[Asia Economy Reporter Seulgina Jo] As LG Electronics officially hinted at the possibility of exiting the smartphone business, the domestic smartphone market is expected to be effectively reorganized into a solo run by Samsung Electronics. The domestic smartphone market, known as the "graveyard of foreign phones," has so far been a structure where Apple and LG Electronics challenged Samsung Electronics. With market share already concentrated on Samsung Electronics, concerns are rising about potential price increases for mobile phones if even LG phones based on Android disappear from consumer choices.

According to market research firm Counterpoint Research on the 23rd, LG Electronics' domestic smartphone market share last year was 13%, ranking third after Samsung Electronics (65%) and Apple (21%). If LG Electronics exits the smartphone business, a significant demand is expected to shift to Samsung Electronics. This is because LG Electronics has mainly sold mid-to-low-end phones rather than premium phones in the domestic market, and both use the same Android OS. Some consumers are expected to switch to Apple iPhones, but Samsung Electronics is more similar in terms of price range and user environment.

It is also predicted that penetration by Chinese manufacturers such as Xiaomi, Oppo, and Vivo, which emphasize cost-effectiveness, will be practically difficult. The trust level in Chinese brands is still not high in the domestic market, making their brand competitiveness weak. This aligns with the reason why the Korean market is called the "graveyard of foreign phones." Currently, Huawei, Oppo, and Vivo do not sell smartphones domestically. Xiaomi's sales volume is extremely minimal.

Ultimately, Samsung Electronics is expected to solidify a solo run system by capturing 70-80% of the domestic smartphone market share. Globally, Samsung Electronics will be the only manufacturer covering everything from premium to low-end lines.

Inside and outside the industry, concerns are pouring in that Samsung Electronics' solo run system will reduce domestic consumers' choices, eventually leading to mobile phone price increases and restrictions on service and product competition. However, as a global player, Samsung Electronics is unlikely to sell smartphones at higher prices only in the domestic market.

Nevertheless, there will definitely be negative effects on product and service competition. The enthusiasm for form factor competition, such as rollable phones, seems to have cooled down immediately. Also, in terms of device supply contracts, the bargaining power of telecom companies will decline. As Samsung Electronics stands in a monopolistic position, there will be no reason to offer various subsidies to consumers to secure market share.

There is also analysis that Samsung Electronics will not view it entirely positively if its domestic market share exceeds 80%, as it would face government sanctions.

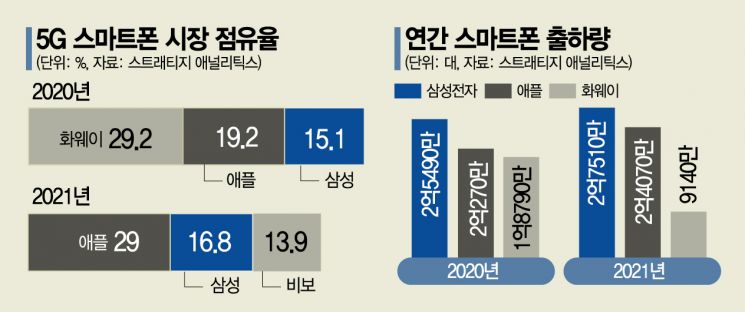

Global market upheavals are also expected. Following Huawei, which was pushed out due to U.S. sanctions, and with LG phones now at a crossroads of survival, the premium market is expected to solidify into a duopoly of Samsung Electronics and Apple. Chinese Huawei, which once aimed for first place, is projected to fall to seventh place this year.

In particular, Samsung Electronics will be the only manufacturer operating across all lines from premium to mid-to-low-end. Although LG Electronics did not make the top 5 in global market share rankings, it maintained third place in North America with double-digit market share behind Samsung and Apple. Its market share in the fourth quarter of last year was 14.3%, and it was expected to accelerate its North American market strategy this year through rollable phones and others.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.