[Asia Economy Reporter Yujin Cho] Bloomberg reported on the 20th (local time) that the non-performing loans of Indian banks are increasing unprecedentedly, threatening the recovery from the COVID-19 pandemic.

The Reserve Bank of India (RBI) announced that the banks' non-performing asset ratio has risen to 6.3%, the highest in the past five years. According to the latest statistics from the RBI, the non-performing asset ratio of Indian banks surged by 1 percentage point compared to the previous year as of March last year, and experts predict that this upward trend will accelerate further.

The deterioration in the asset quality of Indian banks is due to companies that borrowed money from banks facing difficulties in repayment amid the COVID-19-induced economic downturn over recent years.

Consecutive default declarations by IL&FS, one of India's largest infrastructure project investment companies, Dwan Housing Finance Corporation, a major Indian mortgage company, and Altico Capital, a housing finance company, have heightened concerns about non-performing loans in the Indian financial sector.

In response, the RBI introduced an internal audit system last month to strengthen credit evaluations of non-bank financial companies and is closely monitoring the top 100 non-bank financial companies, showing a tense stance.

Earlier last month, the U.S. credit rating agency Fitch also warned that the credit rating outlook for non-bank financial companies has turned negative and that asset quality could reach a risk level.

The report analyzed that non-bank financial companies such as securities firms, insurance companies, credit card companies, and housing finance companies have the highest exposure to non-performing assets. In the case of IL&FS, companies exposed to non-performing loans range widely from banks to insurance companies and mutual fund companies.

Non-performing loans are spread across various businesses, from travel agencies to large real estate development companies, causing the Indian economy to remain trapped in the recession caused by COVID-19.

The report analyzed that earnings for the last fiscal year ending in March recorded the lowest level since the 1950s, indicating a contraction in the economy.

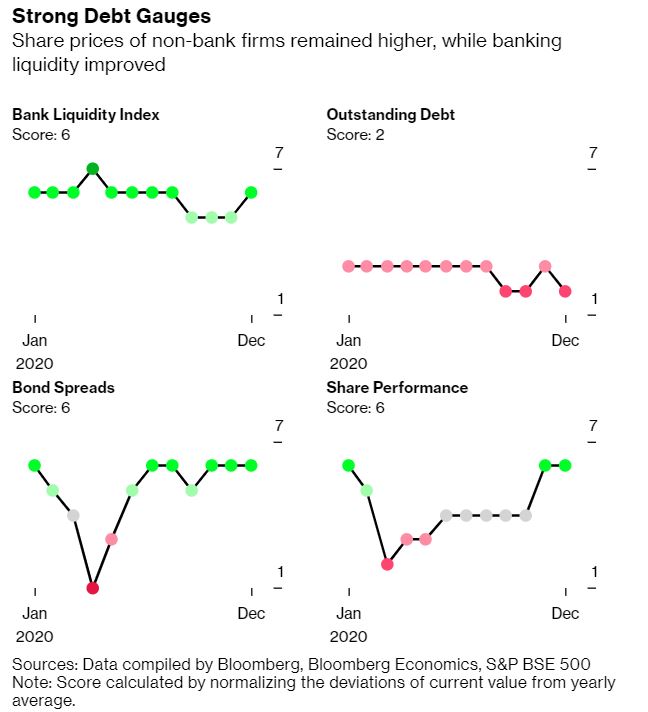

However, it is positive that the cash situation in the Indian financial market has somewhat improved, as evidenced by the rebound of the BSE Sensex index, the benchmark index of the Indian stock market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.