The news that e-commerce company Coupang will be listed on the US Nasdaq market struck the market at the beginning of the year. Coupang's corporate value is mentioned to be around $30 billion (approximately 32 trillion KRW). If it were listed on the KOSPI, it would immediately rank within the top 10 by market capitalization. Coupang has been aggressively increasing its market share every year. The market share, which was in the 7% range in 2017, more than doubled last year. This is why many investors are eager. Along with Coupang's listing news, companies related to Coupang are also gaining attention. The logistics business partner Dongbang and the partner company of 'Coupang Play,' KTH, are the main players. Will these companies also benefit from Coupang's halo effect?

[Asia Economy Reporter Jang Hyowon] Comprehensive logistics company Dongbang is one of Coupang's partners. It handles transporting goods to Coupang's logistics centers and camps. Currently, Coupang's share of Dongbang's total sales is not large, but sales in the related business segment of freight truck transportation are gradually expanding. However, the debt ratio exceeding 300% remains a part that needs continuous management.

Contract with Coupang until 2022

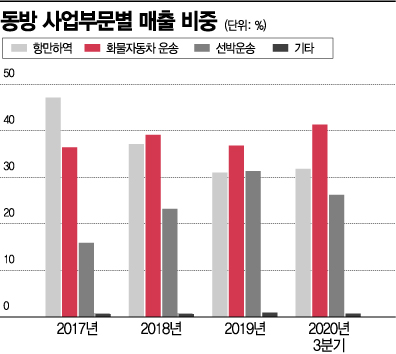

Dongbang is a comprehensive logistics company. Dongbang's main businesses include heavy logistics transporting ship blocks, bulk logistics transporting dry cargo, steel logistics, container logistics, and simple forwarding tasks. As of the end of the third quarter last year, the sales proportion by business segment was port cargo handling (31.8%), ship transportation (26.2%), freight truck transportation (41.3%), and others (0.7%).

The notable business segment is freight truck transportation. Sales in the freight truck transportation segment have been increasing every year. Sales grew by 41.1%, from 150.5 billion KRW in 2017 to 212.4 billion KRW in 2019. Up to the third quarter of last year, sales reached 170.8 billion KRW, maintaining a 7% growth compared to the same period the previous year.

The proportion of freight truck transportation in total sales also increased, expanding from 36.3% in 2017 to 41.3% by the third quarter of last year.

Especially, the freight truck transportation segment showed growth starting in 2018. This is analyzed to be due to the logistics contract with the e-commerce giant Coupang. Dongbang signed a four-year exclusive logistics transportation contract with Coupang starting December 2018.

This involves trunk transportation for Coupang, meaning receiving goods from sellers and transporting them to Coupang's logistics centers and camps. Coupang then delivers these goods to consumers through its own delivery infrastructure called 'Rocket Delivery.' Currently, it is known that there are other companies besides Dongbang responsible for Coupang's trunk transportation.

At the time of the contract, Dongbang disclosed an estimated contract amount of 52 billion KRW, about 13 billion KRW annually. The estimated sales were projected based on sales generated through a temporary contract during 2018. In reality, sales fluctuate depending on volume; more volume means higher sales.

A Dongbang official stated, "Sales have increased significantly due to the growth of online delivery services and the recent COVID-19 situation," adding, "It is understood that sales have exceeded the initially estimated figures every year since the first contract with Coupang."

The market expects that as Coupang's fulfillment system 'Rocket Partnership' expands, companies like Dongbang, which handle trunk transportation, will benefit. Currently, Coupang's Rocket Delivery is only for products it directly purchases, but Rocket Partnership is a system that allows general sellers to use Coupang's infrastructure, including Rocket Delivery. As the number of Rocket Partnership companies increases, trunk transportation will also grow.

Debt Ratio Over 300%

Dongbang's sales and operating profit have remained stable without significant changes. As of the end of the third quarter last year, on a consolidated basis, Dongbang recorded sales of 445.3 billion KRW and operating profit of 13.6 billion KRW, similar to 2019 levels. Since 2017, Dongbang has maintained sales between 500 billion and 600 billion KRW and operating profits in the range of 14 billion to 20 billion KRW.

However, Dongbang's debt ratio is quite high. As of the end of 2019, it was 443.4%. Although the debt ratio slightly decreased to 355.4% by the third quarter of last year due to the sale of subsidiaries and partial repayment of borrowings, Dongbang has maintained a debt ratio exceeding 300% every year since 2017.

As of the end of the third quarter last year, Dongbang's total borrowings amounted to 229.5 billion KRW, exceeding half of total sales. With limited cash assets, net borrowings approach 215.8 billion KRW. Notably, short-term borrowings and current portion of long-term debt due within one year amount to 160 billion KRW.

Dongbang's high borrowings are analyzed to have been used for investments in facility management. Since Dongbang builds and operates infrastructure such as ports and terminals, it executes hundreds of billions of KRW in tangible asset investments annually. In 2019, it acquired tangible assets worth 34.5 billion KRW. However, operating cash flow has not kept pace with investment scale every year, resulting in negative free cash flow (FCF). Continuous funding is necessary.

Korea Ratings analyzed in a report last year, "Dongbang's capital expenditure (Capex) investments are expected to continue," adding, "Securing orders and realizing performance to control the resulting financial burden at an appropriate level are important monitoring factors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.