Industrial Research Institute, Survey Results on Business Conditions of Korean Companies Entering China

[Sejong=Asia Economy Reporter Joo Sang-don] Korean companies operating in China have reported a negative outlook on the economic situation and sales prospects for the first quarter of this year.

On the 20th, the Korea Institute for Industrial Economics & Trade (KIET) announced the "Survey on the Business Conditions of Korean Companies in China: Q4 2020 Status and Q1 2021 and Annual Outlook."

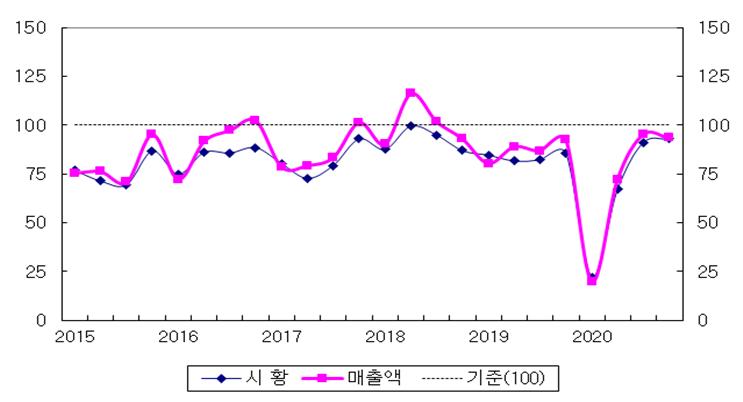

This survey was jointly conducted by KIET, the Beijing Office of the Korea Chamber of Commerce and Industry, and the Korean Chamber of Commerce in China, targeting Korean companies operating in China from November 25 to December 24, 2020 (the 24th regular survey). A total of 211 companies across seven industries responded. The survey covered management performance, sales, costs, business environment, and difficulties, with results calculated on a scale from 0 to 200 based on the conventional Business Survey Index (BSI) method. A BSI above 100 indicates more positive responses, while below 100 indicates the opposite.

According to the survey results, the Q4 2020 current BSI and business conditions showed a rising trend for the third consecutive quarter, but sales slightly declined. The overall Q4 2020 current BSI for all companies showed a slight increase in business conditions (93) compared to the previous quarter, while sales (93) slightly decreased. Local sales (109) exceeded 100 for the first time since Q2 2018, and facility investment (103) also remained above 100 for two consecutive quarters. However, the business environment (80) declined for the first time in three quarters. Regarding management difficulties, responses citing weak local demand (24.2%) and sluggish exports (15.2%) decreased, while issues related to workforce and labor costs (17.1%) and intensified competition (10.0%) increased.

For the Q1 2021 outlook BSI, both business conditions and sales fell below 100 again. The overall Q1 2021 outlook BSI for all companies dropped to 93 for business conditions, falling below 100 again, and sales (96) also fell below 100 for the first time in four quarters. Although the local sales outlook (103) remains above 100, facility investment (99) and business environment (97) fell below 100, marking a decline compared to the previous quarter.

The 2021 annual sales outlook BSI for all companies (110) rose compared to the previous year's forecast (104), reaching the highest level in three years since the survey at the end of 2017 (124). This was due to large enterprises (119) and small and medium-sized enterprises (108) both exceeding 100 for two consecutive years, manufacturing (111) continuously staying above 100 since statistics began, and distribution (109) exceeding 100 for two consecutive years. Within manufacturing, relatively more optimistic sectors include automobiles (117), chemicals (116), and metal machinery (110). The electrical and electronics sector (103) exceeded 100 again for the first time in three years, while textiles and apparel (107) surpassed 100 for the first time since statistics began.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)