All Six Companies in Early-Year Demand Forecast Achieve Four-Digit Competition Rates

Major IPOs Like KakaoBank and LG Energy Solution Awaiting

[Asia Economy Reporter Song Hwajeong] As companies are busy with initial public offering (IPO) procedures from the beginning of the year, the competition rate for subscription and demand forecasting is soaring, intensifying the enthusiasm for public offering investments. Following last year's series of major IPOs, the hot public offering craze despite the novel coronavirus (COVID-19) is expected to continue this year as well.

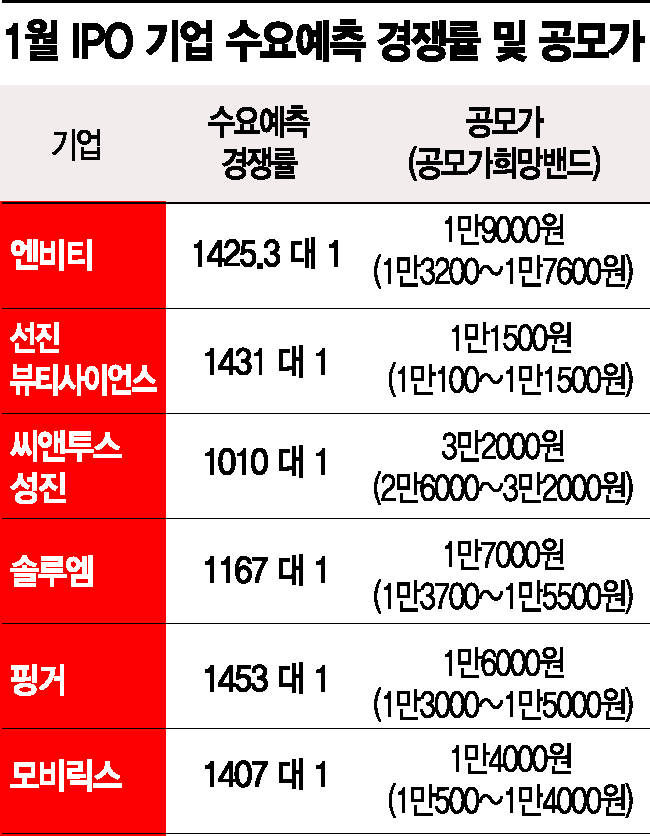

According to the securities industry on the 21st, a total of six companies completed demand forecasting by the 15th of this year, all recording four-digit competition rates. NBT, which launched the first IPO of the year, started strong with a ratio of 1425 to 1, followed by Ssenjin Beauty Science with 1431 to 1, and CN2Sungjin with 1010 to 1. SoluM, Finger, and Mobirix, which conducted demand forecasting on the 14th and 15th respectively, also succeeded with competition rates of 1167 to 1, 1453 to 1, and 1407 to 1. SoluM recorded the second-highest demand forecasting rate in KOSPI history, and Finger recorded the second-highest in KOSDAQ history.

Cases of public offering prices exceeding the upper limit of the expected price band have also emerged. NBT broke through the upper limit of 17,600 KRW with a public offering price of 19,000 KRW, and SoluM and Finger also confirmed their public offering prices at 17,000 KRW and 16,000 KRW respectively, surpassing the expected price bands. In addition, Ssenjin Beauty Science, CN2Sungjin, and Mobirix set their public offering prices at the upper limit of their expected price bands.

The heated enthusiasm in demand forecasting continued into the general subscription that followed. NBT recorded an all-time high general subscription competition rate of 4397.67 to 1. The previous record was 3039.56 to 1 set by Iruda last year. Ssenjin Beauty Science, which followed with a subscription, recorded a general subscription competition rate of 1987.74 to 1.

The subscription success also appears to affect the stock price after listing. NBT, which was listed on the day, opened at 38,000 KRW, double the public offering price, and as of 9:50 AM that day, was trading at 43,450 KRW, up 14.34% from the opening price.

This public offering craze is analyzed to be due to abundant liquidity continuing since last year. Na Seungdu, a researcher at SK Securities, said, "Despite the variable of COVID-19, last year's IPO market recorded the highest public offering amount in the past three years and the highest public offering investment returns in the past 10 years. This is due to abundant liquidity, the emergence of companies belonging to attractive industries, and conservative corporate value evaluations by public offering companies. A similar trend is expected to continue this year."

The IPO market, which has heated up since the beginning of the year, is expected to become even hotter once major listings begin. SK Bioscience, highlighted for its contract manufacturing of COVID-19 vaccine candidates; SK IE Technology, a battery separator specialist subsidiary of SK Innovation; Krafton, the game company that developed Tera and Battlegrounds; Kakao Bank and Kakao Pay, subsidiaries of Kakao; and LG Energy Solution, spun off from LG Chem, are considered major IPOs attracting market attention this year.

Choi Jongkyung, a researcher at Heungkuk Securities, predicted, "The public offering scale of the newly listed market this year could challenge the record-breaking scale surpassing last year's strong performance. The public offering scale is expected to be 7.8 trillion KRW, with major companies surpassing last year taking center stage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.