On the 22nd, the travel theme rose by 3.47% compared to the previous day, showing strength, while SM C&C, a related stock attracting attention, surged by 5.11% compared to the previous day. SM C&C is known as a company under the SM group engaged in video content production, management, and travel business.

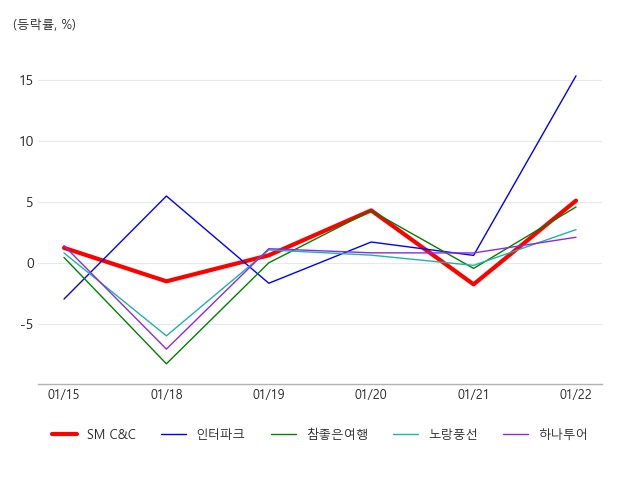

[Graph] Major stock price changes in the travel theme

According to preliminary data compiled at 10:28, foreign investors have purchased 37,200 shares of SM C&C, indicating a large net buying by foreigners.

[Table] Net trading volume of foreigners and institutions (unit: 10,000 shares)

According to the analysis by Thinkpool Robo Algorithm RASSI, SM C&C's quant financial score is 11.76 points, which is lower in stability, profitability, and growth compared to the average of other travel-related stocks. This can be interpreted as SM C&C having relatively low investment attractiveness compared to other stocks from a financial perspective. On the other hand, Redcap Tour ranked first in quant financial ranking with higher growth, stability, and profitability scores compared to the average of other stocks.

[Table] Top financial scores within the theme

※ The quant financial score is the result of the robo algorithm analyzing each company's sales growth rate, equity growth rate, debt ratio, current ratio, ROA, ROE, etc.

※ This article was generated in real-time by an article automatic generation algorithm jointly developed by Asia Economy and the financial AI specialist Thinkpool.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.