Major Raw Material Prices Double Since COVID Crisis

Liquidity Expansion Outweighs Demand...Cautious Interpretation of Economic Recovery

[Asia Economy New York=Correspondents Baek Jong-min, Joo Sang-don, Lee Hyun-woo] The international commodity market is heating up. Metals such as copper and iron ore, crude oil, as well as grains like soybeans and wheat are all showing clear upward trends. Amid evaluations that this marks a replay of the 'commodity supercycle,' which signifies a simultaneous surge in commodity prices, experts point out that the background differs from the past, necessitating careful analysis and response.

On the 26th (local time), copper spot prices traded at $7,984.5 per ton on the London Metal Exchange (LME). Known as 'Doctor Copper' for its indication of the global economy's direction, copper experienced a crash last April when the COVID-19 pandemic began, falling below the $5,000 mark. Since then, it has nearly doubled, reaching an eight-year high. Investment bank BOA forecasts that copper prices could surpass $10,000 per ton.

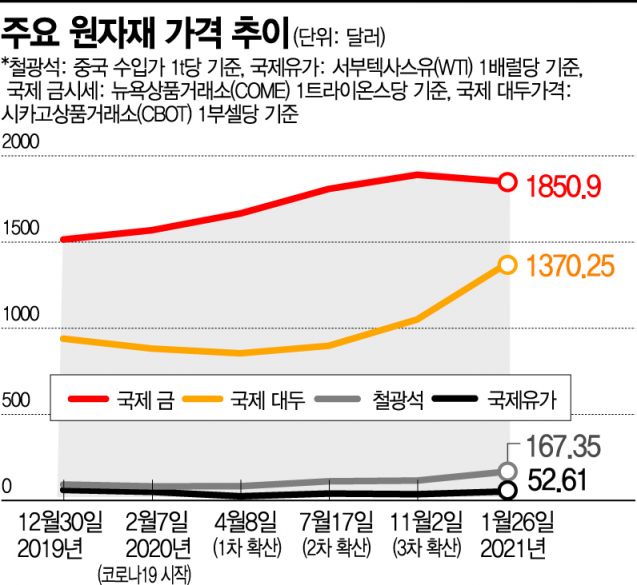

Iron ore prices, which depend on the economic situation of China?the largest importer?are also strong. The international benchmark price for iron ore, China's import price, was announced at $167.35 per ton on the same day. This is more than double the price, which had fallen to the low $80s in February last year. International crude oil, which even recorded negative prices intraday in April last year, has recovered to the $50 level. On this day, March delivery West Texas Intermediate (WTI) crude oil closed at $52.61 per barrel on the New York Mercantile Exchange (NYMEX).

While past commodity supercycles were driven solely by supply and demand issues, this recent rise is attributed to governments' responses to the COVID-19 pandemic and green policies. Lloyd Blankfein, former CEO of Goldman Sachs, is a prominent figure advocating buying commodities as a hedge against inflation. He argued that governments' 'money printing' to combat COVID-19 would lead to inflation and a decline in the dollar's value, resulting in rising commodity prices.

The inauguration of the Joe Biden administration in the United States is also a factor that could shake commodity prices. Market experts diagnose that Biden's green policies and announced large-scale infrastructure investments are key drivers of the commodity price increases.

Given that the background of this commodity price surge differs from the past, caution is advised for our government, companies, and investors. Shin Se-don, Honorary Professor at Sookmyung Women's University, said, "The recent sharp rise in commodity prices is due to speculative demand rather than demand recovery, which could negatively impact the Korean economy," adding, "For Korean companies that have reduced commodity imports over the past one to two years, this price increase inevitably becomes a burden."

Hong Sung-wook, Head of Trend Analysis at the Korea Institute for Industrial Economics & Trade, stated, "The main cause is the increased expectations for economic recovery due to expansive fiscal policies by various countries," and added, "We need to observe whether supply and demand conditions will remain the same with demand from economic recovery while prices rise, or if demand will also increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.