Considering the Expansion Phase of the Short-Long Term Interest Rate Gap, Adjustment Range May Not Be Large

"Need to Monitor Future Short-Term Interest Rate Rise and Long-Term Interest Rate Decline"

Traders are at work on the floor of the New York Stock Exchange in the United States on the 13th (local time). [Image source=Yonhap News]

Traders are at work on the floor of the New York Stock Exchange in the United States on the 13th (local time). [Image source=Yonhap News]

[Asia Economy Reporter Minwoo Lee] Recent sharp rises in U.S. interest rates are unlikely to lead to a large-scale stock market correction, according to analysis. This is because the U.S. Federal Reserve (FED) is maintaining an accommodative monetary policy, and expectations for economic recovery due to fiscal policies in various countries and vaccine distribution remain valid.

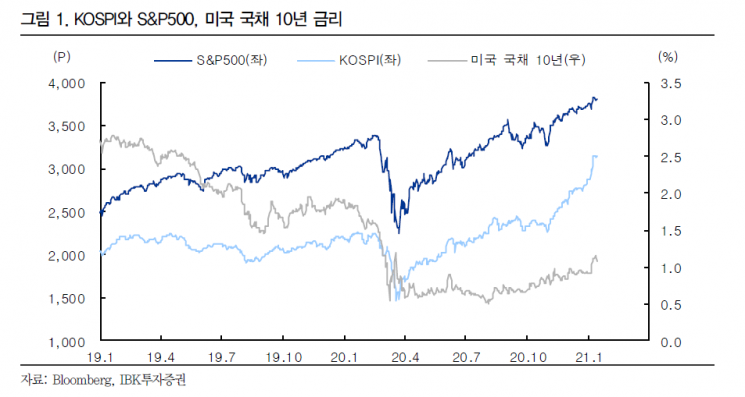

Stock Market Sensitive to Interest Rate Changes

On the 16th, IBK Investment & Securities analyzed that judging the current economic and policy trends solely based on the rise in the 10-year U.S. Treasury yield has its limitations. On the 15th (local time), the 10-year U.S. Treasury yield recorded 1.097% in the New York bond market. Although it fell by 3.1 basis points (bp) from the previous trading day, it has remained in the 1% range this year, maintaining the highest level since the COVID-19 outbreak in March last year.

As interest rates rose, domestic and international stock markets this week retraced some of last week's gains. The realization of a 'Blue Wave,' where the U.S. Democratic Party controls both the House and Senate, highlighted the possibility of expanded fiscal policy and inflation, and concerns about tapering (asset purchase reduction) within the Federal Reserve began to emerge. However, tapering concerns were deemed premature. The December consumer price index also remained within the expected range, contrary to worries. As interest rates stabilized and declined, the stock market correction ended.

Researcher Soeun Ahn of IBK Investment & Securities explained, "The stock market is so sensitive to U.S. interest rate fluctuations because the current bull market is a result of low interest rates and liquidity," adding, "With growing concerns about overheating relative to fundamentals, investors have started to be cautious about potential changes in low interest rate and liquidity conditions."

Focus on 'Long-Short Term Interest Rate Spread' Rather Than Simple Interest Rates

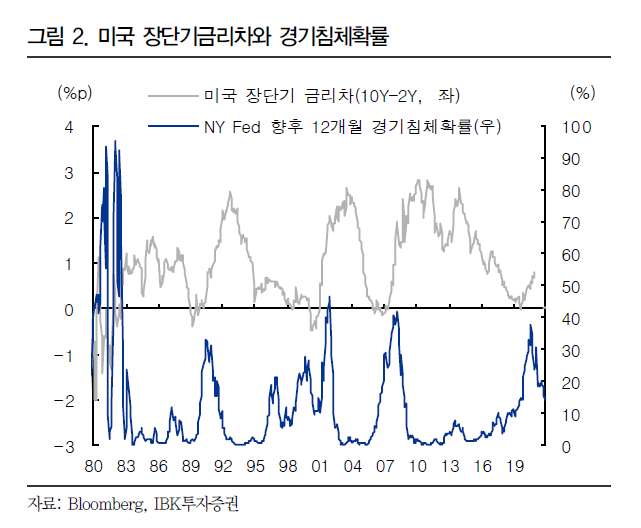

In such a situation, it is pointed out that attention should be paid to the 'long-short term interest rate spread' rather than the simple direction of interest rates. Interpreting interest rate changes from only one perspective is problematic. Researcher Ahn said, "Long-term interest rates reflect investors' expectations of economic trends, while short-term interest rates move in line with changes in monetary policy," adding, "The long-short term interest rate spread reflects differences in the direction and speed of economic and policy trends, allowing for a comprehensive explanation of economic phases. This is also why the New York Federal Reserve calculates the probability of recession within one year based on the long-short term interest rate spread."

Generally, an expansion of the long-short term interest rate spread is interpreted positively for the stock market, while a contraction is seen negatively. However, the correlation between the long-short term interest rate spread and stock indices is not very strong. Market interpretation can vary depending on the direction of short-term and long-term interest rates, even if the spread expands or contracts. Therefore, it is necessary to check whether the current trend and changes in the long-short term interest rate spread are due to long-term or short-term interest rates.

2008 Global Financial Crisis Viewed Through the Long-Short Term Interest Rate Spread

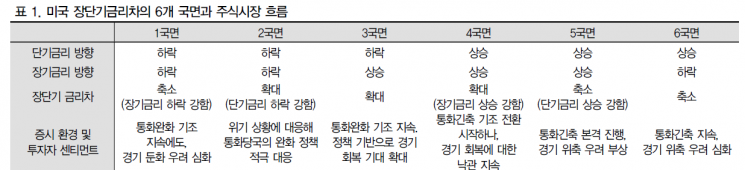

IBK Investment & Securities analyzed this by dividing it into six phases: expansion/contraction of the long-short term interest rate spread and the rise/fall of short-term and long-term interest rates respectively. They applied these six phases to the 2008 global financial crisis period, when 'zero interest rate' and quantitative easing policies were used.

Immediately after the global financial crisis, the long-short term interest rate spread expanded. Due to aggressive accommodative policy responses by monetary authorities, short-term interest rates fell faster than long-term interest rates. Despite liquidity supply, the stock market declined due to recession concerns. Subsequently, the long-short term interest rate spread continued to widen. While short-term interest rates remained low due to ongoing monetary easing, long-term interest rates rose as expectations for economic recovery revived. The stock market also turned upward, reflecting these recovery expectations in advance.

Later, the stock market's upward momentum weakened or corrected. This occurred when the long-short term interest rate spread continued to expand, but short-term interest rates began to rise or long-term interest rates began to fall, leading to a contraction of the spread. During the financial crisis, contraction of the long-short term interest rate spread first appeared due to falling long-term interest rates. Although short-term interest rates remained low, a view emerged that economic recovery was below expectations, causing long-term interest rates to turn downward. Consequently, stock prices corrected, and additional quantitative easing policies followed. At this time, the stock market recorded a stronger upward trend than the previous situation where long-term interest rates rose and short-term interest rates were low.

As economic recovery became visible, a phase appeared where the long-short term interest rate spread continued to expand while short-term interest rates began to rise. This was due to the start of discussions on monetary policy normalization and tightening, causing short-term interest rates to shift to an upward trend. Concerns that the era of low interest rates and abundant liquidity was ending weakened the stock market's upward momentum.

Applying This to the Current Stock Market... "Correction Will Be Limited... Focus on Future Long-Short Term Interest Rate Trends"

Applying this to the recent stock market, immediately after the spread of COVID-19, monetary authorities responded aggressively with accommodative policies, causing short-term interest rates to fall faster than long-term interest rates. Despite rapid rate cuts and liquidity supply, the stock market declined due to recession concerns.

Researcher Ahn views the current phase as one where the long-short term interest rate spread is expanding due to rising long-term interest rates. He analyzed, "Major central banks, including the Federal Reserve, are maintaining an accommodative monetary policy stance, but expectations for economic recovery through large-scale stimulus and vaccine distribution are already priced into stock prices. While short-term interest rates remain low, long-term interest rates are rising, expanding the long-short term interest rate spread, and global stock markets are also showing strong upward trends."

Considering this, the recent rise in U.S. long-term interest rates is unlikely to cause a large correction in other stock markets. Researcher Ahn explained, "Future scenarios that could trigger stock market corrections include whether short-term interest rates rise due to changes in monetary policy stance or whether long-term interest rates fall due to disappointing economic recovery expectations. These factors could act as triggers for future stock market corrections and should be closely monitored."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.