[Asia Economy Reporter Kwangho Lee] Korea Housing Finance Corporation announced on the 22nd that it will freeze the interest rates for February on the long-term fixed-rate, installment-repayment mortgage loan product called 'Bogeumjari Loan.'

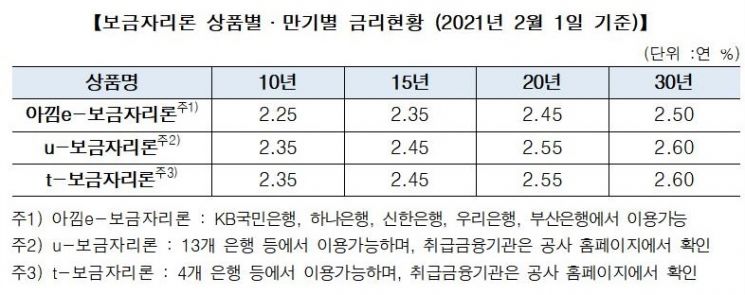

The 'u-Bogeumjari Loan,' which can be applied for through the Housing Finance Corporation's website, and the 't-Bogeumjari Loan,' which can be applied for at bank counters, offer interest rates ranging from 2.35% per annum (10-year term) to 2.60% per annum (30-year term), depending on the loan maturity.

Additionally, the 'Akkim e-Bogeumjari Loan,' which is applied for online through electronic contracts and reduces costs, offers interest rates 0.10 percentage points lower, ranging from 2.25% per annum (10 years) to 2.50% per annum (30 years).

If borrowers refinance variable-rate or lump-sum repayment mortgage loans obtained from secondary financial institutions into a better Bogeumjari Loan, the interest rates will be the same as those of the u-Bogeumjari Loan or t-Bogeumjari Loan, and if an electronic contract is made, the Akkim e-Bogeumjari Loan interest rates will apply.

Additional interest rate benefits are available for socially disadvantaged groups (single-parent families, persons with disabilities, multicultural families, families with three or more children) or newlyweds.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.