At the Supreme Council Meeting on the 21st, Highlighting Tilted Playing Field and Information Asymmetry

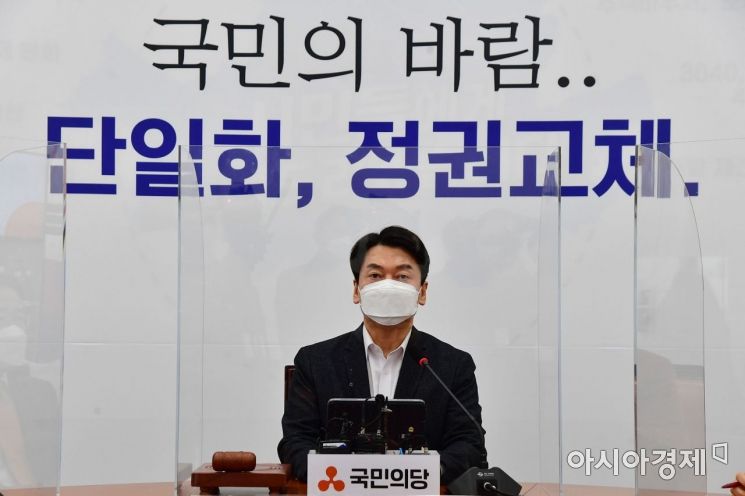

Ahn Cheol-soo, leader of the People’s Party, is attending the Supreme Council meeting held at the National Assembly on the 21st and delivering opening remarks. Photo by Yoon Dong-joo doso7@

Ahn Cheol-soo, leader of the People’s Party, is attending the Supreme Council meeting held at the National Assembly on the 21st and delivering opening remarks. Photo by Yoon Dong-joo doso7@

[Asia Economy Reporter Geum Bo-ryeong] Ahn Cheol-soo, leader of the People’s Party, criticized the resumption of short selling under the current circumstances as a 'poison' to the capital market.

On the 21st, Ahn attended the 70th Supreme Council meeting held at the National Assembly and stated, "Compared to stock markets in other advanced countries, I question whether there are institutional measures in place to harness the positive functions of short selling in our stock market."

The government decided to temporarily ban short selling in March last year. This was during a period when the domestic stock market was plummeting sharply due to the impact of the novel coronavirus disease (COVID-19). The KOSPI, which was at 2103.61 on February 25, dropped to 1482.46 by March 23. The temporarily banned short selling is scheduled to resume this March.

Regarding this, Ahn said, "To get straight to the point, resuming short selling in the current situation is poison to the capital market," adding, "There is always the issue of a 'tilted playing field.' Foreigners and institutions account for 98% of short selling transactions. It is practically a market where individuals find it difficult to participate."

He continued, "Information asymmetry is also a problem. As a result, research shows that from 2016 for three years, foreigners and institutions earned 1.7662 trillion won from short selling, while individuals suffered losses of 726.5 billion won during the same period," adding, "In short, the structure of short selling in the Korean stock market is entrenched so that only institutions and foreigners make money, while individuals incur losses."

Ahn also criticized, "There is a high possibility of market distortion caused by short selling," stating, "Large volumes of short selling transactions are led by some foreign securities firms, and in the process, incorrect information about certain theme stocks and companies combines to distort the market, raising concerns about actual price manipulation."

However, he proposed ways to preserve the advantages of short selling while preventing damage to individual investors. Ahn said, "The lending of stocks held by pension funds for short selling should be completely banned," adding, "From the public’s perspective, it is an absurd structure where stocks purchased by pension funds with their money can be used as a means to cause them losses."

He also emphasized the computerization and systemization of short selling. Ahn said, "Instead of allowing orders via phone, email, or messenger as is done now, all short selling should be transparently supervised through the establishment of an order system and monitoring system," adding, "Only then can illegal arbitrage short selling be fundamentally prevented." He also argued that continuous monitoring of price decline inducement acts by short selling entities is necessary.

Ahn said, "Short selling certainly has positive functions," but added, "However, if short selling resumes without addressing the various problems I have mentioned so far, individual investors will not be able to avoid significant losses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.