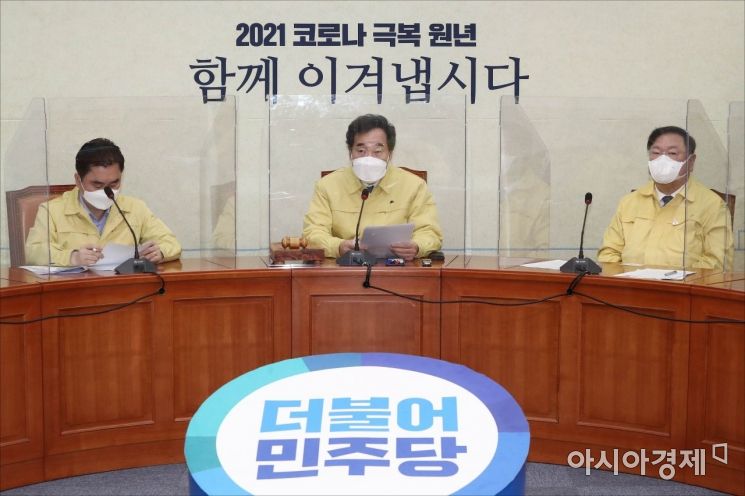

Lee Nak-yeon, leader of the Democratic Party of Korea, is attending the Supreme Council meeting held at the National Assembly on the 22nd and delivering opening remarks. Photo by Yoon Dong-joo doso7@

Lee Nak-yeon, leader of the Democratic Party of Korea, is attending the Supreme Council meeting held at the National Assembly on the 22nd and delivering opening remarks. Photo by Yoon Dong-joo doso7@

[Asia Economy Reporter Kiho Sung] As the Democratic Party of Korea pushes for a 'profit-sharing system' related to the novel coronavirus infection (COVID-19), large financial institutions such as banks are expected to participate as new contributors to the currently operating low-income financial fund, providing more than 110 billion KRW.

According to the financial sector on the 24th, the ruling party and the financial sector are reportedly discussing amending the Act on Support for Low-Income Financial Life (Low-Income Finance Act) as soon as possible and increasing the current low-income financial resources of about 355 billion KRW to 500 billion KRW.

The low-income financial fund serves as the guarantee fund for government-supported low-income loans such as 'Hae-sal-loan'. Currently, the low-income financial fund is formed annually with about 175 billion KRW from government contributions including lottery funds and about 180 billion KRW from savings banks and mutual finance contributions, totaling approximately 355 billion KRW.

Earlier, at the end of 2019, financial authorities announced that government contributions to low-income finance would increase to 190 billion KRW starting this year, and accordingly, the total contributions from the financial sector, including banks, would increase to 200 billion KRW. To reach the fund expansion goal of 500 billion KRW, large financial institutions such as banks are expected to contribute at least an additional 110 billion KRW.

However, within the banking sector, there is criticism that financial institutions are bearing an excessive burden in supporting vulnerable groups affected by COVID-19.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.