were also violations related to excessive loans to the same borrower, which was a major disciplinary reason for ES Savings Bank. The Mutual Savings Banks Act prohibits savings banks from extending credit exceeding 25% of their own capital to the same borrower. Union Mutual Savings Bank was fined 228 million KRW last November for providing 11 billion KRW, exceeding the 2.56 billion KRW limit, to two corporations sharing credit risk. ES Savings Bank also faced issues for lending amounts exceeding 210.3% of its capital to individuals and corporations considered effectively the same borrower.

Among the sanctioned institutions were three of the five major savings banks (SBI, Korea Investment, and Welcome). SBI Savings Bank was fined 264 million KRW for selling insurance products by general employees who were not licensed insurance solicitors. Korea Investment Savings Bank received institutional caution and a 31.2 million KRW fine for providing financial benefits to major shareholders during the sale of mid-term loan receivables to related parties. Welcome Savings Bank also received warnings for two employees for failing to comply with high-value cash transaction reporting obligations.

Financial Authorities: "Industry-wide Strengthening of Voluntary Internal Controls Needed"

Although the savings bank industry has been striving to improve its image and capabilities through internal management structure reforms, sports marketing, and various social contribution activities since the insolvency crisis a decade ago, concerns remain that the industry still has a long way to go to establish stable self-regulatory capabilities.

A financial authority official explained, "The regulations currently imposed on the savings bank industry are a continuation of measures strengthened after the 2011 insolvency crisis," adding, "For regulatory easing to support the growth of savings banks, there must be voluntary efforts within the industry to strengthen internal control functions."

Meanwhile, ES Savings Bank was found to have committed multiple illegal acts while focusing on stock-linked bonds (CB·BW) secured loans, resulting in a six-month suspension of new securities (stock) secured loan operations, a penalty of 9.11 billion KRW, and an administrative fine of 74 million KRW imposed by financial authorities on the 27th. The former CEO was recommended for dismissal.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)