AI Investment Specialist Company Fount Conducts Survey Targeting Customers

[Asia Economy Reporter Minji Lee] It has been revealed that 75% of customers of Fount, an AI investment specialist company, are also directly investing in individual stocks. This means they are using Fount to build stable long-term returns in addition to direct investments.

According to Fount on the 27th, a survey conducted among investors showed that 74.8% of customers are directly investing in individual stocks through HTS, MTS, etc., and the main reason for combining direct investment with Fount investment was found to be "the need for stable asset management," the company announced on the 27th.

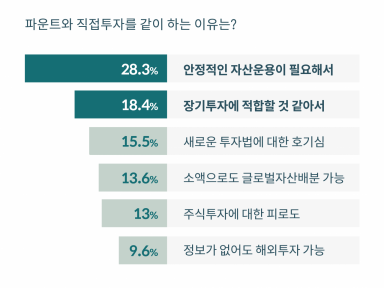

The majority of these investors (30.5%) have been investing in stocks for 6 months to less than 1 year, and 28% have been investing for more than 3 years. The top reason for combining direct investment with Fount was "the need for stable asset management" at 28.3%. Other reasons included "seems suitable for long-term investment" (18.4%), "curiosity about new investment methods" (15.5%), "global asset allocation possible with small amounts" (13.6%), "fatigue from stock investment" (13%), and "ability to invest in overseas stocks without information" (9.6%).

Fount explained, "It is highly likely that the stock investment boom among retail investors last year prompted the start of stock investments," and added, "It is analyzed that investors are attracted to robo-advisor investments due to the stable management by artificial intelligence (AI)."

On the other hand, customers who invest through Fount without investing in stocks cited reasons such as "investment possible without worrying" (27.9%), "stable returns and low volatility" (23.1%), "ability to invest overseas without information" (14.3%), and "global asset allocation possible with small amounts" (14.3%).

Among respondents, 92.1% said they plan to gradually increase their investment amount in Fount, and 65.4% said they intend to continue investing in Fount for more than 3 years. The most common reason for this was "because the returns are good" at 45%, followed by "stable management" (23%), "preparing for retirement" (6%), "purpose of installment-type long-term investment (savings)" (5.5%), and "possible to invest without knowing about stocks" (5%).

Kang Sang-gyun, Head of the Personal Asset Management Division, said, "Even without knowledge of stocks, global asset allocation is possible with small amounts, and investors are attracted by the fact that the investment is managed automatically without needing attention after investing," adding, "As the desire to grow assets is increasing, the growth trend of the robo-advisor market based on objective data is expected to continue for the time being."

Meanwhile, this survey was conducted over three days starting from the 18th of this month through the Fount app, targeting 1,000 investors who have invested for more than 6 months, with a total of 318 respondents. Among the respondents, 66.4% were male and 33% female, with 43.1% in their 30s, 25.2% in their 20s, and 20.1% in their 40s.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.