'Hoohu' App Reports Over 6.7 Million Spam Complaints in Q4

Increase of 656,000 Cases Compared to Previous Year

Rising Ads for Lending Rooms and Loan Businesses Targeting Debt Investment and Young Borrowers

[Asia Economy Reporter Minyoung Cha] In the fourth quarter of last year, illegal spam calls and texts targeting individual investors surged amid the stock investment frenzy.

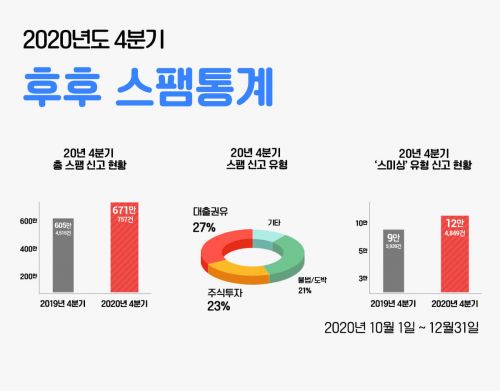

On the 24th, Whowho & Company, which provides the spam blocking application 'Whowho', analyzed the spam call and text statistics for the fourth quarter of last year, revealing that the number of reports reached 6.71 million, an increase of about 656,000 compared to the same period the previous year.

By type, 'stock investment' spam accounted for about 1.54 million cases, increasing by 62% compared to the same period last year, showing the largest rise. Typical methods include sharing fictitious investment information such as manipulated stocks and operation stocks or extorting fees under the pretext of recommending stock items. The stock fever among individual investors led to a corresponding increase in related spam. Its proportion of the total also grew, ranking second among the most reported types.

The most reported type was 'loan solicitation' spam. This category saw an increase of about 660,000 cases compared to the same period last year, with a total of approximately 1.82 million reports received. This is the highest number of reports for the same type since Whowho began publishing quarterly spam statistics. The rise is attributed to more people borrowing to invest and the decisive impact of the banking sector's loan suspension in the fourth quarter. As low-interest credit loans were blocked, third-tier financial institutions and illegal lending businesses flourished.

Smishing reports, a scam method abusing text messages, also reflected the influence of 'all-in borrowing' and 'debt investment'. In the fourth quarter, smishing reports totaled 124,849, an increase of about 30,000 compared to the same period last year. Notably, smishing tactics have diversified beyond impersonating delivery or wedding invitation messages to include impersonation of loan promotion texts from savings banks and credit card companies.

On the other hand, 'illegal game and gambling' spam, which ranked first in annual reports from 2017 to 2019, showed signs of slowing growth. Reports in this category totaled about 1.41 million, ranking third behind loan solicitation and stock investment in the most reported types.

Heo Taebeom, CEO of Whowho & Company, said, “Unlike illegal game and gambling spam, stock and loan-related spam can impersonate regulated financial institutions, so thorough caution is necessary,” adding, “Do not click hastily on internet URLs in texts, and if fraud is suspected, install the Whowho app to check for smishing.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.