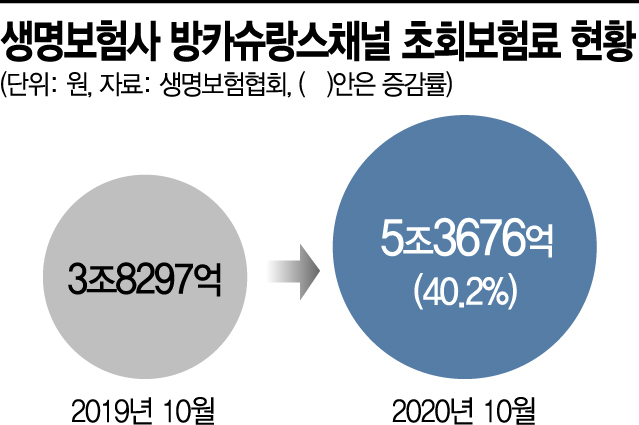

Up 40.2% Compared to Last Year

Banks Also Expand Sales of Insurance Products

[Asia Economy Reporter Ki Ha-young] Last year, the bancassurance sales performance of domestic life insurance companies surged significantly. Due to the impact of the novel coronavirus disease (COVID-19), insurance companies strengthened their bancassurance channels, and banks expanded insurance product sales to increase non-interest income.

According to the insurance industry on the 25th, as of October last year, the cumulative first-year premiums through bancassurance channels of life insurers amounted to 5.3676 trillion KRW, a 40.2% increase compared to 3.8297 trillion KRW the previous year. This represents a rapid increase of approximately 1.5379 trillion KRW within one year.

In particular, the performance of small and medium-sized life insurers stood out. For KDB Life, the amount surged about 5676.9% from 2.6 billion KRW the previous year to 150.2 billion KRW during the same period. KB Life also recorded first-year premiums of 157.9 billion KRW through the bancassurance channel, jumping 1004.2% from 14.3 billion KRW in the same period last year. Hana Life and DGB Life saw increases of 223.93% and 170.66%, respectively, achieving first-year premiums of 29.996 billion KRW and 5.3 billion KRW.

Large life insurers also performed well. Samsung Life Insurance recorded 2.0521 trillion KRW in first-year premiums through bancassurance, a 125.8% increase compared to the previous year. This is nearly double, increasing by about 1.1434 trillion KRW from the previous year. Hanwha Life and Kyobo Life also recorded 453.1 billion KRW and 183.5 billion KRW, up 87.5% and 40.5%, respectively, compared to the previous year.

Over the past two to three years, life insurers have refrained from selling savings-type insurance products that increase capital volatility in preparation for the introduction of the new International Financial Reporting Standard 17 (IFRS 17). However, due to difficulties in face-to-face sales caused by COVID-19 last year, they strengthened sales through bancassurance and cyber marketing (CM) channels. For example, KB Life revised its pension insurance products into mobile bancassurance-exclusive products, resulting in a surge in first-year premiums through the CM channel from 3.1 billion KRW to 9 billion KRW as of October last year.

Banks also increased insurance product sales to expand non-interest income, which analysts say significantly boosted bancassurance performance. With fewer customers seeking deposit and savings products due to low interest rates and difficulties in fund sales caused by issues of incomplete sales of private equity funds, banks increased insurance sales to raise commission income.

An industry insider analyzed, "As the business environment surrounding the financial sector changed due to COVID-19, insurance companies and banks increased insurance sales to secure their respective profits, resulting in a sharp increase in bancassurance performance last year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.