1483 Applications in Two Days at 4 Major Banks, Totaling 25 Billion KRW

Low Interest Rates Attract Self-Employed... Loan Applications Increase 3-4 Times

'Tightening Household Loans Leads to Early Borrowing' Trend Also Plays a Role

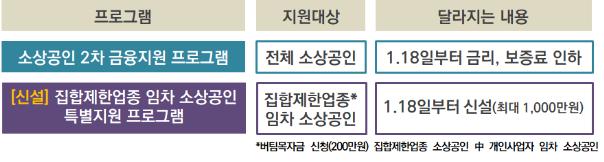

[Asia Economy Reporters Sunmi Park, Kiho Sung]Since the launch of the second round of loans supporting small business owners affected by the novel coronavirus disease (COVID-19) with an annual interest rate in the 2% range on the 18th, calls have surged at branches of commercial banks nationwide. This is because small business owners in restricted gathering industries who rent their premises can receive an additional loan of 10 million KRW at a low interest rate, increasing demand among self-employed individuals desperate for funds.

Most applications are made online through non-face-to-face channels, so the number of customers visiting branches has not significantly increased. However, the influx of calls from customers asking about differences from existing products or expressing dissatisfaction with complicated application documents indicates that the program has successfully attracted attention.

According to the financial sector on the 21st, in the two days following the implementation of the newly established and revised small business financial support program on the 18th, the four major domestic commercial banks executed a total of 1,483 second-round loans for small business owners, amounting to approximately 25 billion KRW. Two banks reported that the number of second-round loans for small business owners increased three to four times compared to a week earlier. The average daily number of second-round loans for small business owners over the past 10 business days at the four major banks was 522, whereas on the 18th and 19th, the average daily number rose to 741.

What is the atmosphere like at branches regarding the second-round loans for small business owners?

The second-round loans for small business owners with interest rates in the 2% range are available through non-face-to-face applications considering the COVID-19 situation, so branches maintain a relatively calm atmosphere. However, calls from small business owners who heard about the possibility of additional loans have continued. A representative from Bank B’s branch in Mapo said, "Loan inquiry calls have increased by more than 10% compared to before the 18th," adding, "Small business owners from various industries, ranging from chicken restaurants to PC rooms, are making inquiries regardless of their business type."

He continued, "Most customers have experience receiving loans through the first and second rounds of small business loans, so they do not complain much about online applications," and predicted, "Judging by the level of inquiries, the number of online loan applications will clearly increase."

Confusion at the field level continues as well. The biggest issue is selecting eligible loan recipients.

In the newly established special support program for small business owners renting premises in restricted gathering industries, banks require applicants to submit a ‘Confirmation of 2 million KRW Support Fund Payment’ to verify whether they belong to the restricted gathering industry category. Previously, the Ministry of SMEs and Startups has been providing 2 million KRW support funds to small business owners in restricted gathering industries since the 11th. However, many have been excluded from the support fund, and reapplications for those excluded will be accepted starting from the 25th. As a result, small business owners who did not receive the support fund on time are unable to apply for the special loan.

Attractive interest rates... "Let's apply first" atmosphere

Despite this, the surge in inquiries is largely due to the attractive interest rates. The maximum interest rate for the second-round loan is 3.99% per annum, reduced by 1 percentage point from the previous 4.99%. The five major commercial banks and Industrial Bank of Korea have further lowered the rate by 1 percentage point, applying a uniform interest rate in the 2% range.

Additionally, government authorities are tightening household loans due to concerns over excessive debt increases, creating a sentiment that "if loans are available, it’s better to secure them first." The financial authorities plan to announce detailed household debt management measures in March after gathering opinions from the financial sector and reviewing various policy alternatives in January and February. They are also considering mandatory principal installment repayments for credit loans above a certain amount, which could make general household loans more difficult to obtain.

Separately from household loan management, financial authorities intend to actively respond to financial support for small business owners affected by COVID-19. Financial Services Commission Chairman Eun Sung-soo personally visited major commercial bank branches the day before to encourage smooth implementation of the second-round financial support program for small business owners. Chairman Eun urged, "Since some small business owners who opened last year and those subject to local government business restrictions have not yet received the support fund, please ensure that the special support program for small business owners renting premises in restricted gathering industries is carried out without any issues."

The Financial Services Commission plans to continuously monitor and listen to difficulties faced by small business owners and frontline bank branches through weekly meetings of the Economic Central Disaster and Financial Risk Response Team. They intend to faithfully implement the ‘175 trillion KRW + α Livelihood and Stability Program’ to support small business owners and companies struggling due to COVID-19, including the second-round financial support program for small business owners.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.