June Capital Gains Tax Surcharge and Comprehensive Real Estate Tax Reference Date

Market Watches Multi-Homeowners' Disposal Decisions

Many Favor Gifts Over Sales

However, Acquisition and Gift Taxes Also Significant Burden

If Apartment Prices Stall, Gifting May Result in Losses

Experts Advise "Assess Market Conditions Before Deciding"

[Asia Economy Reporter Moon Jiwon] Analysis suggests that April to May will be a turning point for soaring housing prices. This is because the government and ruling party have dismissed proposals to ease tax burdens raised by some and firmly stated that they will raise the capital gains tax surcharge rate in June as originally planned. Considering that it takes at least 1 to 2 months to sell a house, how many disposal properties from multi-homeowners come onto the market at this time could determine the success or failure of the policy.

According to the real estate industry on the 20th, President Moon Jae-in sent mixed signals to the market during his New Year's press conference on the 18th by simultaneously emphasizing "maintaining the existing anti-speculation stance" and "preparing special supply measures," complicating the calculations of multi-homeowners. This is interpreted to mean that, apart from supply expansion, the government may further strengthen existing tax and transaction regulations.

Immediately after the New Year's press conference, the government's reaffirmation of its determination to enforce the capital gains tax surcharge and its emphasis on strengthening investigations into speculation and tax evasion at a joint briefing with related ministers added weight to this interpretation.

However, the market largely expects that this spring's tax-avoidance sales by multi-homeowners will not be enough to change market trends. Although sales volume may increase somewhat and housing prices may temporarily stagnate, many multi-homeowners are showing signs of choosing gifting over disposal due to expectations of further price increases.

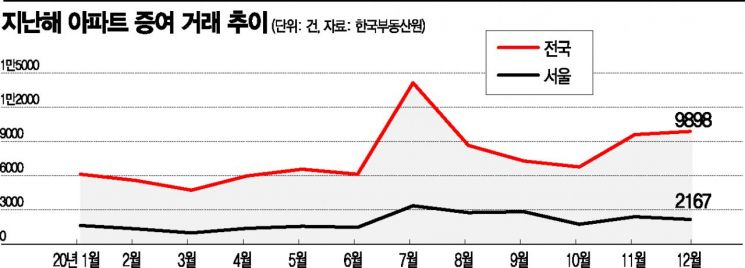

Last year, the gifting trend was stronger than sales. According to the Korea Real Estate Board, there were 91,866 apartment gifts nationwide last year, the highest since related statistics began in 2006. In particular, the number of apartment gifts in Seoul reached a record high of 23,675, with many gifts concentrated in the Gangnam 4 districts of Songpa, Gangdong, Gangnam, and Seocho. The "smart" high-priced homes tended to be gifted rather than sold.

Experts believe this trend is likely to continue this year as well. Although the burden of property tax and gift acquisition tax has increased, expectations for rising housing prices remain strong. Kwon Il, head of the research team at Real Estate Info, said, "Some properties will be put on the market due to the comprehensive real estate tax burden, but even when the property tax burden increased last year, housing prices rose," adding, "Many people think the increase in housing prices is greater than the increase in property tax." In fact, many posts in real estate-related online cafes say, "I will hold on for now."

In the case of gifting, it is advantageous to complete it by the end of April before this year's official property price is confirmed. Gift acquisition tax is calculated based on the official property price, which is expected to rise significantly this year compared to last year. Considering the recent sharp rise in jeonse (long-term deposit lease) prices, market conditions are favorable even for burdened gifts where the tenant's deposit is inherited.

An industry insider said, "There can be a difference of tens of millions of won or more in taxes between general gifting and burdened gifting," adding, "Burdened gifting is advantageous when capital gains tax is absent or low."

However, since the real estate market may undergo a correction period for some time, there are opinions that gifting is not necessarily more advantageous than selling. The increase in gift acquisition tax rate to 12% for homes priced over 300 million won in regulated areas since August last year is also a burden. Burdened gifting also applies high gift acquisition tax on the free gifting portion and capital gains tax surcharge on the paid gifting portion, making it difficult to say it is always better than selling.

Won Jong-hoon, head of WM Investment Advisory at KB Kookmin Bank and a tax accountant, advised, "If housing prices continue to rise as before, it is better for multi-homeowners to gift, but if there is no significant change or a possibility of even a slight drop in housing prices, gifting could be disadvantageous," adding, "Decisions should be made while observing market conditions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.