Production and Sales Not Simply Separated but Large and Specialized Organizations Expected

Mirae Asset Financial Services, Comprehensive Financial Consulting Company

Hanwha Life Financial Services, GA with Overwhelming Existing Scale

[Asia Economy Reporter Oh Hyung-gil] The outlines of sales companies being established by insurance companies to separate the production and sales of insurance (separation of production and sales) are emerging.

It is widely expected that these will rise to a unique position as separate organizations equipped with large-scale and specialization, rather than simply differentiating business functions. A major tectonic shift is also anticipated in the insurance sales channels currently dominated by large corporate agencies (GA).

According to the insurance industry on the 25th, Mirae Asset Financial Services is planning a paid-in capital increase of 14 million shares worth 70 billion KRW targeting April 26 against its parent company Mirae Asset Life Insurance. If the investment is completed as scheduled, Mirae Asset Financial Services' capital will increase to 89.6 billion KRW.

Mirae Asset Life Insurance officially announced the separation of production and sales last December by separating its exclusive sales channels. Ham Andeok, Vice Chairman of Mirae Asset who has led Mirae Asset Life Insurance for nearly 10 years as an insurance sales expert, is leading the separation work as CEO of Mirae Asset Life Financial Services.

Established in 2014, Mirae Asset Life Financial Services is expected to transform into a comprehensive financial consulting company specializing in integrated asset management. It plans to provide comprehensive financial services linked to products from Mirae Asset affiliates such as insurance and securities.

It will build various sales channels including a consulting sales channel providing comprehensive financial consulting by insurance professional financial planners (FP), a corporate insurance channel covering corporate and group loss protection, and 'iOL', Korea's first simple insurance mobile platform. The blueprint is to leap forward as a comprehensive financial product sales company through listing on the stock market in the long term.

Also, as of last October, more than 3,600 exclusive planners of Mirae Asset Life Insurance are expected to complete their transfer to Mirae Asset Financial Services by March. After the separation, Mirae Asset Life Insurance will transform into a product and service-centered company. It plans to provide competitive products to channels such as GA and bancassurance and introduce new innovative products tailored to customers.

Mirae Asset Life Insurance Yeouido Headquarters

Mirae Asset Life Insurance Yeouido Headquarters

Leading the Market with Large Scale and Specialization

Major Changes in Insurance Sales Organizations Inevitable

Hanwha Life Financial Services (tentative name), which is scheduled to launch in April, is expected to surpass existing GAs in both capital and number of employees. Hanwha Life Financial Services has a total capital of 650 billion KRW and nearly 1,400 employees and 20,000 FPs.

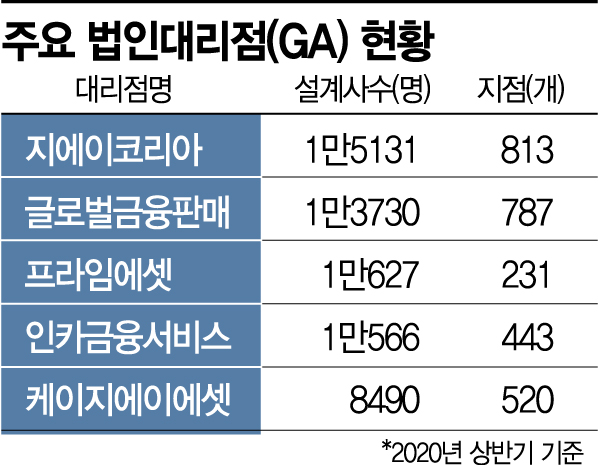

Currently, in the GA industry, G.A. Korea and Global Financial Sales rank first and second in the number of planners with 15,131 and 13,730 planners respectively, so Hanwha Life Financial Services is expected to take the top spot at once.

It plans to have a competitive FP support system matching its scale. Last month, Ye Seung-joo, CEO of Hanwha Life, stated, "We will create the best sales specialized company in Korea by combining differentiated FP education systems, nurturing systems, and various welfare benefits unique to Hanwha Life."

Non-life insurance companies are also announcing the emergence of subsidiary GAs this year. Hana Non-Life Insurance is working on concretizing business strategies through a task force team to establish a subsidiary GA with a capital of 20 billion KRW.

Hana Non-Life Insurance passed an additional subsidiary plan at its board meeting last November, planning to establish a company engaged in insurance agency and brokerage business for new business entry. Hyundai Marine & Fire Insurance is also discussing plans to establish a subsidiary GA.

Meanwhile, the separation of insurance companies' sales organizations is interpreted as a response to changes in the sales environment and insurance solicitation-related systems. Consumers' demands for product comparison and professional consultation are increasing, and product sellers are increasingly defecting to GAs to secure sales competitiveness.

Insurance companies are facing increased pressure to reduce costs due to deteriorating profitability, and with the reform of solicitation commission systems, mandatory employment insurance for special-type workers, and the upcoming enforcement of the Financial Consumer Protection Act, cost burdens are expected to increase.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)