Yuanta Securities Analysis Report

Samsung Electronics Lending Transaction Average Price Only 70%

High Possibility of Targeting Upon Short Selling Resumption

[Asia Economy Reporter Junho Hwang] It is forecasted that Samsung Electronics will become the primary target of short-selling forces once short-selling resumes. The average lending transaction price is at about 70% of the stock price, making it a potential target for short-selling. Since short-selling bets on stock price declines, the ‘90,000 Electronics’ defense built by Donghak Ants is facing a red alert.

Lending demand likely to surge if short-selling resumes

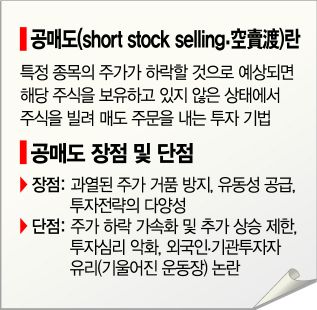

On the 21st, Yuanta Securities analyzed in a report titled ‘Phenomena Observed Due to the Ban on Short-Selling’ that short-selling demand, broadly speaking lending transaction demand, could surge sharply once short-selling resumes. Lending transactions refer to borrowing stocks for trading, and short-selling means borrowing stocks at the current price to sell them, then buying them back at a lower price to return them.

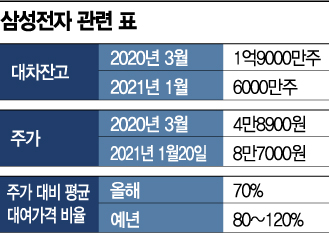

Yuanta Securities calculated the average lending transaction price by reflecting the stock price at the time when Samsung Electronics’ lending balance increased, and found that this price is only about 70% of the current stock price. This is a result of the decrease in lending demand and balance after the short-selling ban last year, which also lowered the average price. Previously, it ranged between 80% and 120%, but the gap with the stock price has widened further.

Specifically, Samsung Electronics’ lending balance decreased from 190 million shares in March last year to 60 million shares recently. As lending transactions decreased, lending prices did not rise. Meanwhile, the stock price rose sharply from 48,900 KRW (March 16, 2020) to 87,000 KRW (January 20 this year). Especially if the government improves the short-selling system and resumes it, lending demand is expected to grow even more. Analyst Jeong Inji of Yuanta Securities analyzed, "Currently, the lending balance is decreasing during the stock price rise, which could cause lending demand to increase if short-selling resumes."

Even if short-selling surges, profits need to be examined

Amid controversy over the temporary ban on short selling scheduled to end next month, an employee at a financial institution in Seoul is seen working on the 21st. The Financial Services Commission plans to hold a meeting before the ban expires on the 15th of next month to decide and announce whether the ban will be extended. Photo by Kim Hyun-min kimhyun81@

Amid controversy over the temporary ban on short selling scheduled to end next month, an employee at a financial institution in Seoul is seen working on the 21st. The Financial Services Commission plans to hold a meeting before the ban expires on the 15th of next month to decide and announce whether the ban will be extended. Photo by Kim Hyun-min kimhyun81@

However, lending transaction profits need to be carefully considered. Analyst Jeong explained, "If we consider the difference between the average lending fee since 2012 and the repayment price as lending profit and loss, it shows a loss of about 6.8 trillion KRW," adding, "Although this amount cannot be definitively said to be the loss of investors who actually engaged in lending transactions, since Samsung Electronics’ stock price rose, it is unlikely that profits were generated solely from lending transactions."

Meanwhile, a prerequisite issue before resuming short-selling is to correct the ‘tilted playing field’ currently favoring foreigners and institutions. Prime Minister Chung Sye-kyun stated the day before, "Foreign and institutional investors did not properly follow the rules, and relatively small and individual investors have a sense of victimization, so healing that is a priority," adding, "Resuming without institutional improvements is not desirable."

In fact, individual access to short-selling is very limited and resources are insufficient. Individuals can also borrow stocks from securities finance through securities firms to conduct short-selling via lending. The problem is that only six securities firms handle this: NH Investment & Securities, Shinhan Financial Investment, Kiwoom Securities, Daishin Securities, SK Securities, and Yuanta Securities. While the lending market used by foreigners and institutions for short-selling (2019) is about 67 trillion KRW, the individual market is only about 23 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)