[Asia Economy Reporter Kim Eun-byeol] South Korea's real gross domestic product (GDP) trend growth rate per working-age population has continuously declined from the late 1980s to the early 2010s, stabilizing at around 2.0%. This decline is attributed to sluggish total factor productivity growth and a slowdown in investment, highlighting the need for policies that take these factors into account.

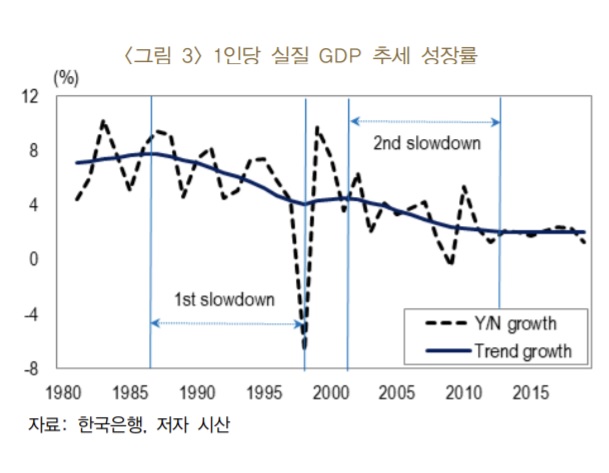

On the 21st, the Bank of Korea analyzed in the BOK Economic Research report "Decline in South Korea's Economic Trend Growth Rate and Its Causes" that "South Korea's real GDP trend growth rate per working-age population experienced a first decline from the late 1980s (7.7%) to 1998 (4.0%), and a second decline from 2001 (4.4%) to the early 2010s (2.0%)."

The Bank of Korea derived these results by analyzing GDP per working-age population, rather than GDP itself, to measure economic living standards considering the labor market. It viewed the decline in South Korea's economic growth rate as a gradual trend decline rather than a rapid structural change. The growth rate fell due to the accumulation of permanent negative shocks.

During the first decline period of the trend growth rate (late 1980s to 1998), the trend growth rate fell due to a slowdown in total factor productivity and a decrease in average working hours. The trend growth rate had been declining even before the Asian financial crisis, with total factor productivity slowing since 1989. At that time, the Labor Standards Act was amended in 1989, reducing the statutory working hours and thus decreasing average working hours.

The second decline period of the trend growth rate was from 2001 (4.4%) to the early 2010s (2.0%), which the Bank of Korea attributed to a slowdown in facility investment and sluggish total factor productivity following the burst of the IT boom in the early 2000s. Since the early 2010s, the trend growth rate has remained at around 2.0%, which is 1.6 percentage points lower than the average annual trend growth rate of 3.6% in the 2000s. The slowdown in total factor productivity in the 2010s is also related to the "productivity paradox," where productivity growth decreases despite active technological innovation.

Namgang Lee, a senior researcher at the Macroeconomic Research Division of the Korea Economic Research Institute, stated, "Since the past decline in growth rates is mainly due to a gradual decline in trend growth centered on the slowdown of total factor productivity, it is necessary to pay attention to and respond to overall changes in economic and social factors related to total factor productivity to raise the trend growth rate in the future."

He emphasized the need for policy support for research and development (R&D) investments in artificial intelligence (AI), including deep learning, and renewable energy sectors, which are expected to have a significant impact on the overall economy. Lee advised, "Investment in these fields leads to visible productivity gains, but there may be a time lag in implementation, so efforts should be made to improve the efficiency of investment expenditures."

He also added, "It is necessary to create a market environment where startups with new ideas can enter the market and perform complementary innovations for potential general-purpose technologies," and "to build an economic structure where resources for production activities can be allocated to productive startups."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.