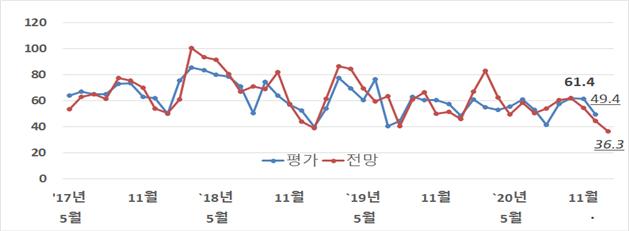

Evaluation and Outlook Trends of the Construction Industry Business Survey Index for Specialized Construction (Source: Korea Construction Policy Research Institute)

Evaluation and Outlook Trends of the Construction Industry Business Survey Index for Specialized Construction (Source: Korea Construction Policy Research Institute)

[Asia Economy Reporter Moon Jiwon] In January, the domestic specialized construction companies' sentiment index is expected to decline compared to the previous month due to seasonal effects entering the winter season.

The Korea Construction Policy Institute (KCPI) announced on the 27th that the Construction Business Survey Index for this month is projected to fall to 36.3 from 49.4 in December last year.

The RICON Construction Business Survey Index (SC-BSI) is based on a survey of major member companies across 16 provinces conducted by the Korea Specialty Contractors Association. Order performance was estimated based on the construction guarantee amounts from the Specialized Construction Mutual Aid Association.

Regarding the decline in the index, KCPI explained, "Since the increase in construction investment this year is virtually predetermined, this survey result can be considered a temporary effect due to the winter season."

According to the Ministry of Economy and Finance's 2021 work plan, 62.0% of the annual budget for social overhead capital (SOC) projects is scheduled to be executed early in the first half of this year. The budget for living SOC projects will also see 65.5% allocated in the first half.

The Bank of Korea has forecasted the scale of construction investment this year at 262 trillion won. The nationwide private housing supply planned for the first quarter is about 110,000 units, which is 2.4 times that of the same period last year. The total planned private housing supply is known to be around 390,000 units.

In December last year, the total order volume for specialized construction companies was estimated at 3.647 trillion won, about 61.7% of the previous month. The order amount for prime contracts was estimated at 1.288 trillion won, about 59.1% of the previous month, and for subcontracted contracts, about 2.36 trillion won, approximately 63.2% of the previous month.

Lee Eunhyung, a senior researcher at KCPI, explained, "Considering the current situation where domestic construction orders are expected to increase to a record high of 170 trillion won last year, and that specialized construction companies' orders tend to increase in January of the following year mainly due to public projects, it is difficult to judge the overall market condition negatively."

He added, "It is also necessary to consider that the significant increase in domestic engineering firms' performance last year is likely to sequentially lead to construction project volumes, which should be viewed in connection with the government's ongoing policy of expanding construction investment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)