Woori Bank Utilizes Big Data for

Customer Behavior-Based Personalized Marketing

Demand for Customized Products Increases

As Non-Face-to-Face Services Grow

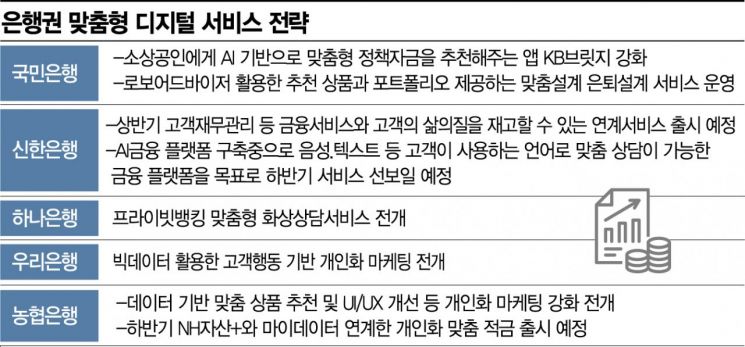

[Asia Economy Reporter Park Sun-mi] Major domestic banks are focusing on bespoke strategies that provide customer-tailored services using artificial intelligence (AI), big data, and other technologies as they promote digital transformation this year. Bespoke means custom production according to individual orders, referring to the provision of products or services exclusively for one person.

According to the banking sector on the 19th, Woori Bank has been conducting "personalized marketing based on customer behavior using big data," which analyzes customer behavior information with AI to recommend customized products for each customer, the first in the banking sector this year. This method analyzes all channels of unstructured customer behavior information such as consultation records (voice), deposit and withdrawal details (text), and internet and smart banking usage logs, along with structured data like customer personal information and transaction details previously used, with AI to recommend optimized personalized products for each individual. Customers can receive recommendations for financial products they are interested in either by visiting branches or through their smartphones.

Shinhan Bank is also preparing to launch customer-tailored services using digital technology. In the first half of the year, it plans to release customized linked services that can improve customers' financial management and quality of life. Currently building an AI financial platform, it will launch a financial platform service in the second half of the year that enables personalized consultations in languages customers use, such as voice and text.

KB Kookmin Bank operates a customized retirement planning service that provides optimal recommended products and portfolios using robo-advisors, offering practical solutions necessary for retirement preparation. Recently, it revamped the app KB Bridge, which recommends customized policy funds based on AI to small business owners. Hana Bank, which has been providing private banking (PB) customized video consultation services since last year, is expanding customer care operations by strengthening AI functions based on a big data platform. It is continuously building big data infrastructure for personalized services.

The importance of bespoke strategies in the banking sector has increased because, although digitalization has progressed with the onset of the non-face-to-face era due to the spread of COVID-19, there is a gap in the "customized" satisfaction that can only be felt through services provided by humans. Customers' needs for personalized digital financial experiences are growing.

NH Nonghyup Bank is preparing to launch a personalized savings product linked with NH Asset Plus, a non-face-to-face comprehensive personal asset management service, and MyData in the second half of the year. Personalized marketing will also accompany this by analyzing customers' channel journey information based on data to recommend suitable products and provide tips for preferential interest rates on individual subscription products.

Hwang Sun-kyung, senior researcher at Hana Financial Management Research Institute, advised, "There is a growing need for means to complement the physical experience and emotional aspects that the convenience and simplicity of digital experiences cannot solve, so financial companies also need to provide bespoke experiences based on 'phygital' (physical + digital)." She added, "By implementing bespoke services using AI and data on existing platforms, products and services that meet segmented customer needs can be provided."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)