Average Usage Amount 9.92 Million KRW, Average Usage Period 64 Days

Most Victims Are Urgent Loan Borrowers ... 16 Times the Legal Maximum Interest Rate

[Asia Economy Reporter Song Seung-seop] Last year, the average interest rate on illegal private loans soared to 401%, far exceeding the legal maximum interest rate of 24%. This is about 16.7 times the legal maximum interest rate.

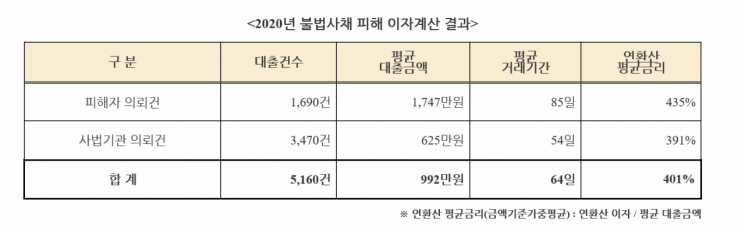

The Korea Financial Investment Association announced on the 20th that after analyzing 5,160 high-interest loan transactions conducted last year, the annualized average interest rate was 401%. The average loan amount was 9.92 million KRW, and the average transaction period was 64 days.

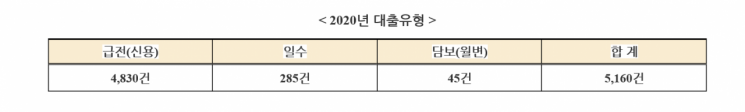

Users of short-term loans accounted for the largest portion at 93% (4,830 cases) of the total, followed by daily loans with 285 cases and secured loans with 45 cases.

According to current law, unregistered lending businesses face imprisonment of up to 5 years or fines up to 50 million KRW, and violations of the legal maximum interest rate regulations are subject to aggravated punishment with imprisonment of up to 3 years or fines up to 30 million KRW.

Nevertheless, unlike regular financial transactions, illegal private loans involve irregular and non-fixed repayment of principal and interest, making it difficult for victims to calculate the amount of interest damage. Law enforcement agencies also needed to calculate interest rates to prosecute illegal lenders for violating interest rate limits.

Accordingly, since 2015, the association has continuously supported law enforcement agencies and victims in calculating interest rates. Last year, for 458 cases of illegal private loan damage, the interest rates were readjusted within the legal limit, or 44.38 million KRW of interest already paid was refunded to the debtors.

The association stated, “Recently, illegal private lenders have been enticing self-employed individuals and low-income earners who cannot use institutional financial institutions through false and exaggerated advertisements on the internet and direct loan transaction sites, leading them to take high-interest private loans,” and warned, “As cases of damage are rapidly increasing, special caution is required.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)