Continuously Improving Operating Profit Margin... Advertising, Commerce, and Content All Soaring Vertically

[Asia Economy Reporter Minwoo Lee] Kakao is expected to post solid results for the fourth quarter of last year. Not only in advertising and commerce sectors, but also in mobility, simple payment, and webtoon content, profitability is strengthening, with external growth outweighing cost increases. It is analyzed that another leap forward is possible as the initial public offerings (IPOs) of key subsidiaries such as Kakao Pay (simple payment) and Kakao Bank are expected to be successful.

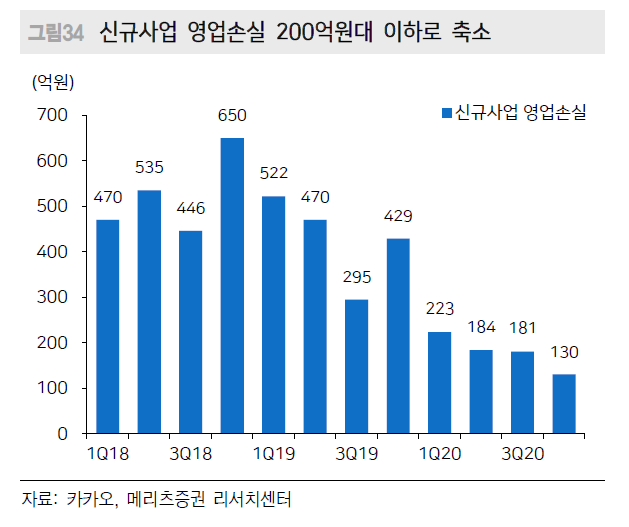

On the 17th, Meritz Securities forecast that Kakao would achieve consolidated sales of 1.168 trillion KRW and operating profit of 141.7 billion KRW in the fourth quarter of last year. Compared to the same period last year, sales are expected to increase by 37.8% and operating profit by 78.1%.

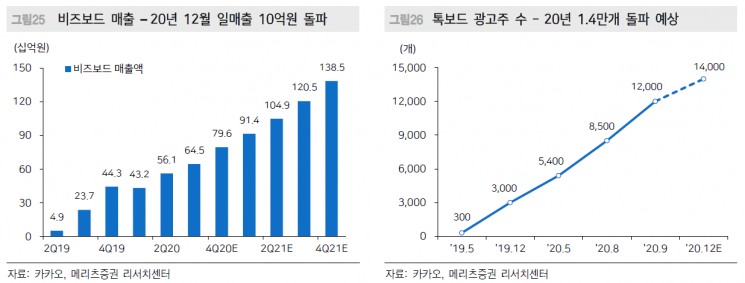

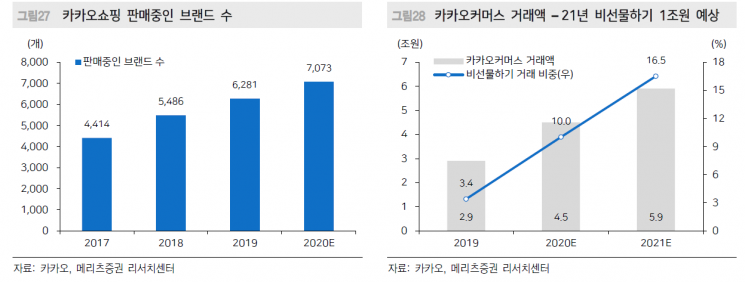

Sales from TalkBiz, KakaoTalk-based advertising and commerce business, are expected to reach 313 billion KRW, up 41.3% from the same period last year. Bizboard, an advertisement displayed in the KakaoTalk chat room list, surpassed daily sales of 1 billion KRW in December last year. This is nearly double the growth compared to the same month last year. Commerce sales are also increasing as Talk Store, which operates in the form of channels within KakaoTalk, is growing, indicating a rapid transformation into an e-commerce business operator.

Meanwhile, Kakao Pay's transaction volume in the fourth quarter of last year is estimated at 21 trillion KRW, a 55.6% increase from the same period last year. This is interpreted as a significant increase in financial transactions such as loan brokerage. Although Kakao Pay was excluded from the preliminary approval for the MyData business by the Financial Services Commission in December last year, it is expected to pass the re-examination scheduled for this month smoothly. As a result, the total operating profit margin for the fourth quarter of last year improved by 1.2 percentage points from the previous quarter to 12.1%.

Kakao is expected to continue growth this year through emerging powerhouses such as Kakao M and Kakao Enterprise. Kakao TV has begun to devise a full-fledged monetization model. The revenue model is being concretized through ▲time-lagged paid content (free preview followed by paid access after a period) ▲content sales to external online video service (OTT) providers such as Netflix and WAVVE ▲general advertising and indirect/virtual advertising (PPL). Monetization of Kakao TV content applies to some drama content, which is free for the first week after release but charges 500 KRW per episode for the following seven days. This is a revenue model similar to Kakao Page's 'Wait and Free.' It is analyzed that this enables expansion of the user base and monetization focused on loyal customers.

Meanwhile, Kakao Enterprise, launched in December 2019 to enter the AI-based business-to-business (B2B) platform business, secured an investment of 100 billion KRW from KDB Industrial Bank this month. The company was valued at 1.15 trillion KRW. Through services such as Kakao Work (messenger-based work collaboration tool) and Kakao i Cloud (enterprise cloud), it is expected to make a full-scale entry into the domestic cloud market in the first half of this year. The Industrial Bank established a scale-up finance office in 2020 to expand domestic venture investments and support promising startups, investing over 10 billion KRW in 14 companies. Among them, Kakao Enterprise received the largest investment.

Against this backdrop, Meritz Securities maintained a 'Buy' rating on Kakao and raised the target price to 570,000 KRW. The closing price on the previous trading day was 437,500 KRW. Donghee Kim, a researcher at Meritz Securities, said, "This is a phase where external growth outweighs cost increases," and added, "Key financial subsidiaries Kakao Pay and Kakao Bank are expected to successfully IPO by overcoming hurdles such as MyData and real estate mortgage loans, respectively."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)