Lee Ju-yeol, Governor of the Bank of Korea, "Caution Advised on Changes in Financial Stability Such as Household Debt Increase"

Longest Record-Breaking Period Expected

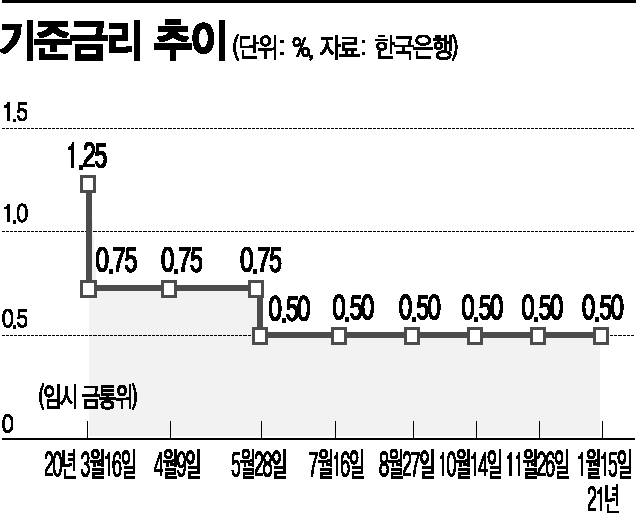

[Asia Economy Reporter Jang Sehee] The Bank of Korea has once again kept its benchmark interest rate at a record low of 0.5% per annum. This decision reflects ongoing concerns about the impact of the novel coronavirus disease (COVID-19), as well as side effects from low interest rates such as rising household debt and overheating in the real estate market. With the policy rate freeze continuing for eight consecutive months, there are forecasts that this will break the longest record in history. The Bank of Korea’s Monetary Policy Committee held a meeting on the 15th and decided to keep the benchmark interest rate at 0.50% per annum. This marks eight months of holding steady since the rate was cut by 0.25 percentage points in May last year.

Lee Ju-yeol, Governor of the Bank of Korea, stated at a press conference following the Monetary Policy Committee meeting, "We will maintain an accommodative monetary policy stance," but also noted, "We will pay close attention to changes in financial stability, such as capital flows into asset markets and the increase in household debt." He projected that this year’s gross domestic product (GDP) growth rate will be around 3%, in line with the forecast made in November last year.

◆ Rising Household Debt and Overheated Real Estate Market... Concerns Over Financial Imbalance Deepen = The Bank of Korea’s decision to hold the interest rate reflects a comprehensive consideration of rising household debt and sluggish economic conditions. Although low interest rates have led to excess liquidity and side effects such as overheating in the real estate market, the economic downturn caused by the COVID-19 pandemic remains, making it difficult to adjust rates. Governor Lee analyzed, "Household loans have continued to increase at a high rate, and housing prices have risen in both the Seoul metropolitan area and other regions."

As of last month, the outstanding household loans at banks reached 988.8 trillion won, an increase of 100.5 trillion won compared to a year ago. Among household loans, mortgage loans increased by 68.4 trillion won over the past year. It is assessed that the liquidity injected into the market to mitigate the economic shock from COVID-19 has driven up asset prices such as real estate. In November last year, the money supply was 3,178.4 trillion won, increasing by 27.9 trillion won in just one month. Kim So-young, a professor of economics at Seoul National University, advised, "If low interest rates persist, the pace of household debt growth could accelerate further," and cautioned, "Attention should be paid to the rapid rise in asset prices caused by recently released liquidity."

◆ If the Freeze Continues This Year, It Will Set a New Record for the Longest Duration = The Bank of Korea is expected to maintain an accommodative monetary stance until the Korean economy recovers from the COVID-19 crisis. If the benchmark interest rate freeze continues through the end of this year, it will break the longest record in history. Previously, the Bank of Korea lowered the benchmark rate to 1.25% in June 2016 and held it steady for a record 17 months before raising it by 0.25 percentage points in November 2017.

The employment market remains frozen due to the economic shock from COVID-19, and the retail sales index, a consumption indicator, has been negative for two consecutive months, including October last year. Additionally, the timing of economic recovery remains uncertain due to varying vaccine supply situations worldwide, and export volatility remains high.

Experts predict that the 0.50% interest rate will be maintained through the end of the year. Professor Jung Jin-wook of Yonsei University’s Department of Economics said, "It is truly an unavoidable situation where low interest rates must be maintained reluctantly," adding, "Raising rates under the current circumstances would incur much greater costs." He also noted, "The Bank of Korea’s monetary policy goal is price stability, and unless inflation rises, the interest rate cannot be increased," forecasting a prolonged period of rate freeze. Gong Dong-rak, a researcher at Daishin Securities, also expects the freeze to continue this year, stating, "Given the poor real economy indicators due to the COVID shock, the freeze will be maintained until a stable growth trajectory is confirmed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)